Getting real value

from the audit

tender process

Audit Committee Institute part of

KPMG Board Leadership Centre

Contents

Ge

tting real value from the audit tender process | January 2018

© 2020 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

1

Choosing the right audit firm 2

What you need to do as an Audit Committee 2

Finding the right balance 2

The approach 3

Tendering – the myths 4

Step 1 – Identify objectives 5

Step 2 - Plan the process 6

Appointing a project manager 6

Setting the parameters 6

Designing the proposal process 6

Timetable 7

Selecting the invitee list 8

Shareholder consultation 8

Step 3 - Making the right decisions 9

Factors to consider 9

Decision makers and other inputs 9

Recommendations from others 11

Independence and objectivity 11

Decision making process 11

Step 4 - Begin the audit tender 12

Issuing the invitation to tender 12

Site visits 12

Managing site visits 12

Access to company personnel 13

Proposal documents 13

Evaluating documents 13

Presentations 13

Making the decision 13

Appointing a firm 13

After the process 13

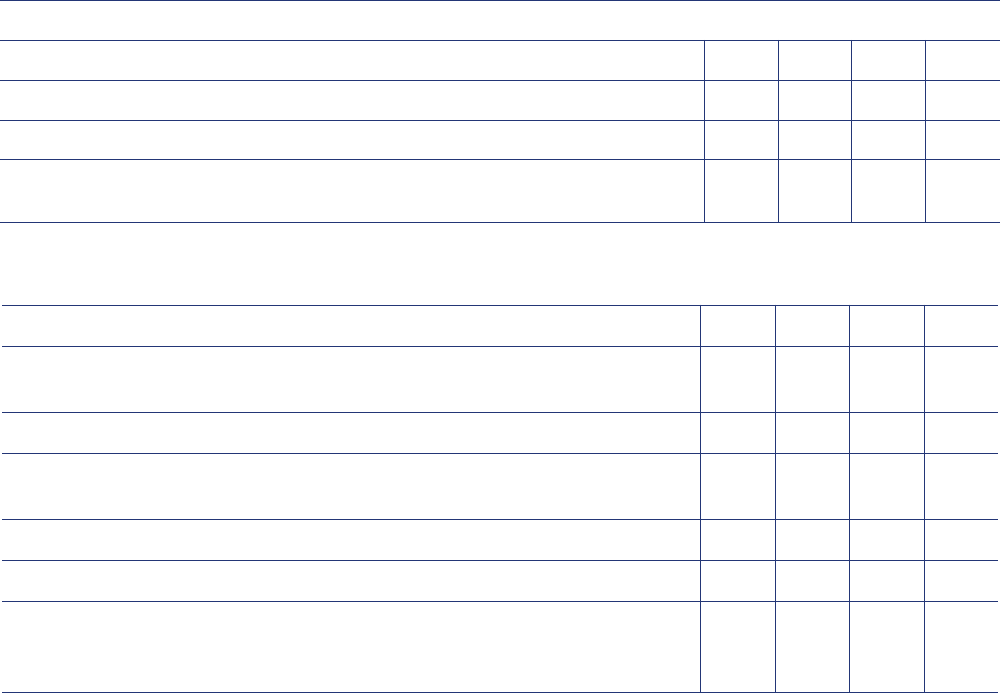

Appendices 14

Appendix I – Example invitation to tender letter 15

Appendix II – Example site visit scorecard 16

Appendix III – Information to be supplied to participants in audit 18

tenders

Appendix IV – Example content for written audit submissions 19

Appendix V – Guidance for data rooms in audit tenders 20

Getting real value from the audit tender process | January 2018

© 20

20 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

2

–

Choosing the right audit firm

Choosing the right auditor for your

organisation is essential – it’ll help to make

sure you get the best out of the process and

allow you to reap the material benefits of an

audit for your business.

It’s true that the audit process is there to make sure

your business is compliant, and if it’s done well, it

should keep disruption to a minimum. But it’s also a

chance to take a close look at how you’re doing things

now, to see what could change and to understand how

you can use the process to make your business more

efficient. It could save you time and money in the long

run, so you need an auditor that knows how to fine tune

the process to your needs. That’s what we mean by

getting real value from the audit tender process.

What you need to do as an Audit Committee

Making the recommendation to the board on the

appointment of the s

tatutory auditor has for many years

been a fundamental Audit Committee responsibility.

Nevertheless, the recent EU Audit Reforms introduce

legally binding requirements in relation to audit

tendering and rotation for Public Interest Entities (PIEs)

that for many Audit Committees will represent a

significant change to their role. Specifically, unless the

company qualifies as a small or medium-sized company

or is a company with reduced market capitalisation, the

Audit Committee must inter alia:

— ensure that the tender process does not in any way

preclude the participation in the selection procedure

of non-Big 4 firms;

— ensure that tender documents are prepared that

allow the invited auditors to understand the business

of the audited entity;

— ensure that the audit proposals are evaluated in

accordance with the predefined non-discriminatory

selection criteria and that a report on the conclusions

of the selection procedure is prepared and validated

by the Audit Committee;

— identify in its recommendation to the Board its first

and second choice candidates for appointment and

give reasons for its choices; and

— ensure that the company is able to demonstrate to

the competent authorities, upon request, that the

selection procedure was conducted in a fair manner.

As Audit Commi

ttee members, you are responsible for

initiating and supervising the audit tender process and

for recommending the best auditor to suit the needs of

your business. We’ve put this guide together to help

you approach the tender process in a way that makes it

a really worthwhile exercise – one that delivers lasting

benefits for your organisation.

Finding the right balance

Getting the balance right in your audit tendering process

is really important – it’ll help you to become more

efficient and it can also help you keep down the time

and cost of the audit process itself. Finding the right

firm, one that’s experienced in your sector, understands

your needs and knows your business can give you a

head start.

Getting the balance right in your audit

tendering process is really important –

it’ll help you to become more efficient and

keep down the time and cost of the audit

process itself

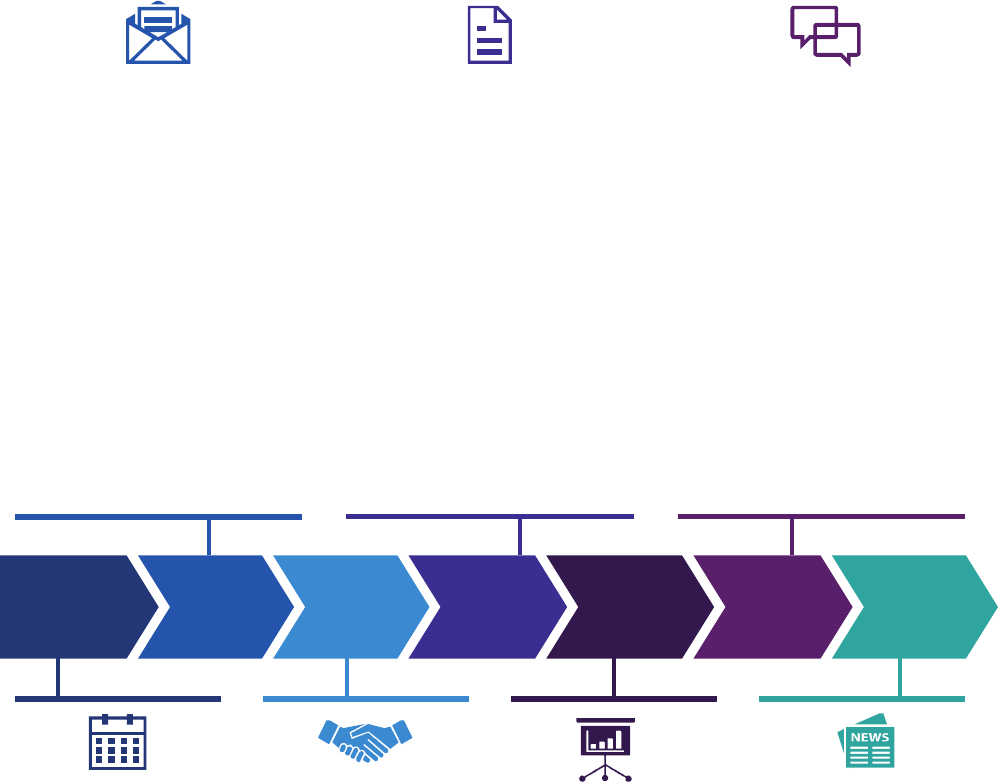

The approach

This is what a typical tender process looks like.

We’ve added some key points around how to get the best from it.

Plan and confirm

the process

Develop initial

scorecard

— Workshop to align

stakeholders – Audit

Committee/Board/

executive management.

— Gain input from others

and the existing auditor.

— Include tangible and

intangible criteria.

— Prioritise and weight

scorecard.

— Pre-tender evaluation.

— Keep scorecard flexible

at feedback

points.

— Share the scorecard

with participants.

— Assign

project

management

resource.

Invite a

shortlist of

firms

How many?

— Consider who to invite. The tender

process must not preclude the

participation in the selection

procedure of non-Big 4 firms.

— Ensure firms are independent or

able to obtain independence

confirmation.

— Acknowledge the existing auditor, if

it’s useful, seek their collaboration

and input.

— Understand the benefit of change

for both you and them. Keep a

positive relationship with the

current auditor.

— Consider how various firms in audit

and non-audit roles may shuffle.

What’s likely to change? How do

you benefit from any potential

movements in both audit and non-

audit service providers?

Hold initial

meetings/

site visits

Communication

and data

— Be clear around what’s

involved in the projec

t.

— Structured briefing to

participants – 1 to many

and 1 to 1.

— Workshops with

tenderers.

— Involve executive

management

and AC.

— Create

a data-room.

— Manage the relationship

with the incumbent.

— Keep site visits well

managed and efficient.

— Provide feedback.

— Update decision

scorecard criteria.

Receive

tender

documents

Document or not?

— Provide workable timings for

tenders to give their best response.

— Think about how the formats they

use to respond – traditional hard

copy document response vs

alternatives such as soft copies.

— Keep RFP and allowed response

size guidance short.

— Link tender document questions to

the scorecard.

— Provide feedback to tenderers.

— Update decision scorecard criteria.

Presentation

and

evaluation

What is real?

— Consider

alternatives to

a formal presentation

that will allow you to

see what it’s really like

to work with

prospective firms.

– LP – interviews

– Q&A

— Mark against

decision

scorecard criteria.

— What do the documents

tell you?

Recommend

Manage any differing

internal points of view

— Use scorecard as a guide.

— Give consideration to both tangible

and intangible scoring.

Announce

decision

Now what

— Finalise any

remaining

commercial terms.

— Transition – allocate

resources.

— Involve the incumbent.

— Consider any actions to

be taken relating to

changes to the services

various

firms

will now

provide (the service

shuffle).

— When does

independence start?

— Win/loss debriefs.

Getting real value from the audit tender process | January 2018

© 2020 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG I

nternational Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

3

G

etting real value from the audit tender process | January 2018

© 2020 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

4

Tendering – the myths

Myth 1 – You need three firms to create competitive

tension

While the EU Audit Reforms requires that the Audit

Committee recommends two potential audit firms - a

first and second choice candidate - together with the

reasons for its choices, narrowing the field to two

competitors early in the process reduces effort all round.

It’s possible to achieve a healthy level of competition

with two firms, but it’s important to address two key

issues:

1. Do the two firms address your key criteri

a?

First, run a tight RFI/EOI process. Keep to a small

number of questions, say five, that address y

our

k

ey criteria. From this, reduce the list to the top tw

o

f

irm

s.

2. E

nsure both firms are thoroughly independenc

e

c

leared. Ensure that the selected firms ca

n

es

tablish independence by the required date befor

e

na

rrowing down the field. Not doing so may resul

t

i

n a firm having to remove themselves from the

pr

ocess for independence reasons, which coul

d

m

ean losing the competitive environment

.

N

ote, there is a risk to Audit Committee members (who

may face a temporary ban of up to three years from

being a Board member of a Public Interest Entity if

found to be in breach of the new Regulation) and the

process itself if the Audit Committee is unable to

recommend a first and second choice if (say) one firm

pulls out late in the selection process or subsequently

proves to be an unacceptable choice.

Myth 2 – There’ll be a level playing field

Each firm has very different experiences and levels of

established relationships. You can’t have a complete

like-for- like comparison.

Fairness is really important. Allow each firm the time,

access and opportunity to build and present their best

offering.

Myth 4 – There should be a clear winner

If there’s daylight between the firms then there’s an

easy decision, but this could also point to there not

being enough competitive tension between those

participating. Make sure you give each tenderer fair time

and access to demonstrate their capability to meet your

needs.

Myth 5 – There shouldn’t be any feedback during the

process

As you progress, firms may raise issues that merit

revisiting their performance against certain of the

predefined selection criteria. Equally some predefined

criteria may alter or become redundant as the group’s

circumstances change (e.g., the withdrawal from a

geographic market or business sector). Some flexibility

in this regard would – if handled transparently – be

reasonable as ultimately it will ensure a fair process that

leads to a better informed choice of audit firms.

Similarly, providing f irms with feedback across the

process will allow them to tweak their solution to be the

strongest it can be for you. For example, if a team

member isn’t quite gelling with you, why not provide

feedback? This allows the firm the opportunity to

change that team member, meaning that you’ll

ultimately have a stronger team available t o you.

Myth 6 – Tendering firms don’t need access to the

Audit Committee chair/the Audit Committee chair

will rubber stamp the decision.

Allowing f irms time and access to your organisation

strengthens their ability to provide the most relevant and

tailored service offering. Remember, only the Audit

Committee can initiate and supervise the tender

process and make the appointment recommendation to

the Board.

Getting real value from the audit tender process | January 2018

© 20

20 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

5

Step 1 – Identify objectives

Think about what you want to achieve

before starting the process. Stakeholders

may have different objectives so it’s

important to align each stakeholder well in

advance to avoid later disruption to the

process or decision making. It’s often

beneficial to hold a stakeholder workshop to

identify and collate the objectives of the

collective group. You may want to involve the

existing auditor in this discussion where

appropriate, to ensure you’re covering all

considerations.

Give careful consideration to the services you need:

— What’s included in the tender? Should it include “the

fund” as well as the corporate audit?

— Which services should be tendered at the same

time? Are there potential benefits from tendering

internal audit and expat taxation or other services at

the same time as the external audit? Tendering a

number of services simultaneously will increase the

effort involved, but this could be marginal compared

with conducting separate tenders for separate

services over a number of years.

Your objectives may include:

— Improved audit quality and/or service.

— New ideas.

— New approach.

— Fee reduction.

— Testing the market.

— Rationalising t

he

advisers in a

group.

— Access

to a wider

range of experience.

— Better

continuity.

— Responding to corporate

governance

best practice.

Agreeing objectives with key stakeholders

well in advance will lessen potential for

disruption throughout the process or during

the decision making process.

Getting real value from the audit tender process | January 2018

© 202

0 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

6

Step 2 – Plan the process

Planning is important. Not only to help achieve a successful outcome – it also ensures the

process is as efficient as possible. Careful planning can help you to control the amount of

time devoted to the exercise, while allowing firms the access they need to develop an

effective proposal.

A poorly managed tender can create additional work through, for example, participants

needing to clarify matters or seek additional information, duplicated effort by internal

personnel or an inefficient decision making process. There’s also the potential for significant

management time to be diverted from their “real” job – managing the business.

Appointing a project manager

Appointing a project manager coul

d allow you to focus

your efforts on assessing the firms and reaching the

right decision for you based on your evaluation criteria.

The role of the project manager is to manage the

process and be the direct contact with the participants.

Setting the p

arameters

The project manager will need direction, so ensure that

the parameters of the process are clearly defined. The

following activities could help smooth the process and

increase efficiency:

— Document the objectives of the tender.

— Clearly define clearly the scope of the work you’re

offering.

— Define the information to be made available to the

participants and make it easily available to them.

— Establish a timetable for the process, which takes

into account the commitments of both your senior

executives and the financial management team.

— Consider access to the Chairman, Chair of the Audit

Committee and other non-executives and directors

as appropriate.

— Agree the composition of the selection panel and the

decision making process and criteria that you’ll

follow.

— Decide on the scope of the written proposals you

require and the format of the oral presentations.

For the firms to be able to develop the right approach,

they need a good understanding of your business, your

needs and your key personnel. This means providing

them with an appropriate level of information and

access to management.

Designing the proposal process

Professional services tenders traditionally follow a

standard st ructur

e:

— Invitation to tender – the organisation writes to the

firms asking if they’re interested in pitching for the

work and are capable of delivering to headline needs.

— Site visits – the firms meet with key personnel to

understand the business and its needs.

— Document – firms submit a document setting out

their proposal. The company reviews the documents

and can then draw up a shortlist.

— Presentations – selected firms present to a panel

and answer questions.

— Appointment – the decision makers agree which firm

they want to appoint, notify the firm and complete

negotiations and contractual aspects.

Discussion and negotiation may continue throughout the

process.

Increasingly, organisations choose to design tender

processes that don’t strictly follow the approach set out

above. For example, you may choose not to hold formal

presentations and instead host deep Q&A sessions

developed specifically for each individual firm. This can

reduce time and cut straight to the areas where you

need most clarity.

Timetable

The length of time you need for your tender will depend

on a number of factor

s:

— The process you decide to follow.

— The number of firms you invite – the more you invite,

the longer the process will take.

— Availability and other commitments of your

personnel involved in the tender.

— Timing of existing Board and Audit Committee

meetings.

The timing of a tender can affect the ease of changing

auditors and the efficiency of the process. Typically an

audit tender process lasts between eight and twelve

weeks from the time the invitation to tender letter is

issued. However the timetable should be developed to

accommodate the specific needs of your organisational

requirements and objectives.

Remember that the ability of the firms to develop an

offer tailored to your objectives and requirements

depends on them being given reasonable access to

management during the process. Balance this with the

amount of time your organisation can commit.

Planning a tender process is very important and

appoint

ing a project manager is one way of improving

the efficiency of the process.

As well as the timetable of your process it is also

important to consider the timing of when you first

connect with the market and subsequently run the

process. This is particularly relevant for independence

purposes as some firms might take longer than others

to establish independence so it is important to factor in

plenty of time for firms to work through what may be

required to achieve independence. Of specific note, are

the “cooling in” provisions, that prohibit internal audit

services and certain design and implementation

services in the year prior to the first period which will be

subject to audit by

the new auditor.

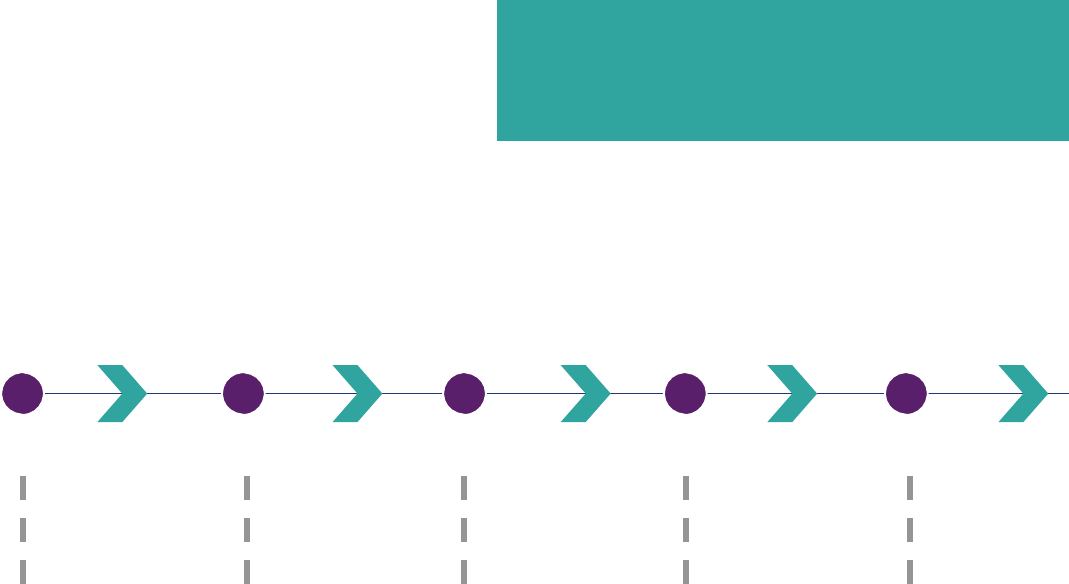

As an illustration, we ‘ve included a twelve -

week timetable below.

Pre-process

Internally, there may be a few

w

eeks planning the process

and setting criteria.

You should also consider an

RFI which would give firms

opportunity to consider

independence.

Day 1

Invitation to

tender

dispatched.

Week 1

Initial meet

ing between

CFO and the firms

involv

ed in the tender

process.

Week 2-5

Meetings with other

per

sonnel and

visits to

locations.

Week 6

Tender document

submi

tted.

Example timeframe for a twelve-week external audit process

Getting real value from the audit tender process | January 2018

©

2020 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

7

Selecting the invitee list

It’s a good idea to invite only those

firms that you know

have the resources, infrastructure and coverage to be

able to do the job.

If you’re not sure which firms to invite, think about

those that you, or other people in your organisation,

already have a relationship with. You could ask for

recommendations from:

— Other Board members.

— Current suppliers.

— Your own contacts.

— Other business networks.

— Other finance directors.

— Multipliers (bankers/lawyers).

If you have a concern about a particular firm that could

disqualify it from being appointed, for example over a

conflict of interest, it’s better to resolve the issue before

the tender gets under way.

The Audit Committee should be cognizant that the new

EU Audit Reforms require that the tender process does

not in any way preclude the participation in the selection

procedure of firms which received less than 15% of the

total audit fees from PIEs in the previous calendar year –

effectively non-Big 4 firms.

In the absence of any further guidance, perhaps the

safest course of action is to put advance notice of any

tendering plans into the public domain either through

disclosure in the annual report (see below) or disclosure

on the company website.

Inviting two firms can be all that’s required for sufficient

competition. However organisations regularly invite

three or more firms to provide a fuller picture of what

the marketplace has to offer. Remember, the EU Audit

Reforms require that the Audit Committee recommends

two potential audit firms - a first and second choice

candidate – together with the reasons for its choices.

Shareholder consult

ation

Whatever the timing you decide on, think about

shareholder consultation and make sure they

understand the context of any decision. Guidance on

tendering says you should disclose your intention to

tender well in advance, for example, in your annual

report up to 1-2 years before a tender. This would help

you manage shareholder expectations and prevent any

“spooks” in the market when you announce a tender.

Inviting two firms can be all that ‘s required

for sufficient competition and can save real

time and effort for yourself and those

tendering.

Week 7

Selection panel

reviews

documents and

obtains feedback

from locations and

shortlists firms for

the oral

presentations.

Week 8-9

— Oral presentations.

— Selection pa

nel

decides its preferred

firm and makes a

recommendation to the

Audit Committee.

— Board approval is

sought.

Week 10

Firms are informed

of the Boar

d’s

decision.

Week 11

-12

Debrief with firms on their

p

erformance dur

ing the

process.

Getting real value from the audit tender process | January 2018

© 2020

KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

8

Step 3 – Making the right decisions

Factors to consider

— When planning the proposal process

, you should

agree;

— Who in the organisation should be involved in

making the decision.

— How the decision will be reached.

Your decision is likely to be based on two elements:

— Tangible – a number of factual/tangible criteria for

comparing the firms (the evaluation criteria).

— Intangible – how you feel about the firms, the

teams they put forward and how well their cultures

fit with your own organisation’s style.

Decision makers

and other inputs

Regulations require tha

t the Audit Committee be

responsible for the process of auditor selection and

making the recommendation to the Board for the

appointment. To find the best audit firm for your

organisation, input should be sought from various

perspectives from around the organisation and the

process should include representatives of all the parties

who’ll have a relationship with the auditor and impacted

advisory services providers. This would typically be:

— Those who have responsibility for audit related

matters – the Audit Committee, the finance director.

— Those who’ll have a relationship with the advisers,

Head of Internal Audit, Head of Tax, General

Managers, members of the finance functions.

It’s important to get the right balance between having

enough input and involving too many people and

wasting time. You can ask people for their views

without them being involved in the whole decision

making process, for example, general managers or

subsidiary managers can f eed back their views following

the firm’s site visits. Giving i nternal business units a

voice in the development of the scorecard allows them

to be heard and will reduce future internal noise around

the decision.

It’s essential to try to ensure that all the key people are

available for significant meetings, for example, site visits

and the firm’s presentations. Also make sure they’ve

been briefed on the proposal process and its objectives,

and that the Audit Committee takes ownership of the

evaluation criteria and decision making process.

Identif

ying the evaluation criteria

The EU Audit Reform

s require that the Audit Committee

be responsible for ensuring that tender documents

contain transparent and non-discriminatory selection

criteria that shall be used to evaluate the audit

proposals.

Consider what you’re looking for in your auditors and

potentially other professional advisers. This will relate t o

your current needs and to the strategic plans for the

future. The factors that are important to you should form

the evaluation criteria that you apply.

They may i

nclude:

— understanding your bus ine

ss – how well do the

prospective teams understand your business, the

issues you face and the emerging industry trends?

The audit firms’ experience in providing audit and

other services to other companies in the same

sector should be assessed. The perceived

disadvantage of such sector experience may be that

the audit firm provides services to direct

competitors. Auditors are under a professional and

legal obligation of client confidentiality and normally

go to great lengths to construct ‘Chinese walls’ to

prevent any abuse of an apparent conflict. This threat

may be more perceived than real, but it could be a

matter of genuine concern.

— people – are the team members authorities in their

field? Do they have the experience that you’re

looking for? Do you trust them?

It ‘s important that the audit team is able to address

complex technical issues and that appropriate back-

up resources are available if required.

— relationship – is there a personal fit with members

of your team? Do the key partners and managers

have the qualities to establish the type of

relationship your executive management prefer?

One of the many important aspects of the auditors’

position is the working relationship with the

company’s executive management. The finance

director and the finance team must believe that

they’ll have a relationship with the new auditors that

will work and can be based on trust and respect for

each other. They need to be satisfied that the audit

team will have the appropriate level of staff, with the

necessary experience and knowledge and that the

personal relationship at the key company/ audit

contact points will be workable.

Getting real value from the audit tender process | January 2018

© 2

020 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

9

In particular, it’s important that the audit partner has an

appropriate working relationship with the finance

director and the chairman of the Audit Committee, and

that the audit manager has an appropriate working

relationship with the finance director and key finance

staff.

— proactivity, ideas and strategies – to what extent

have the teams demonstrated that they’ll be

proactive, bring new ideas and continually enhance

their service to you?

Throughout the process, the level of ideas brought to

you will provide you with an indication of the type of

performance you can expect in your relationship with

the firm. Ideas brought to you upfront in the process

also all ow you to assess the teams’ commercial

understanding of your business.

— organisational fit – does the firm have the coverage

that you need? Do its culture and values fit well with

your organisation?

The firm needs to be capable of serving the needs of

the company. It also needs to really understand your

priorities and values and ideally, display these

characteristics itself.

— commitment – how committed is the firm to

providing you with the service you want? How far

are they prepared to go?

The level of input at partner level can be an indicator

of the level of commitment that the firm has to

developing a working relationship with your

company.

— approach – how well does the proposed approach

to the work address your needs and provide the

added value that you’re looking for?

— Independence – can the firm achieve

independence?

— dedicated service professional input – to what

extent do the firms have the dedicated service

professional experience that you’d like access to?

This can be a section required in the documentation

by which you can assess approaches and use of

industry authorities on the team.

— fees – will you get good value for money on an

ongoing basis?

The executive management may be keen to

demonstrate their tight control over the company’s

costs, through a reduction in the audit fee, but this

may not necessarily be in the interests of the Board

or the shareholders, or even of the executive

management themselves. A more appropriate

measure may be value for money rather than

absolute cost.

Where there’s a downward pressure on the audit fee

particularly, this poses a challenge to the audit process.

The Audit Committee should be mindful of the

appropriateness of the proposed audit fee, so as to

strike a balance in which the fee is low enough to

present a challenge to the audit process to improve the

efficiency and effectiveness of the audit, but high

enough to enable the auditors to undertake a thorough

audit in accordance with auditing standards.

The Audit Committee must satisfy itself that the audit

fee quoted is a realistic fee for undertaking a full and

proper audit and that the auditors aren’t relying on

obtaining additional non-audit work to subsidise an

unrealistically low audit fee.

To some extent, audit efficiency can be helped by the

company providing the correct information in an

appropriate format at the right time. In this way the

company may have some influence over the overall

audit cost. Such arrangements, and any other ways by

which the company might be able to help the efficiency

of the audit, should be discussed with the potential audit

firms as part of the selection process.

The proposed audit fee, needs to strike a

balance in which the fee is low enough to

present a challenge to the audit process to

improve the efficiency and effectiveness of

the audit, but high enough to enable the

auditors to undertake a thorough audit in

accordance with auditing standards.

G

etting real value from the audit tender process | January 2018

© 2020 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

10

Independence and objectivity

The Audit Commi

ttee needs to consider any threats to

independence and objectivity faced by each audit firm

and the safeguards that each proposes to overcome

those threats. The Audit Committee should assess the

extent to which each audit firm would be – and be seen

to be – independent and objective in the position of

auditor, covering non-audit services, in the case , other

firm relationships (e.g. financial arrangements) and the

personal independence of teams.

You’ll need to review your approach to awarding

contracts for advisory and tax services, often referred to

as “non- audit” services, in the case of certain services

up to a year before the start of the audit period. The

outcome of your tender process may affect other

projects you have underway. Understanding how long it

may take to resolve these issues and the impact on your

business will prevent any last minute p anics.

Also give consideration to the independence of your

Board and exec team. Could you be challenged on their

independence? If so, you’ll need to assess whether

these are valid concerns and think about how you could

mitigate or remove this. Because you need to be

independent in decision making, you may even need to

change your succession plans or committee

chairmanships. The earlier you can think about this, the

better – consult your investors and have a proposed plan

of action.

The dec

ision making process

The EU Audit Refor

ms require that your pre-determined

non-discriminatory selection criteria be shared w ith

participants.

Once you’ve identified the criteria that are important to

your organisation, prioritise them according to

importance and weight them with a number score. You

might do this by asking all relevant internal parties to

identify and weight the criteria that are important to

them. Combining the responses should ascertain the

overall weighting as fairly as possible.

Make sure that whatever process you devise takes into

account both the tangible and the intangible. If you rely

solely on the highest score for tangible elements, you

may appoint a firm that’s the best technically, but find

that key people in your organisation don’t want to work

with them.

The EU Audit Reforms states that the Audit Committee

must ensure that the “audited entity shall evaluate the

proposals in accordance with the selection criteria

predefined in the tender documents. Prima facia this

would appear to remove any latitude for changing the

selection criteria once the process has started. Selecting

the right selection criteria, in conjunction with all

relevant stakeholders, before the process begins, and

articulating them in the ‘right’ way, is therefore essential

– and arguably the most difficult part of the selection

process.

Rotati

on – consider the shuffle of services, role of

the previous auditor and step change

The changes to audit

tendering and rotation

requirements will mean that firms with an established,

long-standing audit role will be required t o rotate off. It’s

important to consider how to avoid losing the positivity

of this relationship and what you’ve jointly learned about

your working relationship.

Discuss in advance with the previous auditor, the

mutual benefit of change. What role would be most

beneficial for them to play after they rotate? The rotating

firm will also no doubt have insights into how the audit

is most beneficially undertaken, what kind of approach,

in their opinion, is best for your organisation and what

kind of personalities will mesh best in your organisation.

Involve them early in your identification of objectives

and consider advice in other areas.

Maintaining an open dialogue with your incumbent will

also allow you to consider what possible step change is

desired or required. What would you like to improve

upon? In what areas do you see most potential for gain?

Selecting the right selection criteria, in

conjunction with all relevant stakeholders,

before the process begins, and articulating

them in the ‘right’ way, is therefore essential.

Getting real value from the audit tender process | January 2018

©

2020 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

11

Step 4 – Begin the audit tender

Issuing the invitation to tender

The first stage is to prepare a

nd dispatch an information

pack to the firms – see Appendices I-V. The pack should

include a formal invitation to tender and additional

background information.

Your invitation to tender letter should clearly set out:

— The scope of the services being tendered.

— The period of the appointment.

— The process and timetable.

— The pre-determined non-discriminatory selection

criteria.

— Areas

to include in the proposal

document.

— Document delivery information – number

of copies

required,

format and delivery details.

— Likely

format, content

and timing for any

presentation

phase.

— Any

ground

rules

for

the proposal,

for

example,

all

communication must

be copied to the project

manager.

— Information regarding

access

to your

personnel.

— Contact

information for

the key

contact.

Provide as

much relevant background

information on the

company

as

you can.

Appendix

III

lists

the type of

information that

firms

find useful in developing their

response.

Consider

asking the firms

to sign a

confidentiality

agreement

before

releasing documents

that aren’t

in the public

domain.

Site visi

ts

Get feedback from your staff on their impressions of the

firms during their visits to your sites. To ensure some

consistency in their feedback, you might find it helpful

to provide a site visit scorecard for them to complete.

There’s example in Appendix II.

Managing site visits

The firms’

ability

t

o develop propositions

that are

tailored to your

objectives

and requirements

depends

on

them

being given reasonable access

to management

during the process. If you want to reduce the amount

of

time

this will

absorb, you could:

— Cut

down on the number

of firms

involved in the

tender,

rather

than reduce the number

of

managers

you allow them

to see.

— Arrange a

group briefing for

all

firms

covering basic

matters. Firms will still

need

individual

time w

ith

management

to discuss

and refine their

thoughts

and ideas with you.

Arranging site visits

can be time consuming. Either

allow

the

firms

to make their

own arrangements,

or let

the project

manager

control

this

stage of

the process.

It

may be

easier for your staff

to liaise

with one internal

project

manager

rather

than representatives

of

a

number

of firms.

Ensure that the individuals

are briefed thoroughly

on the

process, reasons

for the tender

and their

role in the

selection process.

You’ll need a

way

for individuals

to feed back

their

assessments

of the tendering firms

to the decision

makers.

This

might

be done informally,

for

example

through a

telephone

call,

or

more formally

through a

scoring system

linked

to the evaluation criteria.

Appendix II provides a sample

site visit

scorecard.

You

may shortlist

participants following asse

ssment

of

the

site visits and full written

submissions. Shortlisting

at this stage allows

you to form a

more informed view

of

what’s

on offer,

without

spending the time attending

a

large number

of presentations.

It’s important

that

you have time to build a

rapport

with

the proposed

teams

to make a

fair decision regarding

the personal

and cultural

fit. If

you already have strong

relationships

with the firms,

this

may

be a

good

approach.

Getting real value from the audit tender process | January 2018

© 2

020 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

12

Access to company personnel

The firms find it useful t

o meet a number of people,

primarily the decision makers and those people who can

help them understand the business. It won’t always be

practical or appropriate for them to meet all of these

people, but the more people they have access to, the

better they’ll understand your business and your needs.

Relevant people may include:

— The chief executive.

— The finance director.

— The chairman.

— The Audit Committee chairman and members.

— Other Board members and non-executives.

— General managers of key business units.

— The head of internal audit/head of risk.

— The head of IT.

— The head of tax.

— Managing directors and financial directors at

subsidiaries and key locations.

Proposal docum

ents

Be as specific as you can in your re

quest for proposals,

regarding the content, number of pages and format that

you want the firms to follow in their documents.

Most documents impose a page limit of approximately

12-18 pages with additional appendices, such as CVs

and fee breakdowns.

Documents may be provided to you electronically as

well as in hard copy. If you want electronic copies, you’ll

need to specify the software that’s acceptable and/or

ask for the document in a read-only PDF format.

There’s an example contents list in Appendix IV.

Evaluatin

g documents

Decide who in the organisation will carry out a technical

evaluation of the documents and summarise the

findings in a short report.

For example, the review could encompass a comparison

of fees, comment on the quality and completeness of

responses to questions asked in the request for tender,

facts on the teams and their firm’s resources.

As with site visits, you need to decide who should be

involved within the organisation at this stage and how

they’ll feed back their comments.

You might also want to contact the firms to discuss the

issues raised and any points that need clarification. This

will help them focus their presentations on the areas of

greatest interest to you.

Presentations

First, give consideration to the format you want to

follow. Thi

s may be formalised presentations, for a set

period of time, covering specific topics, or you may

choose to instead host deep Q&A sessions developed

specifically for each firm. This can r educe time an d cut

straight to the areas where greatest clarity is required.

Either way, communicate the format in advance, detail

how long each presentation slot will last, and how this

time should be allocated between formal presentation

and Q&A. Best practice would have the presentations

lasting for 60-90 minutes. You may also set a limit on

the number of people each firm should bring to the

presentation and/or give guidance on the inclusion of

dedicated se rvice professionals.

Preparing a list of questions to be answered by all firms,

to supplement those that arise spontaneously in the

individual presentations can also be helpful.

Making th

e decision

Having discussed the contenders in light of their

performance during the proposal process and at the

presentation, a consensus will often emerge on which

firm should be appointed. Follow your agreed decision

making process and use the evaluation criteria you’ve

continuously developed.

Appointing a firm

Once you’ve reached a decision, not

ify all the decision

makers and the Board as necessary, then inform the

tendering firms. If you intend to change your auditors,

there’ll be some procedural company secretarial

formalities to comply with.

You’ll also need to be clear with the appointed firm,

regarding when independence will need to begin.

Report on the

selection procedure

The EU Audit Refor

ms require a written report setting

out the conclusions of the selection procedure. The

report is to be prepared by the audited entity

(presumably management or those responsible for

managing the audit proposal on a day to day basis) and

validated by the Audit Committee. It should include the

rationale for the selection of the auditor or

reappointment of the incumbent auditor.

Also, the Audit Committee must ensure that the

company is able to demonstrate to the competent

authorities, upon request, that the selection procedure

was conducted in a fair manner.

A

fter the

process

It

’s likely that both the winner and losers will ask you to

debrief them on their performance during the process.

This is always a helpful learning exercise from the firms’

point of view and allows you to communicate how you’d

like to continue your relationship with them in future.

The firms should appreciate your open and honest

feedback and you making time available for them.

Getting real value from the audit tender process | January 2018

© 2

020 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

13

Appendices

I. Example invitation to tender letter

II. Example site visit scorecard

III. Information to be supplied to participants in

audit tenders

IV. Example content for written audit

submissions

V. Guidance for data rooms

G

etting real value from the audit tender process | January 2018

© 2020 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

14

Appendix I

Example invitation

to tender letter

Dear [ ]

The Board of [ ] ha

s decided to review its audit arrangements for the year ending [ 20xx]. The purpose of this letter is

to invite your firm to propose, and to advise you of the process which the Board will adopt to select the firm to be

recommended for the appointment and the proposed timetable. The selection process will be confined to [] and it is

anticipated that each firm will bear the costs associated with the tender submission.

Each firm will be required to submit a written tender setting out your capabilities, the key elements of your service and

team, as well as your proposed fee by [ ].

The tender should cover the following areas:

— Details of your firm

— Resourcing

— Approach

— Transition

— Quality assurance

— Independence and governance

— Fees

— Additional

services.

Further

detail

that

outlines

the information to be included in tenderers’

written

submissions

is

set

out

in Appendix

(E)

to this letter.

From

the tenders,

we will

identify

a

shortlist

who will

be asked to make a

presentation

to [selection panel]

including a

question and answer

session. Appendix (B)

details the key dates

in the selection process.

Further

information to be provided should you choose to tender

is

outlined in Appendix

(D) to this letter.

Mr/Ms

[

]

of

our

company

will

be responsible for

coordinating

the tender

process

and all

questions

and requests

for

further

information should be coordinated

through him/her.

He/she can be contacted as

follows

[].

I

should be grateful

if

you will

confirm

your willingness

to participate in the selection process and your ability

to comply

with the indicated timetable by

[].

Your

s sincerely

G

etting real value from the audit tender process | January 2018

© 2020 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

15

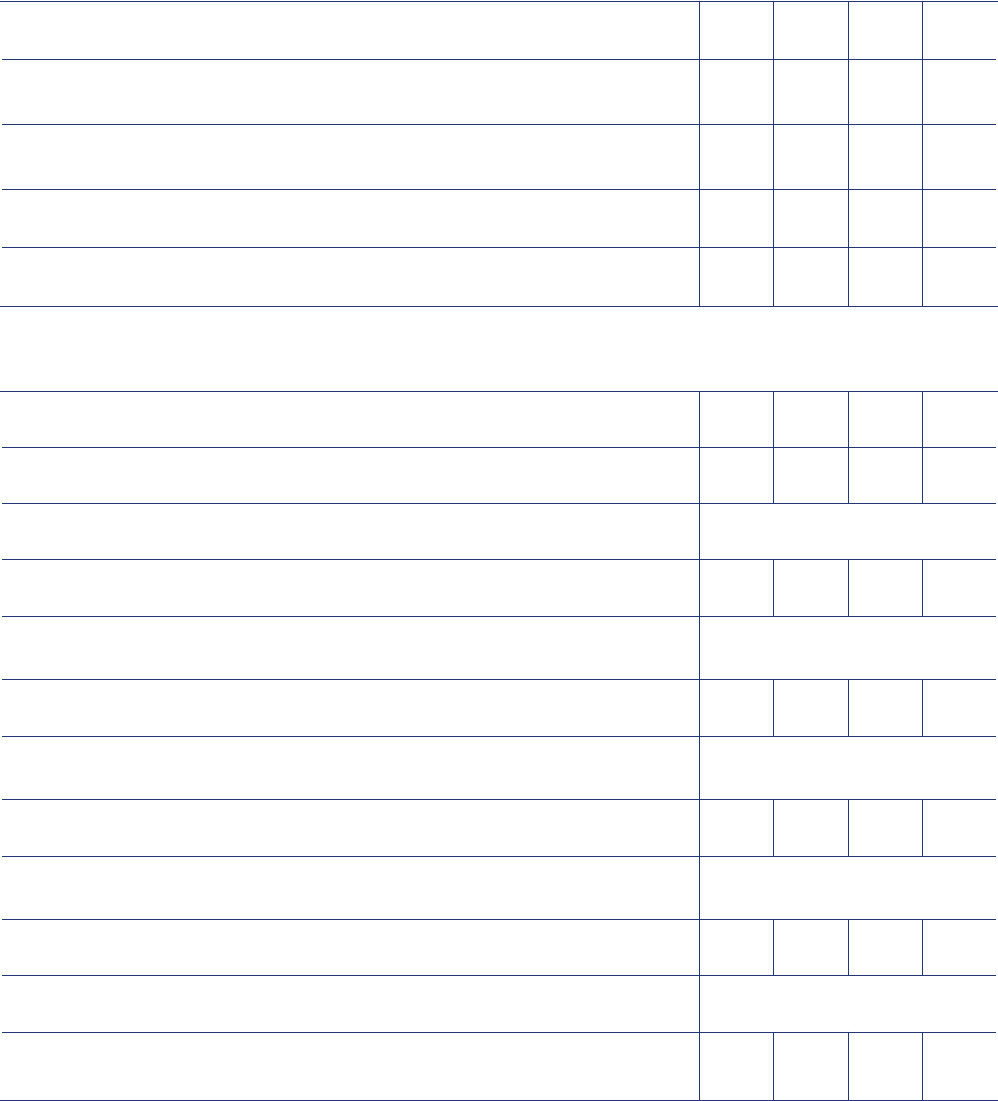

Appendix II

Example site visit

scorecard

Firm: Completed by:

Please answer the following questions by circling the relevant score based on your perception of the firm during the

site visit.

1 = totally dissatisfied –do not believe they will deliver

4 = completely satisfied –wholeheartedly believe they will deliver the service discussed

Understanding the business

1. Did the firm demonstrate clear understanding of:

— the business 1 2 3 4

— the industry 1 2 3 4

— the market place? 1 2 3 4

2. Did the team clearly understand the business issues and take account

of these in their approach to you and the work to be undertaken?

1 2 3 4

People

1. Did the team have the requisite experience and availability?

1 2 3 4

2. Did the team have the necessary qualifications and

expertise of your industry?

1 2 3 4

3. Did the team appear professional?

1 2 3 4

4. Was your importance as a client fully appreciated by the

whole team?

1 2 3 4

5. Did the culture of the team fit with your site’s culture?

1 2 3 4

6. Do you feel you could work well with the team?

1 2 3 4

7. Do you have any concerns about a member of the

proposed team? If so who and what? Comments (please

be succinct)

1 2 3 4

Getting real value from the audit tender process | January 2018

©

2020 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

16

Approach - for audit tenders

1. Has the team explained and agreed the audit approach with you?

1 2 3 4

2. Will key audit areas and issues be discussed prior to the interim and

final audits?

1 2 3 4

3. Will issues be properly discussed and, where possible, resolved prior

to Group Reporting?

1 2 3 4

4. Will audit evidence be cost-effectively obtained?

1 2 3 4

5. Does the proposed standard of reporting meet your expectations?

1 2 3 4

Previous experience of the firm

1. Has the team delivered on previous occasions?

If yes

1 2 3 4

2. Has the team met expectations?

Yes / No

If yes

1 2 3 4

3. Has the quality of reporting and feedback obtained from the team

been consistently of a high quality?

Yes / No

If yes

1 2 3 4

4. Have you found their approach to be robust in dealing with you and

your team?

Yes / No

If yes

1 2 3 4

5. Have the team been proactive and provided strategies to issues before

they have become problems?

Yes / No

If yes

1 2 3 4

6. Would you be happy to continue working with this team?

Yes / No

If yes

Comments (please be succinct)

1 2 3 4

Ge

tting real value from the audit tender process | January 2018

© 2020 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

17

Appendix III

Information to be supplied to

participants in audit tenders

Information which firms find useful and you

might consider providing is outlined below.

Selection criteria (required)

— Tr

ansparent and non-discriminatory pre-determined

selection criteria.

Or

ganisational

— M

ission statement and corporate st rategy.

— Organisation chart, showing the key individuals,

responsibilities and reporting lines.

— Organisation structure, e.g. business processes,

business units, functional, including key locations.

— List of subsidiaries and associates.

— Names of all Audit Committee members and senior

management.

— Locations and operations, domestically and

overseas.

— Cultural information.

Fin

ancial

— M

ost recent financial statements for all key group

companies (last two years).

— Group structure chart.

— Year-end / reporting / consolidation process and

timetable.

Oth

er (as appropriate)

— I

nternal Audit scope and plan.

— Internal Audit department structure, responsibilities

and reporting lines.

— IT systems in operation.

— Current tax arrangements / suppliers.

— Current tax status.

G

etting real value from the audit tender process | January 2018

© 2020 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

18

Appendix IV

Example content for written

audit submissions

The tender document should include the

following information.

Details of your firm

— A s

tatement summarising the benefits to [client] of

selecting your firm.

— The organisation an d structure as it is relevant to this

engagement.

— Industry experience and client base.

Resourcing

— Names of your core service team, location and

relevant experience.

— Personal fit with the management team and culture.

— The time the key team members will commit to this

appointment.

— Succession planning and steps to ensure staff

continuity.

Appr

oach

— U

nderstanding of our broader business needs and

risks.

— Processes for delivering audit services which are

customised, responsive and aligned with [client's]

specific needs.

— Processes that your firm will employ to address

matters related t o client satisfaction, performance

measurement and continuous improvement.

— How you will liaise and work with our internal audit

and/ or tax department.

— How you will use technology to deliver your service.

— How you will report your audit findings to us.

Tra

nsition (if appropriate)

— P

rocess for audit transition of [global] clients.

— Relevant previous experience with audit transitions

of similar companies.

— Transition plan.

Quality assurance

— Describe the internal processes used for quality

assurance.

— Describe your firm's approach to resolving

accounting an d financial reporting i ssues.

Inde

pendence and governance

— I

nternal practices to ensure compliance with

independence requirements and freedom from

conflicts of interest.

— Summary of relationships that may reasonably be

thought to bear on independence and the proposed

plan to manage them (e.g. non-audit services)

— Confirmation by your firm that it will take all

necessary steps to ensure its independence.

Fees

— C

ompetitive fee quote to complete the [global audit

for 20XX].

— Separate estimates of your total audit fees for

reporting on:

– half year result

s

– t

he final group account

s

– t

he accounts of subsidiaries, required for statutor

y

or ot

her purposes

.

—

The basis on which fees will be determined in future

years.

— General overview of the schedule and timing of

billings

G

etting real value from the audit tender process | January 2018

© 2020 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

19

Appendix V

Guidance for data rooms in audit tenders

Why use a data room?

Data rooms give you the chance to give tendering firms

lots of information in one go, making the process much

more efficient and saving you time and money.

Six things to think about when you’re putting a data

room together

1. Make it virtual rather than an actual physical space

.

T

his way firms can have acce ss to it as and whe

n

t

hey need to. And you don’t need to use valuabl

e

sp

ace in your office

.

2. M

ake it easy for lots of people within each firm t

o

get a

ccess to it by giving them just one ID a

nd

pa

ssword. (Rather than an ID/password to eac

h

individual.)

3. I

ndex and label the information clearly to make i

t

e

asy to find. (This will also save yo u time if firm

s

have questions about specific documents.)

4. M

ake sure documents can be downloaded. This wil

l

m

ean firms can have all the information at the

ir

f

inger-tips and will scope and price the Audit

appropriate

ly.

5. K

eep the questions that each firm asks confidenti

al

t

o protect each firm’s competitive position.

6. Set up an automatic data alert, so firms know when

y

ou’ve added a new document

.

What to include in a data room?

Below you will find a list of all the information that’s

useful to include. We haven’t included information that’s

publically available, e.g. Annual Report, Accounts and

published strategy documents etc.

Group structure

— Organisation chart, showing ke y individuals,

responsibilities and reporting lines including Finance,

Compliance, Corporate Audit, Commercial

organisation including clusters and categories,

specialist areas (such as IT, Treasury, Tax, Enterprise

support etc.)

— Location of operations globally including addresses

and number of personnel

Statutory accounts

Group structure chart and how it compares to the

structure in t he financial reporting system if different

— Detailed listing of audit requirements in each country

including statutory audits within scope and any other

requirements

— Latest statutory accounts of entities requiring an

audit for last 2 years

— Prior year or indicative current year fees for

subsidiary entities requiring an audit (indication

whether statutory, regulatory and group reporting

fees)

— Details of where l ocal statutory accounts are

prepared if it is other than the local country itself

Financial results for the last 2 years

— Breakdowns of revenue and operating profit (before

and after tax) by company

— Balance sheet by company

— Tax workings

— Budget

presentation

— Current

bank model / cash flow

forecast

Group reporting and consolidation

Indicative reporting dates

and detailed year

end

timetable

— Example

reporting

pack

— Full system

databook

or

equivalent

— Description

of the month end and year

end

consolidation process.

Process

notes to include how

key

transfer

pricing works, how intercompany

transactions and balances are processed,

local

sign

offs and the top level

journals process

Standards

and manuals

— Policy on Auditor Services

— Financial

Planning and Budgeting Policy

— Financial

Reporting and Control

Policy

— Accounting Policy Manual

G

etting real value from the audit tender process | January 2018

© 2020 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

20

Governance

— Risk register

— Description

of the process for

updating the risk

register

— The process supporting:

— Key Group risk policies

— Credit

risk policy

— Insurance risk policy

— Liquidity risk policy

— Market

commodity risk policy

— Key audit risks

Audit Committee/

Board papers

— Executive

management

and Audit

Committee

meeting dates

— Audit

Committee Agendas (and attendees)

for

last 2

years

— Audit

Committee papers for

the last

3 years

including key judgements

papers

— Board papers

including strategy

papers

— Board committee papers

Group Audit &

Assurance

— Charter

— Plan

— Summary

of

key

findings

for

prior

year and year to

date

— Corporate audit

reports

for

key

group processes

for

last

3 years

— Group audit &

assurance department

structure,

responsibilities and reporting lines

Compliance

and controls

— Detail of any significant deficiencies and

material

weaknesses for

last

2

years

— Description

of

SOx compliance

review process

including scoping

— Copies

of any

agreed CIA

with the SEC/DOJ

— Internal

Anti

Bribery and Corruption policies and

procedures

Internal controls and

risk management

— Description

of Internal Control Questionnaire

process

— Summary

of the results of the internal

control

evaluation process

— Full details of the financial

controls framework with

description of

controls

and key

controls

highlighted

— End-to-end financial

controls process documentation

(including automated controls and specifying location

of

control

operation)

for

the following processes:

– Rev

enue

– P

urchase

s

– E

xploration

and

evaluation cost

s

– D

eferred strippin

g

– C

lose

down,

restoration and clean-

up

– T

ax accountin

g

– C

ash

managem

ent

– I

ntercompany

elimination

& profit

in st

o

ck

m

anagement

– Foreign exchange managem

ent

– P

ayro

ll

– I

mpairm

ent

– P

ension obligation and char

ge

– M

onth end consolidati

on

– SA

P Master Data amendment

s

– T

echnical

reporting

process

and reserv

es

– Qu

arterly reporting proces

s

– A

nnual

Report and Account

s

– S

chedule with

vision f

or

key high

level revie

w

c

ontrols

planned to implem

ent

– D

escription

of

SOx compliance

review process f

or

t

he last

two years

including scoping to s

ee

progression

– Results of

testing for

SOx

– Compliance

team

structure, responsibilities and

reporting

li

nes

G

etting real value from the audit tender process | January 2018

© 2020 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

21

IT Systems

— Overview of IT environment

— Details of global applications (version, description of

use)

— Details of IT infrastructure and supporting tools

— Overview of IT organisation

— IT organisation structure, roles and responsibilities

and geography

— Extent of use of third parties, and details of the

services they provide

— Current and future IT Projects

— Overview of the current portfolio of IT projects

— Overview of key IT projects recently completed,

ongoing or future projects likely to impact on

systems / processes and controls

— IT Risk, Security and Control Environment

— Overview of current / emerging IT risks

— Details of tools currently used to serve as continuous

monitoring of IT controls e.g. SAP GRC, Data

analytics engines

— Controls

catalogue detailing General

IT Controls

(User

access,

change management,

security,

segregation of duties, program

development,

computer operations,

etc.)

— Any

third

party assurance reports over IT

services

(e.g. ISAE3402)

— IT internal

audit reports

from the past 2 years

Enterprise

support

— Structure, responsibilities

and reporting lines

— Key priorities,

strategy

papers

and project

plans

— Details (and examples) of financial analysis/reports

produced

for

local

countries

Accounting

papers

— Accounting papers

for

key

accounting issues

— Detailed

accounting policy

notes

— Notes on

critical

accounting

estimates and

judgments

(for

those in the annual

report)

— All

correspondence with FRRP

in respect

of

queries

for

the

last

five

years

— All

correspondence with the SEC in respect

of

queries for the last

five

years

Specialist

ar

eas

— Detailed

tax workings

— Tax status

— Current

tax arrangements

— Correspondence

with

HMRC

and

similar

for

key

countries

— Process description for

preparation of

taxes

paid

report

— Treasury set up and process description

— Banking/debt

arrangements

— Tax structures

(including sign off from

HMRC

or

equivalent)

Corporate Business Development

— Information about

recent

acquisitions

including

copies

of accounting papers

on the accounting for

the acquisition, valuation of intangibles, SPAs, due

diligence papers

and integration

and integration

plans

G

etting real value from the audit tender process | January 2018

© 2020 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

22

KPMG’s Audit

Committee Institutes

Sponsored by more than 35 member firms around the

world, KPMG’s Audit Committee Institutes (ACIs)

provide audit committee and board members with

practical insights, resources, and peer exchange

opportunities focused on strengthening oversight of

financial reporting and audit quality, and the array of

challenges facing boards and businesses today –from

risk management and emerging technologies to strategy

and global compliance.

To learn more about ACI programs and resources, visit:

www.kpmg.com/globalaci

The

information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity.

Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date

it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional

advice after a thorough examination of the particular situation.

© 2020 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with

KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in the United Kingdom. The KPMG name

and logo are registered trademarks or trademarks of KPMG International. Designed by CREATE | December 2017 | CRT89155