Credit Strategy

Froom Boom to Gloom: Navigating the Impending Downturn in the German Construction and Real Estate Sector

1

From Boom to Gloom: Navigating the

Impending Downturn in the German

Construction and Real Estate Sector

A decrease in demand for new buildings is threatening the

performance of the Construction and Real Estate (CRE) sector in

several European countries. Germany, one of the largest and robust

economies in the EU with an active property market, is currently

experiencing a downturn in its real estate sector.

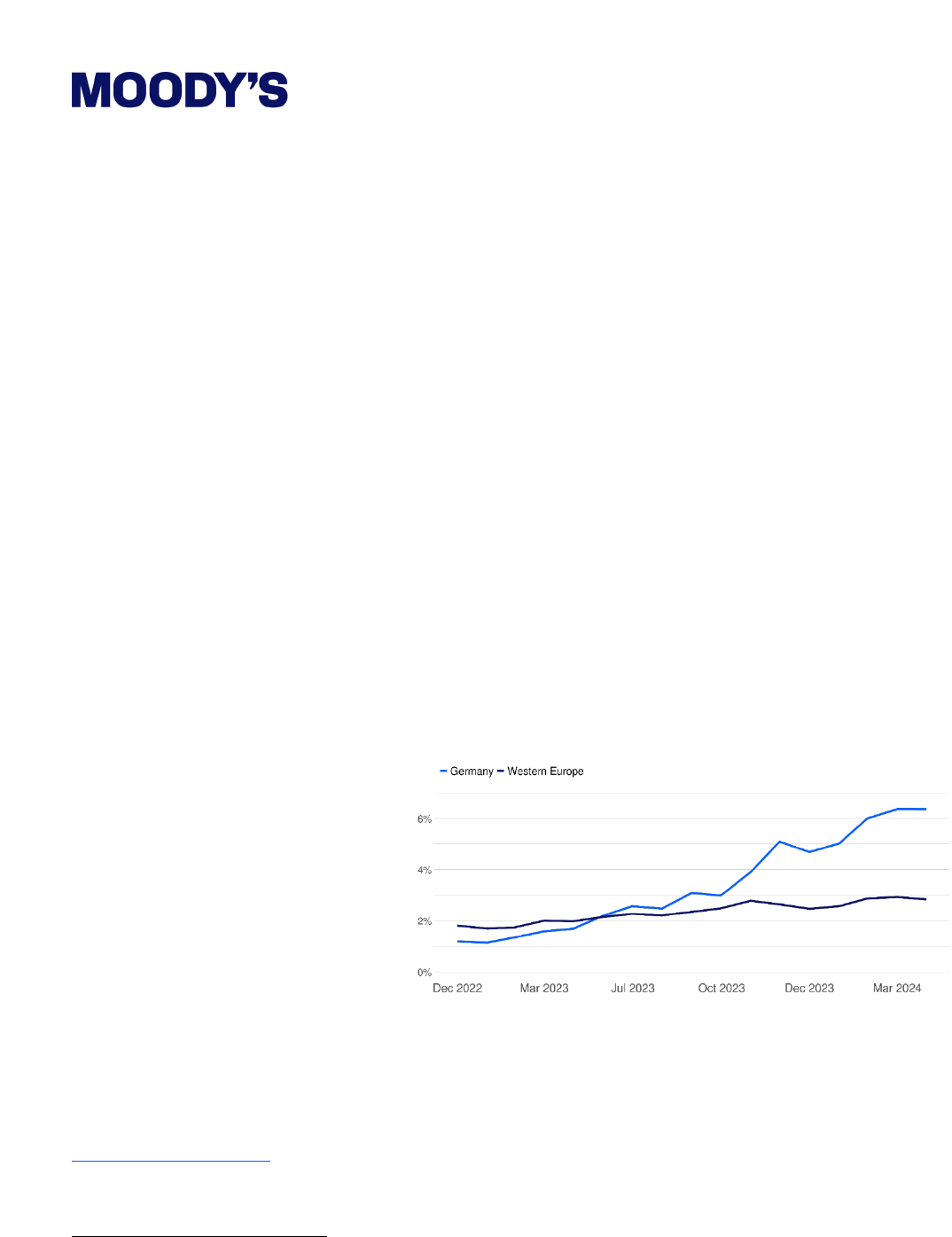

Credit risk has jumped sharply in the past twelve months. Figure 1

shows the average one-year probability of default (PD) for public

companies in the CRE sector in Germany and Western Europe.

1

For

German CRE companies, the average PD jumped from 1.7% in April

2023 to 6.37% in April 2024. This contrasts sharply with the increase

observed for CRE companies in Western Europe with the average PD

rising from 1.99% to 2.84% over the same period.

FIGURE 1 Average one-year PD for public companies in the CRE

sector, Germany and Western Europe

Data source: Moody’s EDF-X platform.

1

Western Europe includes Åland Islands, Andorra, Austria, Belgium Switzerland, Cyprus, Germany, Denmark, Spain,

Finland, Falkland Islands, France, Faroe Islands, United Kingdom, Guernsey, Gibraltar, Greece, Greenland, Isle of Man,

Ireland, Iceland, Italy, Jersey, Liechtenstein, Luxembourg, Monaco, Malta, Norfolk Island, Netherlands, Norway, Portugal,

Svalbard and Jan Mayen, San Marino, Sweden, and Holy See.

EUROPE CREDIT STRATEGY

JUNE 2024

CONTACTS

Cecilia Bocchio

Head of Regional Growth for Europe and

Africa

Predictive Analytics

+44 (207) 772-5666

Cecilia.Bocchio@moodys.com

Marco Del Treppo

Associate Analytics & Model Analyst

Predictive Analytics

+420 (234) 747-561

Marco.DelTreppo@moodys.com

Santiago Otero

Research Associate

Predictive Analytics

+420 (234) 747-537

Santiago.[email protected]

Jose Luis Luna-Alpizar

Associate Director

Predictive Analytics

+420 (224) 222-929

JoseLuis.LunaAlpizar@moodys.com

ABOUT

EDF-X, Moody’s flagship solution for

accelerated financial risk insights and

early warning signals, pre-calculates

credit measures for 450+ million

companies globally – public and

private, rated and unrated – using the

best data available and provides

customized views for a range of

business and credit decisions.

Learn more about EDF-x

Credit Strategy

Froom Boom to Gloom: Navigating the Impending Downturn in the German Construction and Real Estate Sector

2

The deterioration in credit quality for German construction reflects a worsening in economic fundamentals in

the sector. In August 2023, the number of new building permits granted reached a ten-year low. This downturn

can be attributed to declining residential property prices and stagnant growth in construction employment.

Residential construction project cancellations in Germany rose to 22.2% in October, and new building permits

saw a decrease of 9.4% in November compared to the previous month. The ongoing deterioration in the sector

can largely be traced back to escalating project failure rates, driven by a surge in interest rates (with the

European Central Bank's interest rate peaking at 4.5% in September 2023) and soaring construction costs due

to geopolitical and supply chain challenges. In May 2024, construction workers went on a nationwide strike, the

first one in 22 years.

GERMAN CONSTRUCTION SECTOR SHOWS HIGH CONCENTRATION OF RISKY

COMPANIES

The increase in the average probability of default for German CRE companies belies the potential credit risk of

the sector. When industries experience sector-wide stress, it becomes more difficult, but even more essential,

to be able to differentiate the companies in the sector that are most at risk. Moody’s EDF-X Early Warning

System (EWS) was designed to do just that. The EWS currently shows that the German construction sector

shows a high concentration of exceptionally risk firms.

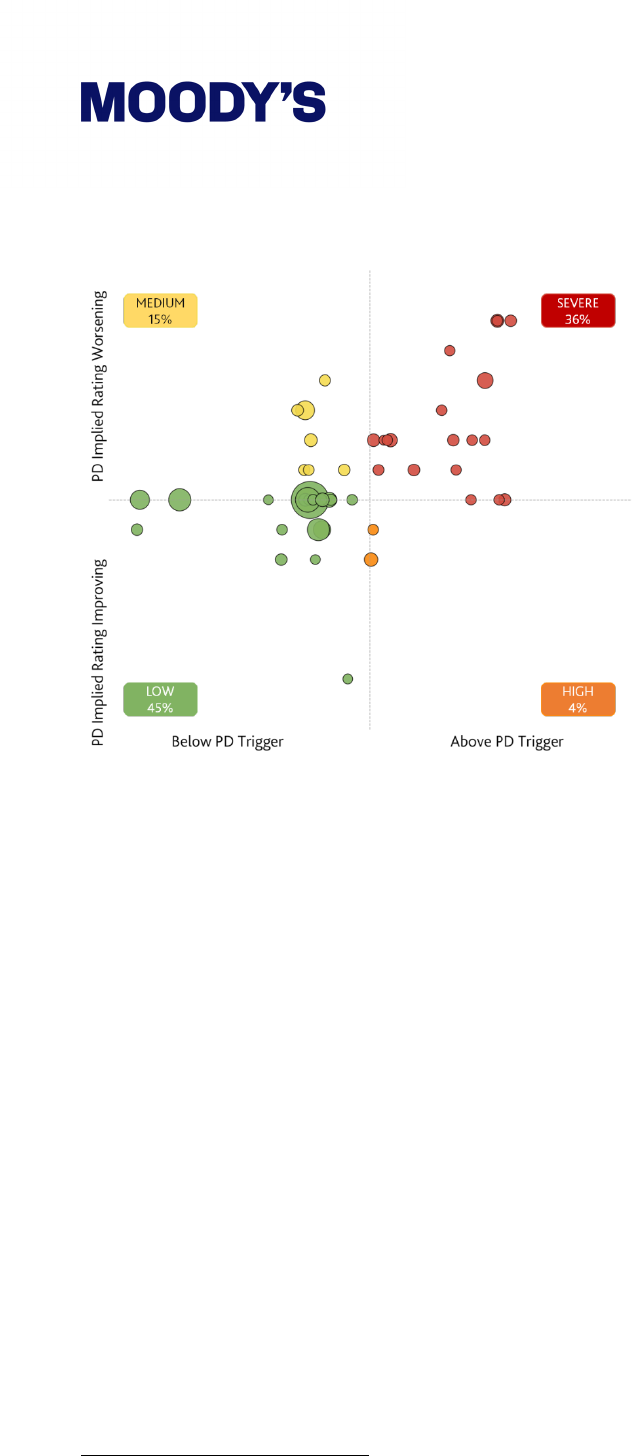

Moody’s EDF-X EWS uses two key measures to identify companies as low, medium, high, or severe risk over the

next 12 months. The two measures are (1) whether a company’s forward-looking PD measure is above an

appropriate sector early warning trier level; and (2) the change in the PD-implied rating. Moody’s research has

shown that public companies with high early warning signals are 25 times more likely to default over the next

year than firms with low early warning signals.

The EWS signals show that 36% of publicly traded German companies were classified as severe risk in April

2024 compared to its peers, vs. 18% in the previous year. Figure 2 presents the April 2024 snapshot of Moody’s

EWS, with each circle representing a company and their relative size (measured by asset value). The largest

firms have been relatively more resilient to the increase in credit risk, as indicated by their placement in the

bottom left quadrant (Low Risk EWS category). This adverse situation might impact an already highly exposed

banking system. Not only do German banks hold the largest exposure to commercial and real estate loans in the

European Union, they are also witnessing a rise in non-performing loans.

2

The planned government measures

will alleviate the sector contraction, but they are not expected to avoid the decline already anticipated for 2024.

3

2

Sidders, J., Confort, N. and Callanan, N. (2024, February 27). Germany’s Slow-Motion Property Crash Is a Looming Risk

for Banks, Bloomberg.

3

https://www.moodys.com/research/Construction-Germany-Construction-downturn-will-hurt-materials-producers-but-

help-Sector-In-Depth--PBC_1389566#Summary

Credit Strategy

Froom Boom to Gloom: Navigating the Impending Downturn in the German Construction and Real Estate Sector

3

FIGURE 2 EDF-X Early warning signals for public German companies in the CRE sector, April 2024

Data source: Moody’s EDF-X platform.

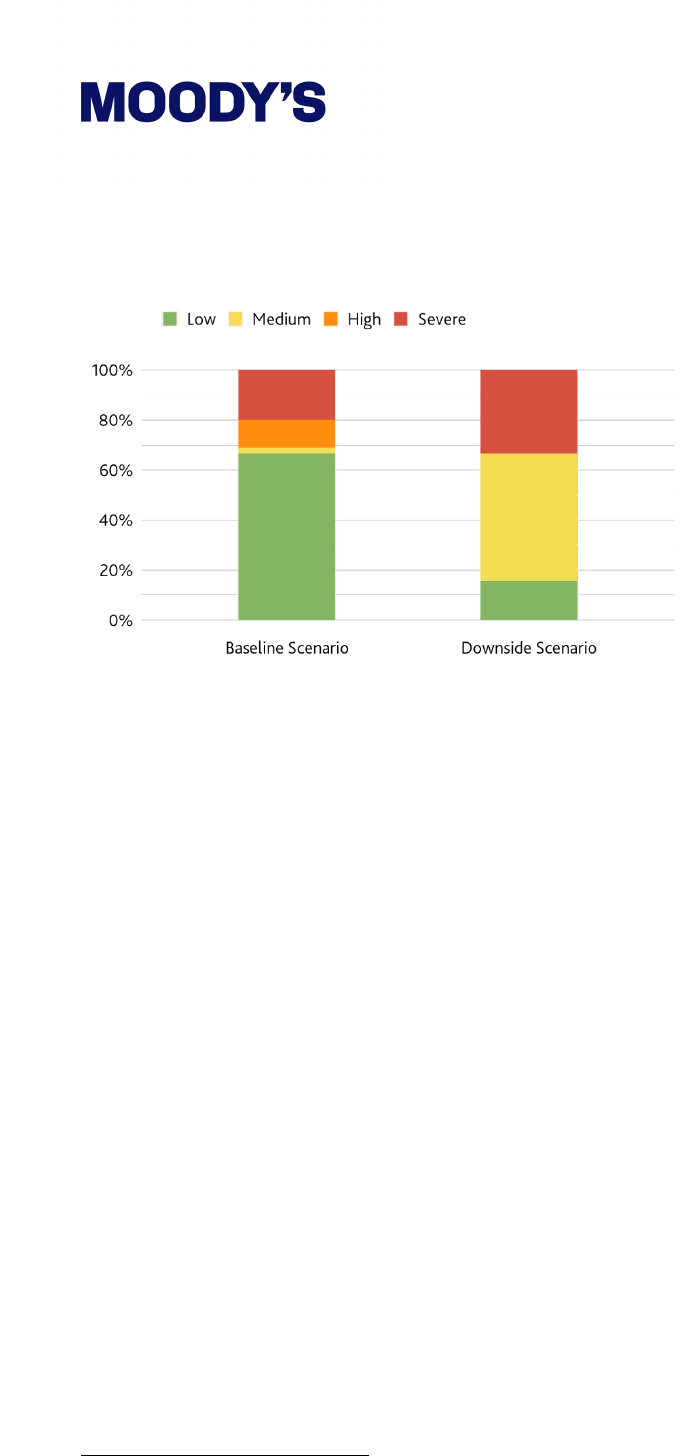

While Moody’s EDF-X Early Warning System (EWS) provides actionable forward-looking signals, it's also crucial

to consider the impact of a shifting macroeconomic environment and the potential realization of different future

scenarios. To address this need, Moody ’s’ EWS methodology has been expanded to account for alternative

macroeconomic scenarios to perform what-if analysis that can ultimately be used for stress testing. In the

analysis that follows, we examine how the EDF-X early warning signals change for German construction

companies under Moody’s baseline economic scenario and a downside scenario.

The Moody's baseline scenario for Germany projects a marginal fall in output with an average negative year-on-

year growth rate of -0.37% until the last quarter of 2024, when growth is expected to turn positive.

4

This

scenario is based on the assumptions of no escalations in global geopolitical tensions and no changes in

monetary and fiscal policies until mid-2024, when the ECB is expected to start cutting rates. Under this

scenario, there is a significant improvement in the risk of public German companies in the CRE sector. Figure 3

shows the scenario-conditioned early warning signals distribution for these companies in December 2024.

Compared to April 2024, the percentage of companies classified as severe risk has decreased significantly from

36% to 20%, while the percentage of companies classified as low risk has increased from 45% to 64%.

In a downside scenario, the credit risk environment for construction and real estate companies deteriorates

significantly. In this Moody’s scenario, sentiment in Europe turns down sharply amidst increasing concerns

around global growth. Geopolitical tensions rise due to fears of escalations in the war in Ukraine and the Israel-

Hamas conflict, as well as an increase in tensions between China and the U.S. The resulting increase in risk

aversion leads to a sell-off in global financial markets, setting the scene for a moderate but prolonged recession

where the ECB hesitates to cut rates. In this scenario, by December 2024 most public firms in the CRE sector

are classified either as medium or severe risk, with firms under severe risk constituting 36% of the sector.

4

Moody’s alternative economic scenarios are available through www.economy.com to subscribers of the service.

Credit Strategy

Froom Boom to Gloom: Navigating the Impending Downturn in the German Construction and Real Estate Sector

4

FIGURE 3 Scenario conditioned early warning signals distribution for public German companies in the CRE

sector, December 2024

Data source: Moody’s EDF-X platform.

A “VICTIM” OF THE SECTOR DOWNTURN: TRAUMHAUS AG

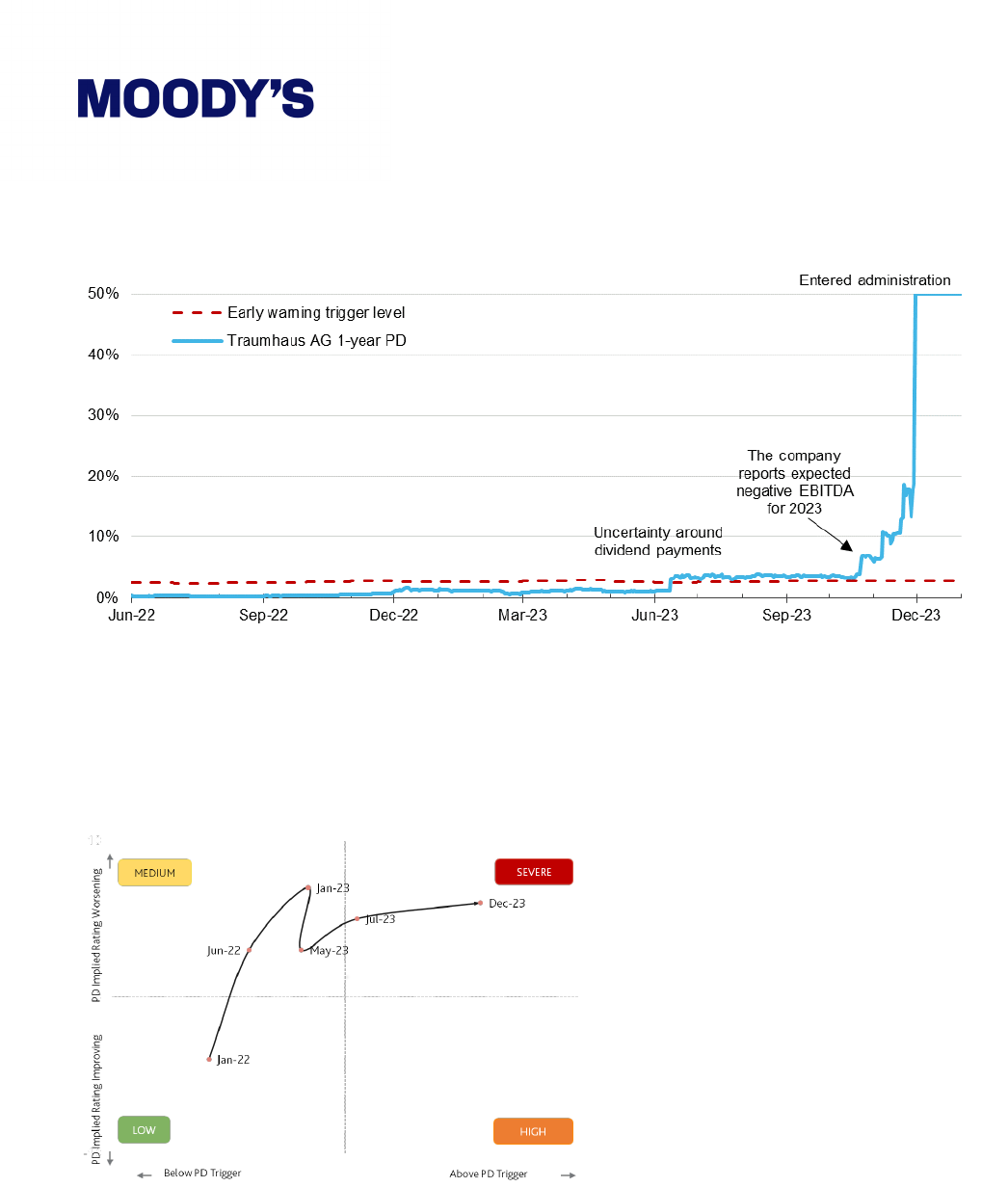

A clear example of how the sector downturn is affecting specific companies is Traumhaus AG, a public German

company with total assets around $160 mil (as of date Orbis, 2022). Founded in 1993, the company operates

within the full chain of real estate project development, from land acquisition to production, marketing, and

management of properties. The company recently filed for self-administration proceedings. The financial

downturn and situation surrounding the company have been extensively covered in the news media.

Moody’s EWS fla ed Traumhaus AG as being under severe risk in June 2023, when the company’s 1-year PD

jumped to 3.1% (equivalent to a B1 implied rating), surpassing the early warning trier level as shown in Figure

4. This severe risk warning was issued four months before the first of several steep declines in the company’s

stock price that would occur in 2023. The initial severe decline took place in October 2023, with the stock value

falling by 38% over a week. A subsequent decline occurred in a single day in November, with the stock plunging

from €2.20 to €0.28. This was also preceded by the EWS’s one-year PD escalating to 18.7%. The PD eventually

reached its peak at 50%, when the company entered administration.

5

5

50% is the maximum forward-looking probability of default for non-financial companies in Moody’s EDF-X platform.

Credit Strategy

Froom Boom to Gloom: Navigating the Impending Downturn in the German Construction and Real Estate Sector

5

FIGURE 4 Traumhaus AG’s one-year PD vs. its sector early warning trier level

Data source: Moody’s EDF-X platform.

The protracted path of Traumhaus AG into administration was traced by EWS, as shown in Figure 5. The

company's low and stable early warning signal began to deteriorate in early 2022, and by June of the same year,

the company was marked as medium risk. The firm’s credit risk continued to deteriorate, gradually approaching

severe risk by June 2023, six months prior to administration.

FIGURE 5 Traumhaus AG’s early warning signal across time

Data source: Moody’s EDF-X platform.

Credit Strategy

Froom Boom to Gloom: Navigating the Impending Downturn in the German Construction and Real Estate Sector

6

NAVIGATING DISTRESS WITH TIMELY RISK IDENTIFICATION

The credit risk deterioration within the German construction sector, as indicated by Moody's forward-looking

probability of default, suests that the industry is potentially on the verge of a significant downturn. This

downturn, characterized by an uptick in project cancellations and a growing number of companies deemed

severe in terms of credit risk, signals a potential crisis in the making. In a scenario where the German economy

underperforms beyond expectations, the sector could face a more prolonged and severe crisis, with an

increasing number of companies struling to maintain their operations. Moody’s scenario conditioned EWS

estimates that the percentage of at-risk companies could rise to 40% under an adverse economic scenario.

A striking example of this crisis is the case of Traumhaus AG. Moody’s Early Warning System (EWS) helped in

identifying and anticipating significant increases in credit risks within specific country and sector markets.

Identifying risky firms on time is crucial for credit risk management as it provides investors and lenders with

greater opportunities to implement mitigation plans and reduce financial impacts.

Credit Strategy

Froom Boom to Gloom: Navigating the Impending Downturn in the German Construction and Real Estate Sector

7

CONTACT US

EMEA

+44.20.1234.5678

clientservices.emea@moodys.com

ASIA (Excluding Japan)

+852.1234.5678

clientservices.asia@moodys.com

JAPAN

+81.1234.5678

clientservices.japan@moodys.com

Credit Strategy

Froom Boom to Gloom: Navigating the Impending Downturn in the German Construction and Real Estate Sector

8

© 2024 Moody’s Corporation, Moody’s Investors Service, Inc., Moody’s Analytics, Inc. and/or their licensors and affiliates (collectively, “MOODY’S”). All rights reserved.

CREDIT RATINGS ISSUED BY MOODY'S CREDIT RATINGS AFFILIATES ARE THEIR CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT COMMITMENTS, OR

DEBT OR DEBT-LIKE SECURITIES, AND MATERIALS, PRODUCTS, SERVICES AND INFORMATION PUBLISHED OR OTHERWISE MADE AVAILABLE BY MOODY’S (COLLECTIVELY, “MATERIALS”)

MAY INCLUDE SUCH CURRENT OPINIONS. MOODY’S DEFINES CREDIT RISK AS THE RISK THAT AN ENTITY MAY NOT MEET ITS CONTRACTUAL FINANCIAL OBLIGATIONS AS THEY COME

DUE AND ANY ESTIMATED FINANCIAL LOSS IN THE EVENT OF DEFAULT OR IMPAIRMENT. SEE APPLICABLE MOODY’S RATING SYMBOLS AND DEFINITIONS PUBLICATION FOR

INFORMATION ON THE TYPES OF CONTRACTUAL FINANCIAL OBLIGATIONS ADDRESSED BY MOODY’S CREDIT RATINGS. CREDIT RATINGS DO NOT ADDRESS ANY OTHER RISK, INCLUDING

BUT NOT LIMITED TO: LIQUIDITY RISK, MARKET VALUE RISK, OR PRICE VOLATILITY. CREDIT RATINGS, NON-CREDIT ASSESSMENTS (“ASSESSMENTS”), AND OTHER OPINIONS INCLUDED

IN MOODY’S MATERIALS ARE NOT STATEMENTS OF CURRENT OR HISTORICAL FACT. MOODY’S MATERIALS MAY ALSO INCLUDE QUANTITATIVE MODEL-BASED ESTIMATES OF CREDIT

RISK AND RELATED OPINIONS OR COMMENTARY PUBLISHED BY MOODY’S ANALYTICS, INC. AND/OR ITS AFFILIATES. MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS AND

MATERIALS DO NOT CONSTITUTE OR PROVIDE INVESTMENT OR FINANCIAL ADVICE, AND MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS AND MATERIALS ARE NOT AND

DO NOT PROVIDE RECOMMENDATIONS TO PURCHASE, SELL, OR HOLD PARTICULAR SECURITIES. MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS AND MATERIALS DO NOT

COMMENT ON THE SUITABILITY OF AN INVESTMENT FOR ANY PARTICULAR INVESTOR. MOODY’S ISSUES ITS CREDIT RATINGS, ASSESSMENTS AND OTHER OPINIONS AND PUBLISHES OR

OTHERWISE MAKES AVAILABLE ITS MATERIALS WITH THE EXPECTATION AND UNDERSTANDING THAT EACH INVESTOR WILL, WITH DUE CARE, MAKE ITS OWN STUDY AND EVALUATION

OF EACH SECURITY THAT IS UNDER CONSIDERATION FOR PURCHASE, HOLDING, OR SALE.

MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS, AND MATERIALS ARE NOT INTENDED FOR USE BY RETAIL INVESTORS AND IT WOULD BE RECKLESS AND INAPPROPRIATE

FOR RETAIL INVESTORS TO USE MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS OR MATERIALS WHEN MAKING AN INVESTMENT DECISION. IF IN DOUBT YOU SHOULD

CONTACT YOUR FINANCIAL OR OTHER PROFESSIONAL ADVISER.

ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY LAW, INCLUDING BUT NOT LIMITED TO, COPYRIGHT LAW, AND NONE OF SUCH INFORMATION MAY BE COPIED OR OTHERWISE

REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE FOR ANY SUCH PURPOSE, IN

WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON WITHOUT MOODY’S PRIOR WRITTEN CONSENT. FOR CLARITY, NO INFORMATION

CONTAINED HEREIN MAY BE USED TO DEVELOP, IMPROVE, TRAIN OR RETRAIN ANY SOFTWARE PROGRAM OR DATABASE, INCLUDING, BUT NOT LIMITED TO, FOR ANY ARTIFICIAL

INTELLIGENCE, MACHINE LEARNING OR NATURAL LANGUAGE PROCESSING SOFTWARE, ALGORITHM, METHODOLOGY AND/OR MODEL.

MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS AND MATERIALS ARE NOT INTENDED FOR USE BY ANY PERSON AS A BENCHMARK AS THAT TERM IS DEFINED FOR

REGULATORY PURPOSES AND MUST NOT BE USED IN ANY WAY THAT COULD RESULT IN THEM BEING CONSIDERED A BENCHMARK.

All information contained herein is obtained by MOODY’S from sources believed by it to be accurate and reliable. Because of the possibility of human or mechanical error as well as other factors,

however, all information contained herein is provided “AS IS” without warranty of any kind. MOODY'S adopts all necessary measures so that the information it uses in assigning a credit rating is of

sufficient quality and from sources MOODY'S considers to be reliable including, when appropriate, independent third-party sources. However, MOODY’S is not an auditor and cannot in every

instance independently verify or validate information received in the credit rating process or in preparing its Materials.

To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability to any person or entity for any indirect, special,

consequential, or incidental losses or damages whatsoever arising from or in connection with the information contained herein or the use of or inability to use any such information, even if

MOODY’S or any of its directors, officers, employees, agents, representatives, licensors or suppliers is advised in advance of the possibility of such losses or damages, including but not limited to:

(a) any loss of present or prospective profits or (b) any loss or damage arising where the relevant financial instrument is not the subject of a particular credit rating assigned by MOODY’S.

To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability for any direct or compensatory losses or damages

caused to any person or entity, including but not limited to by any negligence (but excluding fraud, willful misconduct or any other type of liability that, for the avoidance of doubt, by law cannot be

excluded) on the part of, or any contingency within or beyond the control of, MOODY’S or any of its directors, officers, employees, agents, representatives, licensors or suppliers, arising from or in

connection with the information contained herein or the use of or inability to use any such information.

NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY CREDIT RATING,

ASSESSMENT, OTHER OPINION OR INFORMATION IS GIVEN OR MADE BY MOODY’S IN ANY FORM OR MANNER WHATSOEVER.

Moody’s Investors Service, Inc., a wholly-owned credit rating agency subsidiary of Moody’s Corporation (“MCO”), hereby discloses that most issuers of debt securities (including corporate and

municipal bonds, debentures, notes and commercial paper) and preferred stock rated by Moody’s Investors Service, Inc. have, prior to assignment of any credit rating, agreed to pay to Moody’s

Investors Service, Inc. for credit ratings opinions and services rendered by it. MCO and Moody’s Investors Service also maintain policies and procedures to address the independence of Moody’s

Investors Service credit ratings and credit rating processes. Information regarding certain affiliations that may exist between directors of MCO and rated entities, and between entities who hold

credit ratings from Moody’s Investors Service, Inc. and have also publicly reported to the SEC an ownership interest in MCO of more than 5%, is posted annually at www.moodys.com under the

heading “Investor Relations — Corporate Governance — Charter Documents - Director and Shareholder Affiliation Policy.”

Moody's SF Japan K.K., Moody's Local AR Agente de Calificación de Riesgo S.A., Moody’s Local BR Agência de Classificação de Risco LTDA, Moody’s Local MX S.A. de C.V, I.C.V., Moody's Local

PE Clasificadora de Riesgo S.A., and Moody's Local PA Calificadora de Riesgo S.A. (collectively, the “Moody’s Non-NRSRO CRAs”) are all indirectly wholly-owned credit rating agency subsidiaries

of MCO. None of the Moody’s Non-NRSRO CRAs is a Nationally Recognized Statistical Rating Organization.

Additional terms for Australia only: Any publication into Australia of this document is pursuant to the Australian Financial Services License of MOODY’S affiliate, Moody’s Investors Service Pty

Limited ABN 61 003 399 657AFSL 336969 and/or Moody’s Analytics Australia Pty Ltd ABN 94 105 136 972 AFSL 383569 (as applicable). This document is intended to be provided only to

“wholesale clients” within the meaning of section 761G of the Corporations Act 2001. By continuing to access this document from within Australia, you represent to MOODY’S that you are, or are

accessing the document as a representative of, a “wholesale client” and that neither you nor the entity you represent will directly or indirectly disseminate this document or its contents to “retail

clients” within the meaning of section 761G of the Corporations Act 2001. MOODY’S credit rating is an opinion as to the creditworthiness of a debt obligation of the issuer, not on the equity

securities of the issuer or any form of security that is available to retail investors.

Additional terms for India only: Moody’s credit ratings, Assessments, other opinions and Materials are not intended to be and shall not be relied upon or used by any users located in India in

relation to securities listed or proposed to be listed on Indian stock exchanges.

Additional terms with respect to Second Party Opinions (as defined in Moody’s Investors Service Rating Symbols and Definitions): Please note that a Second Party Opinion (“SPO”) is not a “credit

rating”. The issuance of SPOs is not a regulated activity in many jurisdictions, including Singapore. JAPAN: In Japan, development and provision of SPOs fall under the category of “Ancillary

Businesses”, not “Credit Rating Business”, and are not subject to the regulations applicable to “Credit Rating Business” under the Financial Instruments and Exchange Act of Japan and its

relevant regulation. PRC: Any SPO: (1) does not constitute a PRC Green Bond Assessment as defined under any relevant PRC laws or regulations; (2) cannot be included in any registration

statement, offering circular, prospectus or any other documents submitted to the PRC regulatory authorities or otherwise used to satisfy any PRC regulatory disclosure requirement; and (3) cannot

be used within the PRC for any regulatory purpose or for any other purpose which is not permitted under relevant PRC laws or regulations. For the purposes of this disclaimer, “PRC” refers to the

mainland of the People’s Republic of China, excluding Hong Kong, Macau and Taiwan.