Copyright © 2024 S&P Global

NEWS RELEASE

MARKET SENSITIVE INFORMATION

Embargoed until 0930 CET (0830 UTC) 6 March 2024

HCOB Germany Construction PMI

®

Decline in construction activity eases in February

Key findings:

Total industry activity falls at slowest rate for five months

Downturns soften in each broad sector, but particularly in civil engineering

Input cost inflation at 11-month high as delivery times lengthen

Data were collected 12-28 February 2024.

The German construction sector remained firmly in contraction territory midway through the opening quarter of the year,

although rates of decline in activity, new orders and employment all eased, the latest HCOB PMI

®

survey compiled by S&P

Global showed. The slower fall in total industry activity partly reflected a near-stabilisation in civil engineering work.

Input prices meanwhile rose for the third month running, with the rate of cost inflation hitting the highest for nearly a year but

remaining low by historical standards. The rise in purchasing costs coincided with a second successive monthly lengthening of

supplier delivery times and belied a sustained downturn in demand for building materials.

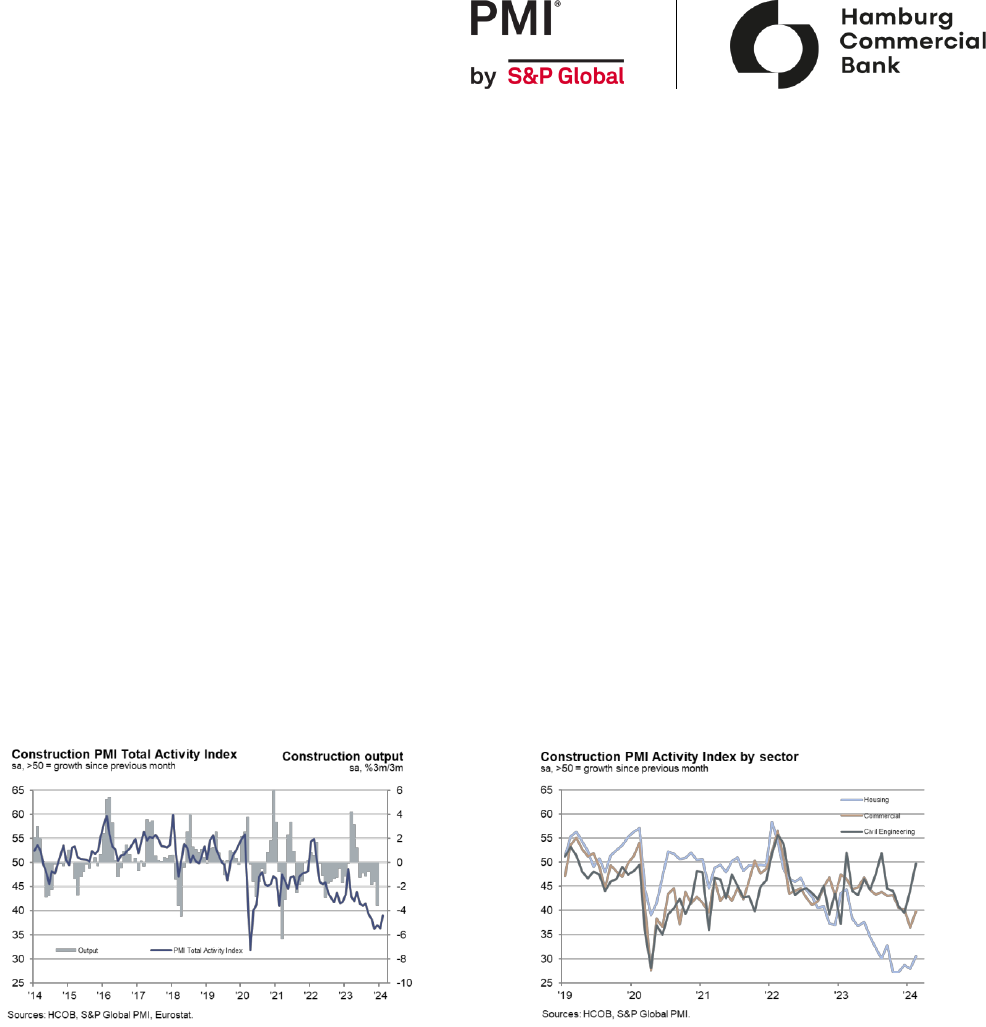

The HCOB Germany Construction PMI Total Activity Index – a seasonally adjusted index tracking changes in total industry

activity – ticked up to a five-month high of 39.1 in February, from January’s 36.3. Nevertheless, the latest reading was still well

below the critical 50.0 no-change mark and shy of its average over the current sequence of decline that stretches back to April

2022.

February data showed slower rates of decline in each of the three broad construction categories monitored by the survey. Civil

engineering activity in fact fell only factionally, its rate of decrease having slowed notably since January. Rates of contraction in

both housing and commercial activity remained sharp, particularly that of the former, but they eased to the weakest since last

September and December, respectively.

Activity in the construction sector continued to be dragged down by a lack of new work. Panellists cited ongoing headwinds to

demand from client uncertainty, price pressures and general weakness in the economy. New orders once again fell at a sharp

rate, but one that was nevertheless the least marked for six months.

The pace of job shedding likewise moderated across the construction sector in February, showing the smallest drop in

employment since last July. Still, the decline in workforce numbers continued a trend of shrinking staffing capacity stretching

back almost two years. Subcontractor usage also fell, contributing to an improvement in their availability. However, February

saw a renewed – albeit marginal - rise in rates charged by subcontractors following a four-month sequence of decline.

Average input prices faced by constructors also increased in February, the third month in a row in which this has been the case.

The rate of cost inflation crept up to its highest since March 2023, although it was still subdued by historical standards. There

were some mentions of supply bottlenecks and shipping delays driving up costs, alongside the pass-through of increased toll

charges and high inflation generally. Supplier delivery times lengthened again in February, in a reversal of the trend seen

throughout most of 2023. That was despite a continued decline in demand for building materials and products.

Looking ahead, German constructors remained downbeat about the outlook for activity over the coming year, citing economic

frailty and domestic politics as potential constraints. Whilst expectations improved slightly to the highest since last April,

pessimists continued to far outnumber optimists.

Copyright © 2024 S&P Global

Comment

Commenting on the PMI data, Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said:

“These numbers continue to paint an ugly picture. True, the PMI has gone up by almost 3 points which is not negligible.

However, the index remains still deep in recessionary territory and it is only a one-month movement for now.

“Housing remains the main driver of the recession in construction, followed by commercial real estate activity. A silver lining

comes from civil engineering as activity has remained more or less the same as in January, instead of continuing its hefty fall

of the previous five months.

“Growth territory remains far away. This is best indicated by new orders which have been shrinking at a fast pace for two

years running. The fall softened a bit over the last three months. But this means only that the deepening of the crisis has lost

some momentum, while the crisis is far from over.

“One thing that does complicate the longed-for recovery is the fact that input prices are on the increase again for three

months straight. Subcontractor rates rose in February for the first time in five months. This means that construction

companies are not only suffering from the high interest rate level but also from increasing costs. Given the weak economy, it

is difficult to build residential units that are both attractive for the builder and affordable to the people.

“The assessment about future activity has been negative almost continuously since the start of Covid-19 in 2020. It is as if

pessimism has almost entered into the DNA of the construction sector. However, we know that better times will eventually

come back. Just as an example, during 2016 to 2019, construction businesses were much more positive on the future. What

could possibly trigger a change for the better? Lower interest rates are certainly one ingredient as well as a general

economic recovery. Interest rate cuts, though probably not too many, are around the corner and we are convinced that the

recession will be over soon.”

-Ends-

Copyright © 2024 S&P Global

Contact

Hamburg Commercial Bank AG S&P Global Market Intelligence

Dr. Cyrus de la Rubia

Chief Economist

T: +49-160-9018-0792

cyrus.delarubia@hcob-bank.com

Katrin Steinbacher

Head of Press Office

Senior Vice President

T: +49-40-3333-11130

Phil Smith

Economics Associate Director

T: +44-1491-461-009

Sabrina Mayeen

Corporate Communications

T: +44-796-744-7030

Note to Editors

The HCOB Germany Construction PMI

®

is compiled by S&P Global from responses to questionnaires sent to a panel of

around 150 construction companies. The panel is stratified by company workforce size, based on contributions to GDP.

Survey data were first collected September 1999.

Survey responses are collected in the second half of each month and indicate the direction of change compared to the

previous month. A diffusion index is calculated for each survey variable. The index is the sum of the percentage of ‘higher’

responses and half the percentage of ‘unchanged’ responses. The indices vary between 0 and 100, with a reading above 50

indicating an overall increase compared to the previous month, and below 50 an overall decrease. The indices are then

seasonally adjusted.

The headline figure is the Total Activity Index. This is a diffusion index that tracks changes in the total volume of construction

activity compared with one month previously. The Total Activity Index is comparable to the Manufacturing Output Index and

Services Business Activity Index. It may be referred to as the ‘Construction PMI’ but is not comparable with the headline

manufacturing PMI figure.

Underlying survey data are not revised after publication, but seasonal adjustment factors may be revised from time to time

as appropriate which will affect the seasonally adjusted data series.

For further information on the PMI survey methodology, please contact [email protected].

Hamburg Commercial Bank AG

Hamburg Commercial Bank (HCOB) is a private commercial bank and specialist financier headquartered in Hamburg,

Germany. The bank offers its clients a high level of structuring expertise in the financing of commercial real estate projects

with a focus on Germany as well as neighboring European countries. It also has a strong market position in international

shipping. The bank is one of the pioneers in European-wide project financing for renewable energies and is also involved in

the expansion of digital and other areas of important infrastructure. HCOB offers individual financing solutions for

international corporate clients as well as a focused corporate client business in Germany. The bank’s portfolio is completed

by digital products and services facilitating reliable, timely domestic and international payment transactions as well as for

trade finance.

Hamburg Commercial Bank aligns its activities with established ESG (Environment, Social, and Governance) criteria and

has anchored sustainability aspects in its business model. It supports its clients in their transition to a more sustainable

future.

The bank’s specialists are as experienced as they are pragmatic. They act in a reliable manner and at eye level with their

customers. They provide in-depth advice in order to jointly find efficient solutions that are a perfect fit – for complex projects

in particular. Tailor-made financing, a high level of structuring and syndication expertise and many years of experience are

just as much a hallmark of the bank as are our profound market and sector expertise.

S&P Global (NYSE: SPGI)

S&P Global provides essential intelligence. We enable governments, businesses and individuals with the right data,

expertise and connected technology so that they can make decisions with conviction. From helping our customers assess

new investments to guiding them through ESG and energy transition across supply chains, we unlock new opportunities,

solve challenges and accelerate progress for the world.

We are widely sought after by many of the world’s leading organizations to provide credit ratings, benchmarks, analytics and

workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help the

world’s leading organizations plan for tomorrow, today.

S&P Global is a registered trademark of S&P Global Ltd. and/or its affiliates. All other company and product names may be

trademarks of their respective owners © 2024 S&P Global Ltd. All rights reserved. www.spglobal.com

Copyright © 2024 S&P Global

About PMI

Purchasing Managers’ Index™ (PMI

®

) surveys are now available for over 40 countries and also for key regions including the

eurozone. They are the most closely-watched business surveys in the world, favoured by central banks, financial markets

and business decision makers for their ability to provide up-to-date, accurate and often unique monthly indicators of

economic trends. www.spglobal.com/marketintelligence/en/mi/products/pmi.html

If you prefer not to receive news releases from S&P Global, please email katherine.smith@spglobal.com. To read our

privacy policy, click here.

Disclaimer

The intellectual property rights to the data provided herein are owned by or licensed to S&P Global and/or its affiliates. Any

unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not

permitted without S&P Global’s prior consent. S&P Global shall not have any liability, duty or obligation for or relating to the

content or information (“Data”) contained herein, any errors, inaccuracies, omissions or delays in the Data, or for any actions

taken in reliance thereon. In no event shall S&P Global be liable for any special, incidental, or consequential damages,

arising out of the use of the Data. Purchasing Managers’ Index™ and PMI

®

are either trade marks or registered trade marks

of S&P Global Inc or licensed to S&P Global Inc and/or its affiliates.

This Content was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately

managed division of S&P Global. Reproduction of any information, data or material, including ratings (“Content”) in any form

is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content

Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not

responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the

use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses

(including lost income or lost profit and opportunity costs) in connection with any use of the Content.