Home Lending

to Communities

of Color in

California

Updated with 2021 HMDA Data

MARCH 2023

2Home Lending to Communities of Color in California | MARCH 2023

Table of Contents

Executive Summary 5

Introduction 8

Slow homeownership rates for communities of color 8

The racial wealth divide 9

Comparing conventional and government-subsidized loans 10

Changes in home lending and the need to protect consumers 11

Methodology 13

Findings 15

State of Home Lending in California 15

Sacramento-Roseville-Folsom MSA 18

San Francisco-San Mateo-Redwood City MSA 24

Oakland-Berkeley-Livermore MSA 30

Fresno MSA 36

Los Angeles-Long Beach-Glendale MSA 42

San Diego-Chula Vista-Carlsbad MSA 48

Policy Recommendations 54

For Legislators and Financial Regulators: 55

For Lenders 56

References 58

Endnotes 60

3Home Lending to Communities of Color in California | MARCH 2023

AUTHORS

Marwa Abubakr is an Economic Equity Fellow at the Greenlining Institute, where she supports the

organization’s research and advocacy eorts to close the racial and gender wealth gap. Being the product

of Afghan refugees, navigating life in a diaspora community, the politics of poverty and discrimination

have always been prevalent in her life. Marwa has passionately dedicated her career towards upliing

and empowering marginalized communities. She spent two years in AmeriCorps service working to

expand literacy development in underserved elementary schools in Oakland. Through her experience in

financial analytics at Morgan Stanley, Marwa was able to grasp how our financial systems stand to benefit

those with the most privilege, driving her dedication towards economic equity. She has since worked at

multiple nonprofit organizations in the Bay Area supporting research and data analytics. Marwa holds a

B.A. in Political Science from the University of California, Berkeley.

Rawan Elhalaby is the Associate Director, Economic Equity at The Greenlining Institute, where she leads

the organization’s research eorts around bank accountability and financial inclusion. As the daughter

of Palestinian, working-class refugees, Rawan is all too familiar with the obstacles that low-income

and immigrant families face in achieving self-suiciency in the United States. She has spent her career

fighting barriers to economic opportunity through direct service at the International Rescue Committee

in San Diego and through policy as a consultant to the Consumer Financial Protection Bureau, the County

of San Diego, the Western Regional Advocacy Project and the Dellums Institute for Social Justice. Rawan

holds a Master of Public Policy from UC Berkeley’s Goldman School of Public Policy and a B.A. in Political

Science from San Diego State University.

Rawan co-authored Greenlining’s recent report, A Fair Financial System, testified before the House

Financial Services Committee’s Subcommittee on Diversity and Inclusion on the lack of diversity in

banks, and has been quoted in a variety of publications ranging from American Banker to Politico.

Editorial:

Danielle Bell, Senior Program Manager of Media Relations at The Greenlining Institute

Tram Quang, Copyeditor

Design:

Zhanae Briggs, Communications Coordinator at The Greenlining Institute

Design Action Collective

ACKNOWLEDGEMENTS

Thank you to Rami Ibrahim, Economic Equity Coordinator at The Greenlining Institute, for his

contributions to transcribing the HMDA data and bolstering GLI’s California State CRA platform.

And thank you to Holden Weisman, Senior Director of Economic Equity at The Greenlining Institute,

for his feedback on our research and review.

4Home Lending to Communities of Color in California | MARCH 2023

THE GREENLINING INSTITUTE

The Greenlining Institute works towards a future where communities of color can build wealth, live

in healthy places filled with economic opportunity, and are ready to meet the challenges posed by

climate change. Greenlining is building an abundant future that brings investments and opportunities

into our communities – what we call Greenlining. Since 1993, we have successfully advocated and

negotiated initiatives directing more than $800 billion in corporate and public investments into

communities of color in California and across the nation.

ECONOMIC EQUITY

The Greenlining Institute’s Economic Equity program advocates for race-conscious policies that hold

financial institutions accountable, end discriminatory practices, and establish pathways to financial

security and prosperity. We are building a future where more people of color are homeowners,

business owners, and have access to wealth-building infrastructure such as high-speed internet for

generations to come.

5Home Lending to Communities of Color in California | MARCH 2023

Executive Summary

California is one of the most racially diverse states in the country, yet its homeownership and home

purchase loan origination rates do not reflect this diversity. Homeownership is one major pathway

to building family wealth, yet owning a home continues to be out of reach for most people of color in

California.

The Greenlining Institute assessed Home Mortgage Disclosure Act lending data from six metropolitan

areas of California: Sacramento, San Francisco, Oakland, Fresno, Los Angeles, and San Diego. This

report evaluates the lending overall in these regions, and the top 15 lenders in each region for 2021.

Although there are slight variations among the largest lenders for each region, the findings across the

regions were consistent.

Findings:

• Communities of color do not access home purchase loans at rates comparable to white

communities. Latino households access 21% of the state’s home purchase loans, despite

making up over 40% of the population, and Black households access 3% of home loans, while

making up over 5% of the population. White households are especially overrepresented in home

purchase originations relative to their share of the population, and Asian households are slightly

overrepresented.

• Women of color, 30% of the state’s population, receive just 8% of home purchase loans by the

top 15 lenders in California, consistent with 2020. Women of color are also more likely to access

a loan from a nonbank lender than from a mainstream bank. The disproportionate caretaking

burdens and responsibilities of women of color are compounded by the gender pay gap and racial

wealth gap—all of which are compounded by an inability to access home loans.

Photo credit: Kadyn Pierce via Unsplash

6Home Lending to Communities of Color in California | MARCH 2023

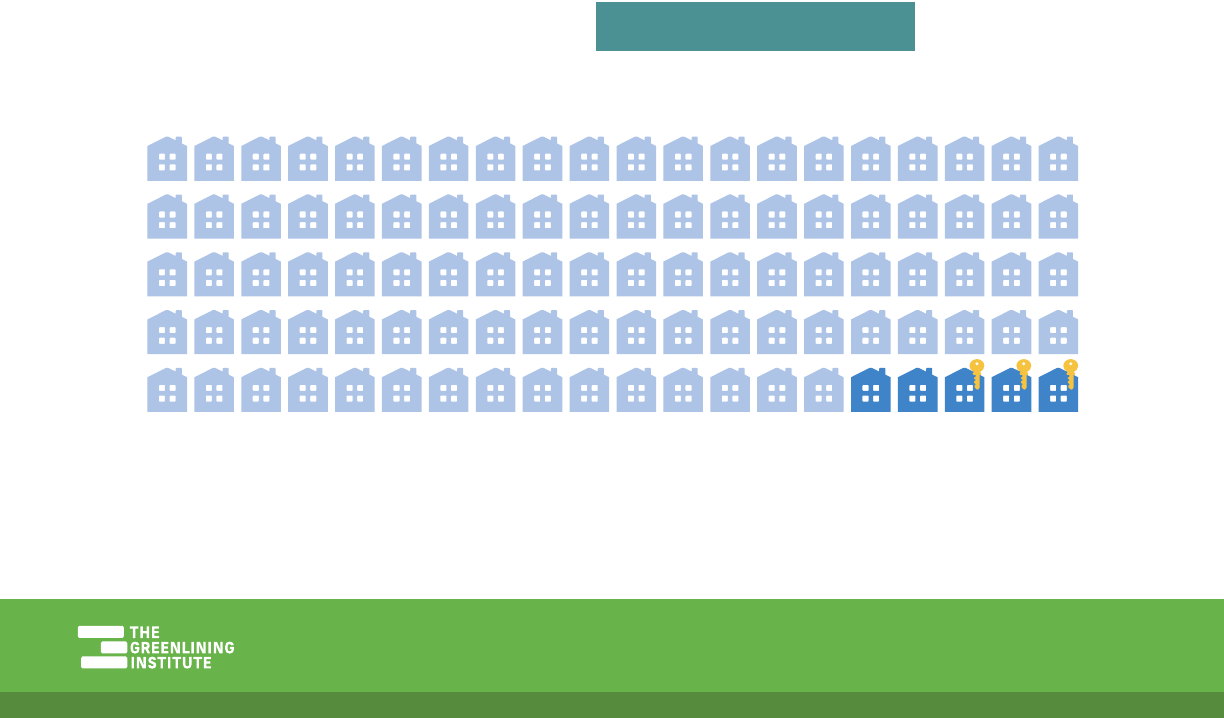

Only EIGHT PERCENT of the home loans made by the

major lenders in California are to women of color, but they

make up 30% of the state’s population.

• Asian ethnic communities do not access home loans at the same rate. While home lending to

all Asian households in California appears to exceed their share of the population—rising to 19.4%

in 2021 from 15.5% in 2020—there are disparities in access for dierent subgroups within the Asian

population, emphasizing the need to collect and disaggregate lending data.

• Nonbank lenders are more likely to make home loans to low-income borrowers than

traditional banks—with both conventional and government-subsidized loans.

• Low-income white borrowers are more likely than low-income borrowers of color to receive

a home loan in over half of the six regions proportional to their percentage of the population.

Low-income Black and Latino borrowers are more likely to receive home purchase loans from

nonbank lenders proportional to their percentage of the population.

• Nonbank lenders dominate several regional markets in California and play an increasing

role in home lending across the state. Ten of the top 15 home purchase lenders are largely

unregulated nonbanks that do not oer traditional banking services and operate largely online.

These nonbank lenders are also not subject to the Community Reinvestment Act, therefore their

lending is not regularly assessed to determine whether they meet the credit and borrowing needs

of the communities where they operate. Like last year, Black and Latino households were more

likely than other racial groups to access home purchase loans from nonbank lenders. In the Fresno

Metropolitan Area, all 15 of the top 15 lenders were nonbanks.

• Low-income and people of color borrowers are more highly represented in government-

subsidized loans than conventional loans, consistent with nationwide trends. Some lending

institutions in this study did not issue any government-subsidized loans in some areas in 2021,

and these loans represent a smaller part of the market than conventional loans. Black and Latino

borrowers are particularly likely to receive government-subsidized loans.

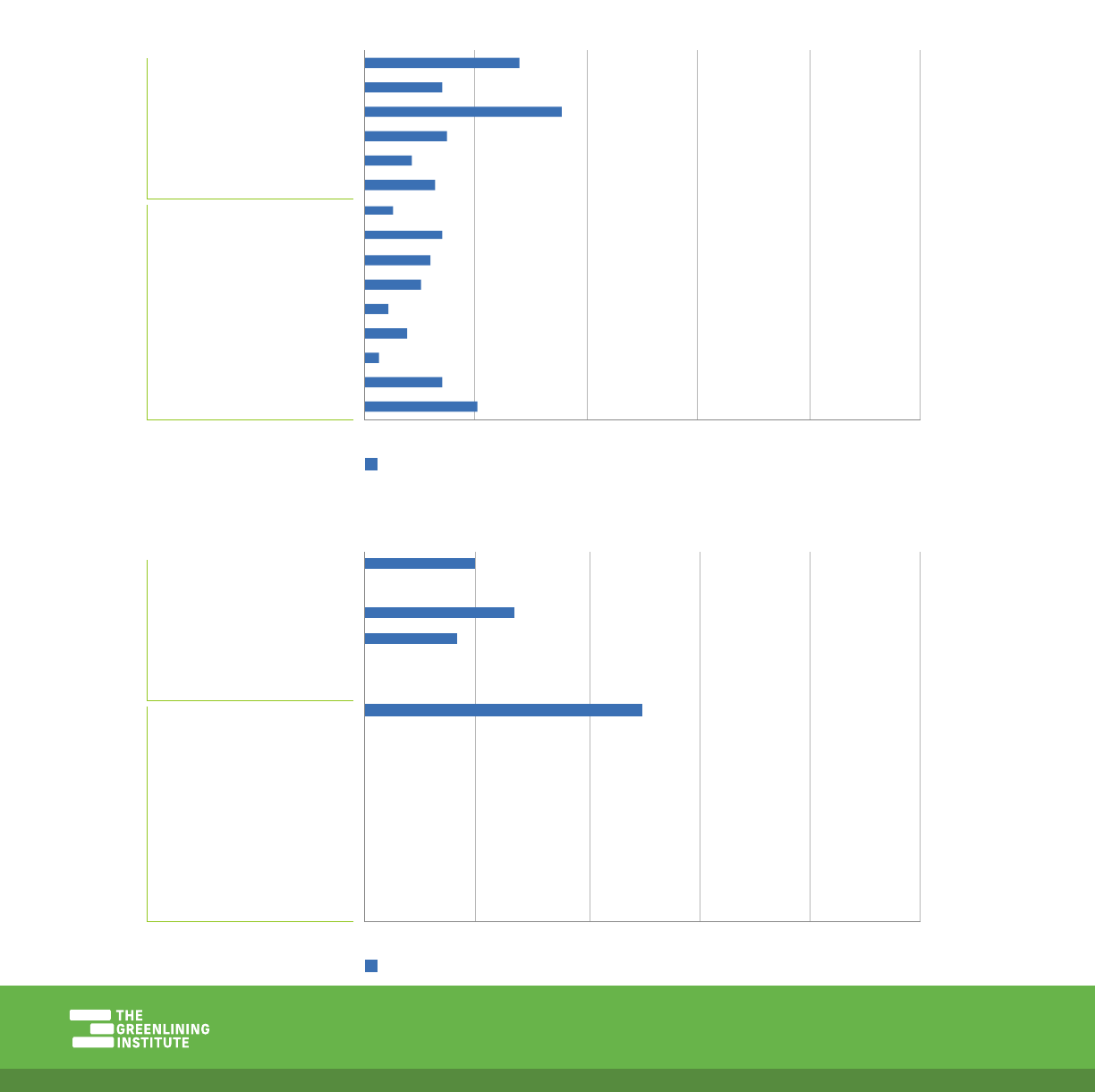

Figure 1: Home Purchase Loans by Race and Gender

7Home Lending to Communities of Color in California | MARCH 2023

Key Recommendations:

• The state should create a California Community Reinvestment Act. Unlike traditional banks,

nonbank lenders are not covered by the federal Community Reinvestment Act despite the

similarities in their products and services. Nonbank lenders should have the same mandate to

serve low-to-moderate-income communities as traditional bank lenders, and this mandate can

come from the state. A state CRA can expand beyond the many limitations of the current federal

law. State governments in Connecticut, Illinois, Massachusetts, and New York have already passed

state CRA legislation.

• The federal government should strengthen the Home Mortgage Disclosure Act. It should be

made stronger, more accessible, and with easier-to-access data that is disaggregated by dierent

racial and ethnic communities. At the state level, California regulators should help to lead this

discussion with respect to nonbank lenders licensed by the state.

• Lenders should provide more loan products and outreach tailored to low- to moderate income

families. Financial institutions should increase mortgage originations to communities of color

through alternative products to government-subsidized loans.

• Lenders should provide more support to nonprofit organizations led by people of color that

provide homeownership counseling. They must also improve the cultural competency of their

products and marketing, and make use of ethnic media outlets to reach communities of color.

The gap in homeownership rates between California and the national average continues to persist

in 2021, with California lagging 11 percentage points behind at a rate of 54.2%. Consistent with

last year’s findings, rates of Black and Latino homeownership are significantly lower in California

than the national averages. According to the latest available data from 2020, in California the Black

homeownership rate is 37% compared to 44% nationally. The Latino homeownership rate in California

stands at 46% and 48% nationally.

Home lenders, including both traditional banks and nonbank lenders, have an important role to play

in ensuring that all communities have access to aordable, safe home loans that increase family

wealth and reduce the racial wealth gap.

8Home Lending to Communities of Color in California | MARCH 2023

Introduction

The Greenlining Institute envisions a future where housing is a human right and contributes to healthy,

resilient communities for all. We believe that every Californian should be able to live in a home that

is aordable, safe, resilient to the impacts of climate change, and contributes to equitable wealth-

building rather than dragging people down further into debt. Under Greenlining’s housing platform,

we work to equitably increase access to capital, economic and homeownership opportunities for

people of color in California.

1

Homeownership continues to be the primary path for wealth-building for families in California

and throughout the U.S. Unfortunately, that path is far less open to Black, Latino, and many other

communities of color than it is for white potential home buyers. Ongoing impacts of the pandemic

and rising interest rates appear to be making the situation worse. However, increasing access to

homeownership is one of the most important ways to address the racial wealth gap and for families to

build wealth.

Slow homeownership rates for communities of color

Between 2019 and 2021, Black and Latino homeownership rates increased nationally.

2

With increases

of 2% and 2.5% percent respectively, the rates of increase exceed that of white homeowners.

Historically low interest rates were key contributors to the rise in Black and Latino homeownership. In

2021, interest rates were below 3% on average for a 30-year fixed rate mortgage, similar to 2020.

3

Since

then, interest rates have soared to record highs, posing a threat to the sustainability of increasing

Black and Latino homeownership.

Photo credit: Taylor Rooney via Unsplash

As of October 2021, 19% of all households report having lost all their

savings during the pandemic, but the number is higher among Black

and Latino households at 31% and over 25% respectively.

9Home Lending to Communities of Color in California | MARCH 2023

In addition, we saw a significant rise in home prices between 2020 and 2022 as well as the highest

level of non-housing inflation since the Great Recession. The Federal Reserve has found that important

contributors to rising inflation rates are increased consumption and decreased price sensitivity as a

result of gaining wealth.

4

In order to combat inflation, the Federal Reserve has raised interest rates in

an eort to discourage borrowing and spending, slowing the economy down.

Currently, inflation poses the greatest threat to low-income marginalized communities. Studies show

inflation stress impacts Black and Latino communities at higher rates than white communities, with

53.7% of Black individuals and 57.2% of Latino individuals reporting financial stresses as a result of

rising inflation compared to 43.6% of white individuals.

5

This increased financial burden has changed

the outlook for potential home buyers in 2023 and risks a further decline in access to homeownership

for communities of color.

Home appraisal bias is another significant disadvantage marginalized communities face when selling

their homes. The Federal National Mortgage Association analyzed nearly two million appraisals from

2019 to 2020 and found that on average Black borrowers’ homes received lower appraisal values

compared to automated models when seeking to refinance.

6

For example, in California, a Black

couple was oered $500,000 less for their home than when their home was staged to be owned by a

white family.

7

8

Additionally, during the pandemic, the wealth gap increased substantially, in part as a result of

unequal access to refinancing. The Federal Deposit Insurance Corporation (FDIC) found that in

2020, low-income borrowers were underrepresented in refinancing applications leading to a $5

billion disparity in refinancing savings between the market and the upper quintile of the income

distribution.

9

Their study further concluded that the pandemic “counteracted the stabilizing eect that

expansionary monetary policy is thought to have on inequality,” hindering the ability of marginalized

borrowers to take advantage of the opportunity to lower their mortgages and build wealth.

The racial wealth divide

The legacy of racism and injustice in the housing market is undeniable – that’s why Greenlining

advances anti-racist policies that promote housing as a human right. In the past two years, the racial

wealth divide has only been exacerbated through the unequal financial toll of the pandemic and its

economic impact. Black and Latino households have consistently been less likely to have liquid assets

or savings that can help them weather economic storms. As of October 2021, 19% of all households

report having lost all their savings during the pandemic, but the number is higher among Black and

Latino households at 31% and over 25% respectively.

10

As housing prices across California continue to rise and the housing market expands against the

backdrop of the economic fallout of the COVID-19 pandemic, communities of color continue to be

disproportionately excluded from homeownership, and people of color do not access mortgages

at equal rates to their white counterparts across the state and country. The national Black

homeownership rate has dropped to 44%, compared to an overall national rate of 65%.

11

10Home Lending to Communities of Color in California | MARCH 2023

Intergenerational wealth transfer plays the largest role in explaining the growing racial wealth divide.

White households are far more likely than similarly situated people of color to have family that can

provide relief from debt burdens, help them weather financial emergencies, and support family

members in asset accumulation, such as assisting with mortgage down payments.

12

Women of color

are disproportionately heads of their households and bear more responsibility for providing for

children and extended family, while overcoming a gender pay gap and racial wealth gap.

13

Comparing conventional and government-subsidized loans

Our analysis distinguishes between conventional and government-subsidized loans. Conventional

loans are issued by the financial institution directly without government backing, while government-

subsidized loans are guaranteed by the government. In this report, government-subsidized loans

include loans guaranteed by the Federal Housing Administration (FHA), Veteran Aairs (VA), Rural

Housing Service (RHS), or FSA (Farm Service Agency).

Government-subsidized loans are typically easier to qualify

for than conventional loans, because government backing

against default increases lenders’ comfort levels. Borrowers

of these loans tend to have lower income and lower credit

scores, and also tend to be people of color due to a history

of economic exclusion and exploitation.

14

Conventional

loans typically oer more options related to mortgage rates,

properties available to purchase, and refinancing than

government-subsidized loans.

15

A recent survey by the National Association of Realtors found

that 89% of home sellers would likely accept a buyer with

a conventional loan whereas only 30% would likely accept

an FHA or VA loan.

16

The higher prevalence of government-

subsidized loans in communities of color, or rather the

absence of conventional loans in communities of color, raises

concerns of ongoing mortgage redlining and discriminatory

loan steering. It may indicate that lenders are illegally steering

applicants of color who could qualify for conventional

loans into government-subsidized loans, which have more

restrictive uses and rigid structures.

17

DEFINITIONS

Nonbank: In this report, “nonbank”

refers to any lender that itself does not

oer traditional banking services such

as savings or checking accounts. These

lenders are oen independent mortgage

lenders and are not regulated by the

Community Reinvestment Act.

Bank: In this report, “bank” refers to any

lender that oers deposit-based services.

They are also referred to as mainstream

or traditional banks.

Fintech: In this report, “fintech” refers to

any lending delivered through online and

digital platforms.

Low-Income: Refers to borrowers who

report an income below 80% of the

region’s Area Median Income.

The national Black homeownership rate has dropped to 44%,

compared to an overall national rate of 65%.

11Home Lending to Communities of Color in California | MARCH 2023

Changes in home lending and the need to protect consumers

Financial institutions continue to play a critical role in the homeownership gap between people of

color and white people. Factors involved include inaccessible products and services, lower branch

presence in communities of color, and an inability to meet the needs of communities that have long

been locked out of the traditional pathways to homeownership—pathways that include generational

wealth, financial literacy, established credit histories and higher incomes.

In addition to these financial barriers to access, people of color were more likely to be denied a

mortgage than their white counterparts, despite having similar debt-to-income ratios. Last year, The

Markup found that nationally, this disparity is driven by algorithms utilized by nonbank lenders that

disproportionately aect information input by people of color.

18

The U.S. financial system has changed significantly in the past few decades, with mergers and

acquisitions resulting in a smaller number of larger banks, each serving a greater number of people.

19

Additionally, the influence of nonbank lenders continues to grow. In 2020, 68% of all mortgages

originated in the United States were issued by nonbank lenders, marking their highest market share on

record.

20

Mergers between mainstream banks and nonbanks are predicted to increase as mainstream

banks seek to expand their markets, increase fee revenue to oset lower rates, and enhance their

digital capabilities.

21

These changes can be expected to impact the available options for financial

products and services as well as how accessible they are to dierent groups of consumers.

As noted in The Greenlining Institute’s 2021 report, A Fair Financial System: Regulating Fintech

and Nonbank Lenders, nonbank lenders are exempt from the requirements of the Community

Reinvestment Act, a federal law passed in 1977 to reverse redlining and meet the credit needs of

low-to-moderate income communities. CRA is critical for obligating banks to meet the needs of low-

to moderate income borrowers and, although race-blind, is an important tool for addressing the

widening racial wealth gap and increasing access to first-time homeownership.

Home lending is changing with the emergence of largely unregulated fintech

22

and the decreasing

presence of physical branches in many communities, particularly low-income communities and

communities of color. Nonbank lenders tend to be more eective than traditional banks at reaching

communities of color, low-income, and immigrant communities, all of which are highly vulnerable

to predatory lending. Because nonbanks are not subject to the CRA, they don’t have the same legal

obligation as traditional banks to meet the credit needs of low-to moderate income borrowers

responsibly.

23

In 2020, 68% of all mortgages originated in the United States were

issued by nonbank lenders

12Home Lending to Communities of Color in California | MARCH 2023

In this report, we use home mortgage data collected under the Home Mortgage Disclosure Act to

provide insight into lending patterns to communities of color in California and six major metropolitan

areas: Sacramento, San Francisco, Oakland, Fresno, Los Angeles and San Diego. HMDA requires

lenders to collect and report demographic information about borrowers, allowing advocates and

policymakers to watch for potential redlining and ensure fair lending.

The HMDA data show that people of color are significantly underrepresented in loans received

across California, and especially in urban areas such as Oakland and Los Angeles. As California’s

demographics continue to shi and communities face the ongoing impacts of rising cost of living,

our economic prosperity and resilience will increasingly depend on people of color having expanding

access to capital and opportunities to build wealth, especially homeownership, to reach their full

potential.

Latino households access 21% of the state’s

home purchase loans, despite making up over

40% of the population.

Figure 2: Home Purchase Loans by Race and Gender

13Home Lending to Communities of Color in California | MARCH 2023

Methodology

We reviewed the loans reported in the 2021 Home Mortgage Disclosure Act dataset. The study was

limited to home purchase loans for single family or manufactured homes.

This study only reflects loan origination of home purchase loans and does not address purchased

loans, which are a major source of income for many lenders and can outnumber loan originations for

some lenders.

Data was controlled for conventional and government-subsidized loan product types. Conventional

loan products include first and subordinate lien conventional loans. The Consumer Financial

Protection Bureau defines conventional loans as those not insured or guaranteed by the Federal

Housing Administration (FHA), Veteran Aairs (VA), Rural Housing Service (RHS) or FSA (Farm Service

Agency).

24

Government subsidized loan products in this report include first and subordinate (where

applicable) lien FHA, VA and FSA/RHS loans.

Loans were examined based on the income, gender and race/ethnicity of the primary borrower. In

our analysis, joint applicant borrowers were not addressed as a separate race or gender group, but

were counted toward the total loan number. This report identifies race and ethnicity in the following

manner: If the ethnicity was indicated as Hispanic, we identified the borrower as Hispanic (we use

the term Latino in this report) regardless of the race selected. If the ethnicity is non-Hispanic, the

borrower is then identified by the primary or first race they selected. Asian in this report refers to

Asian Americans, excluding Pacific Islander communities, which are classified separately. Multirace

responses are extremely rare (1% in California) in the dataset and as such are not addressed as a

separate racial group. Multirace responses were included in calculations of total people of color and

women of color.

Photo Credit: Stephen Leonardi via Unsplash

14Home Lending to Communities of Color in California | MARCH 2023

Unfortunately, approximately 20% of responses in

the dataset on average were identified as “Race Not

Available” and were not included in the calculations

of loans to households of color but were counted

toward the total loan number. As we noted last year,

this is a serious issue with HMDA data collection, and

lenders should take greater care to ensure that race is

collected for all borrowers.

This report identifies gender as utilized by the HMDA

dataset (female and male). Borrowers with “sex not

available” were not addressed as a separate category,

but were counted toward the total loan number.

The top 15 lenders for each region were identified by market share for the Metropolitan Statistical

Area.

This report uses population demographic data from 2021.

20% of responses in the dataset were

identified as “Race Not Available” and

were not included in the calculations of

loans to households of color, but were

counted toward the total loan number.

Given the missing data, in the tables

below the percent of loan originations

will not reflect all lending.This is a serious

issue with the HMDA dataset, and lenders

and regulators should take greater care to

ensure that demographic data is collected

for all borrowers.

15Home Lending to Communities of Color in California | MARCH 2023

Findings

State of Home Lending in California

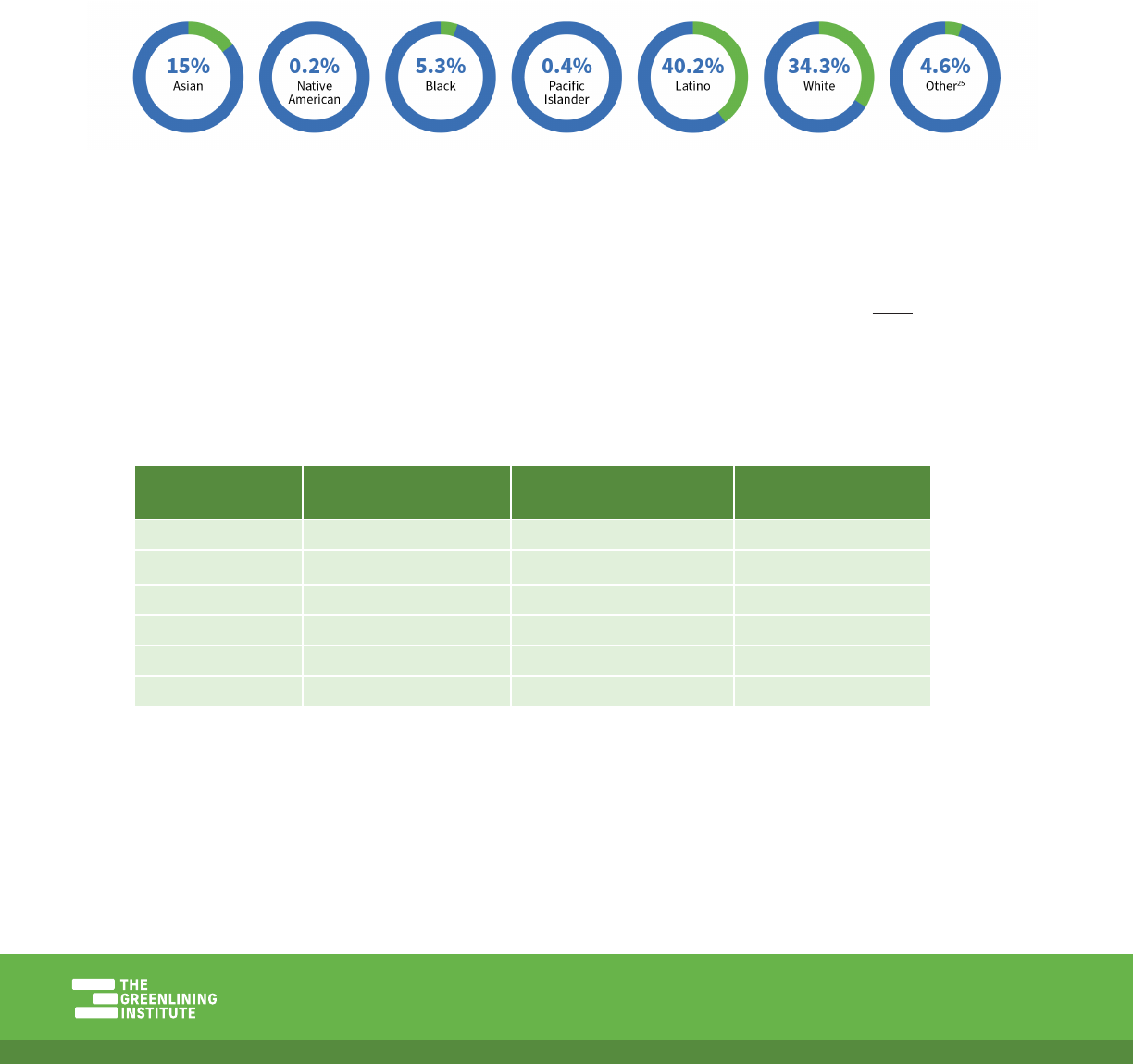

California lenders reported 469,212 home purchase originations in 2021.

California Demographics

Total Population: 39,237,836

++N

00++N

05++N

00++N

++N

++N

05++N

In California, Black and Latino households continue to be underrepresented in mortgage lending.

Home lending to Asian households slightly exceeded their share of the population and home lending

to white households exceeded their share of the population. Home lending rates across all groups

have not changed since Greenlining’s last statewide analysis of 2020 data, conducted in 2021.

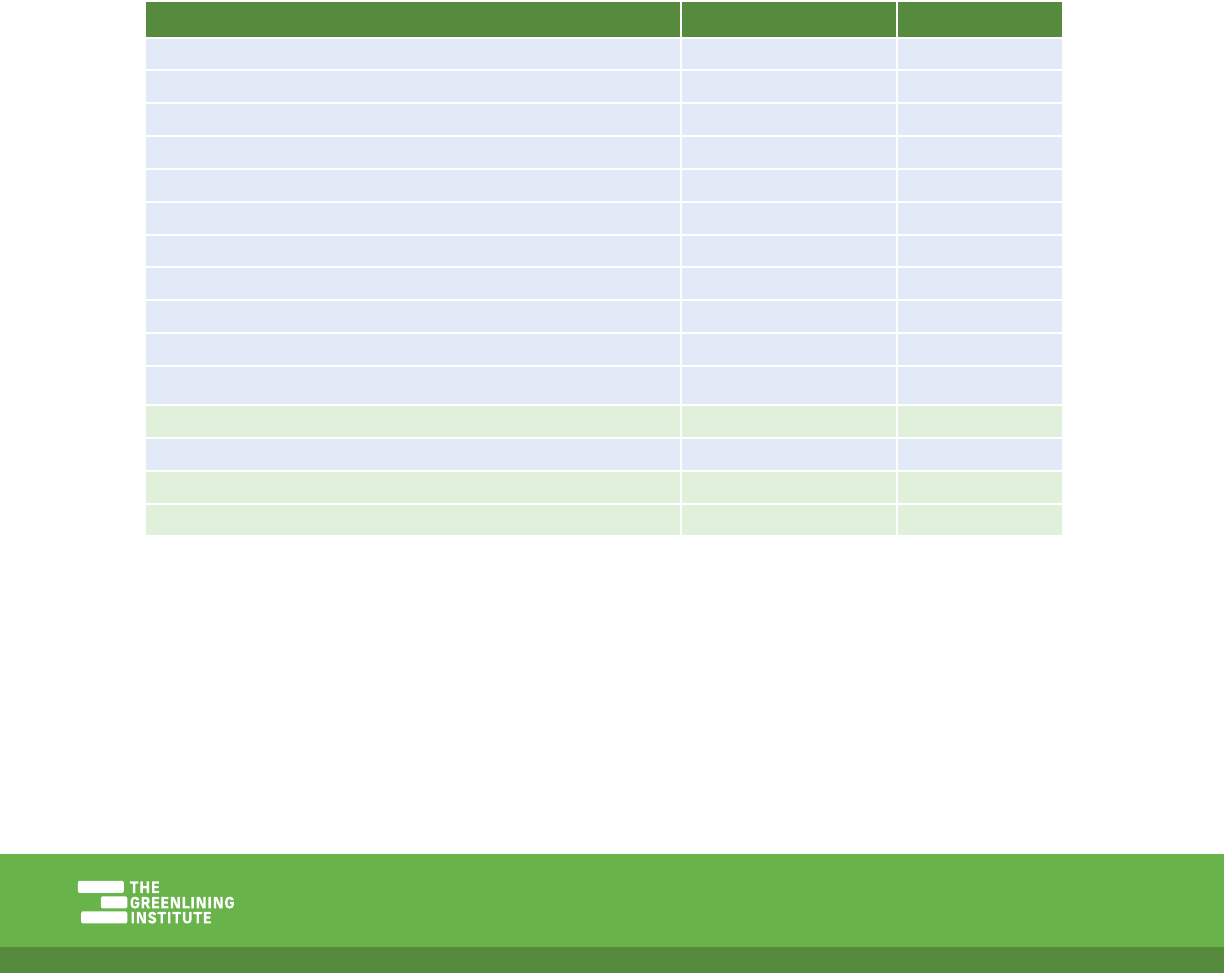

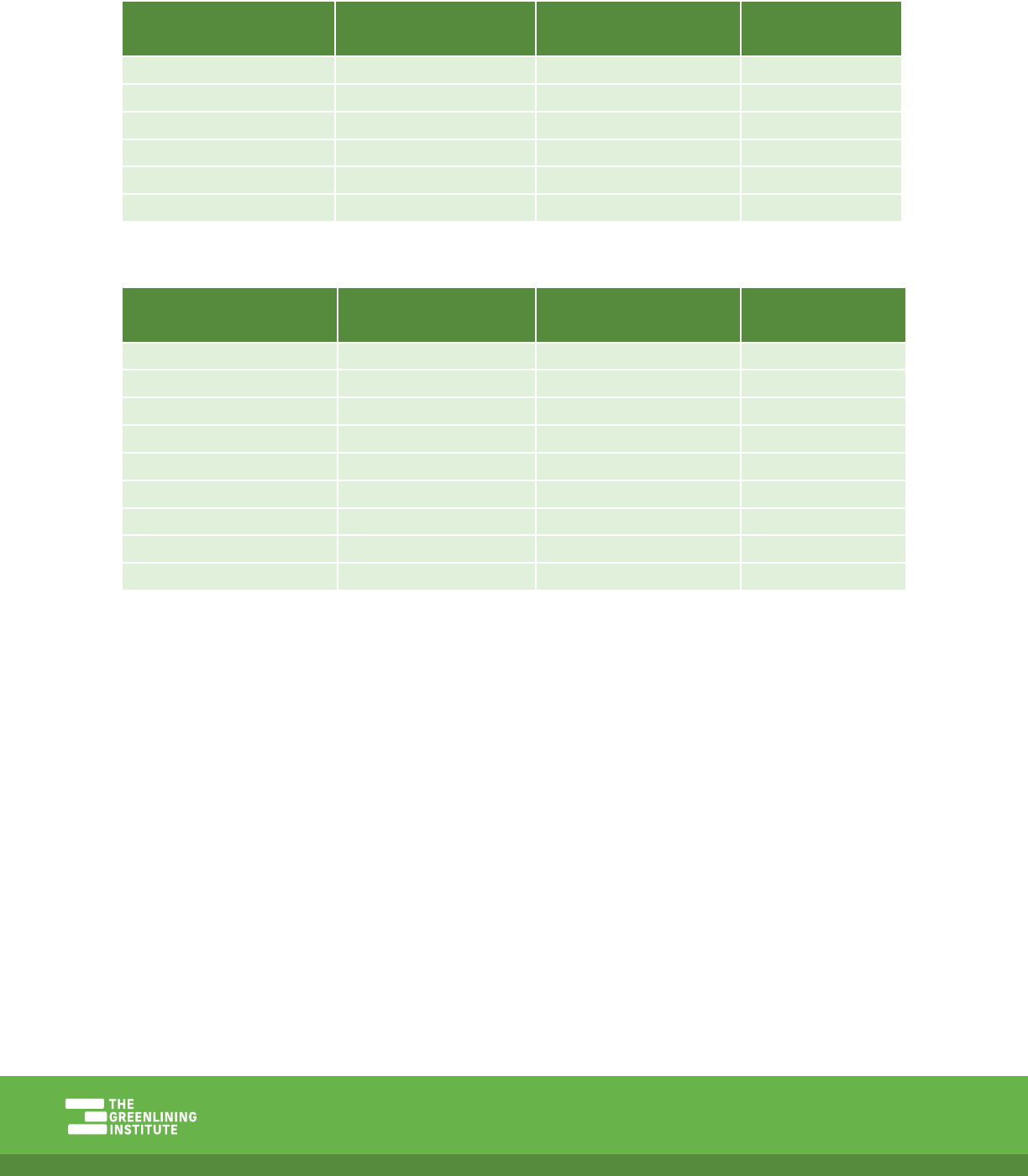

Table 1 below illustrates the number of home purchase loan originations by race for all lenders in

California.

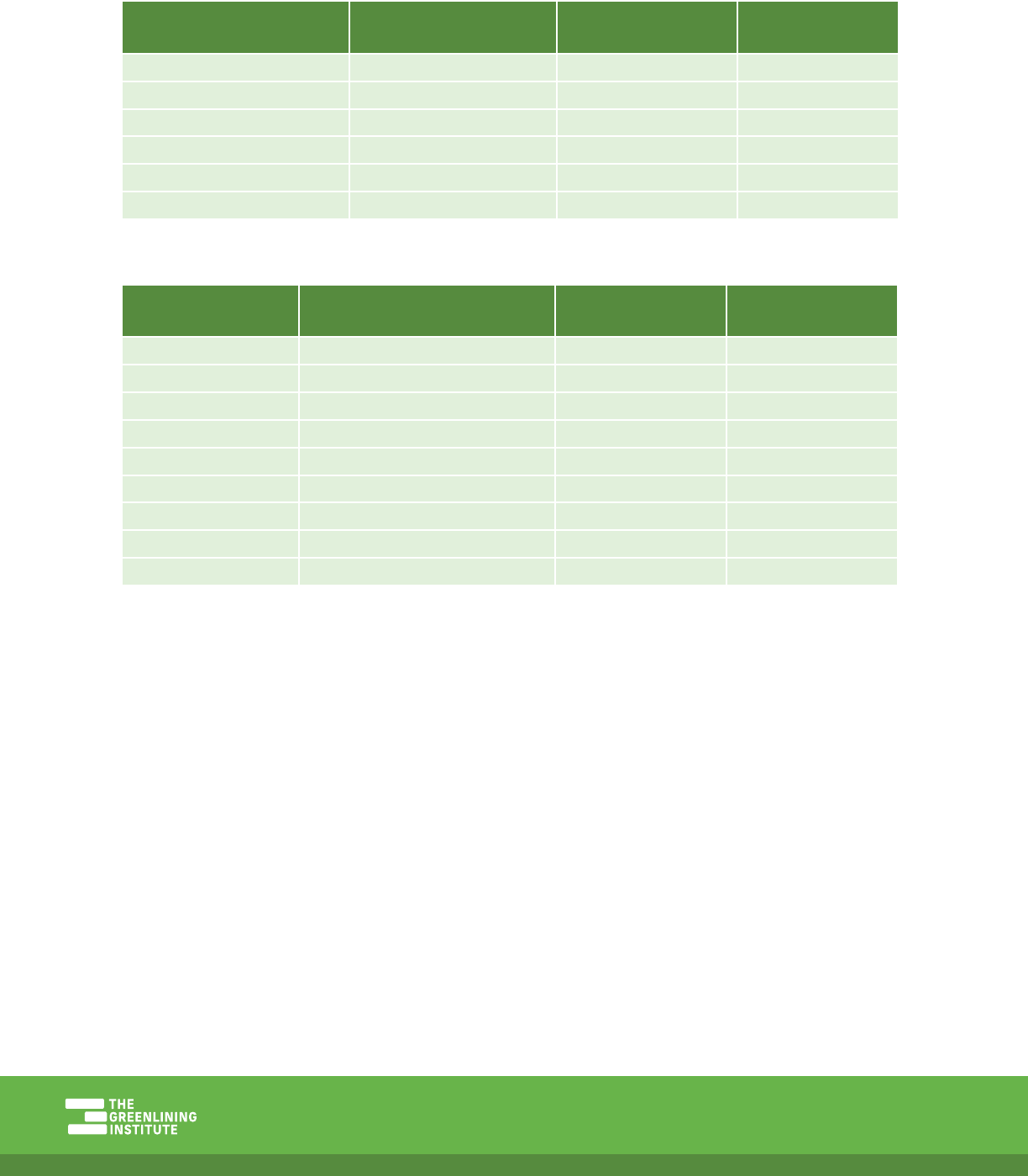

Table 1: Home Purchase Loans by Race for All Lenders

Race

Number of Loan

Originations

Percent of Loan

Originations Percent of Population

White 171,030 36.45% 34.30%

Asian 91,114 19.42% 15.00%

Native American 983 0.21% 0.20%

Black 15,231 3.25% 5.30%

Pacific Islander 1,073 0.23% 0.40%

Latino 97,571 20.79% 40.20%

15%

Asian

0.2%

Native

American

5.3%

Black

0.4%

Pacific

Islander

40.2%

Latino

34.3%

White

4.6%

Other

25

16Home Lending to Communities of Color in California | MARCH 2023

While home lending to Asian households appears to exceed their share of the population (and to

increase from 15.5% in 2020 to 19.4% in 2021), it is important to not treat the Asian population in

California as a monolith, and to disaggregate the Asian category in order to consider the dierences

in access for dierent groups. Nationally, LMI Asian American and Pacific Islanders (AAPI) are far

less likely to own a home compared to white people of the same income group—37% compared to

55%. Further, LMI Native Hawaiians and Other Pacific Islanders (NHOPI) are more than two times

less likely to own a home at 22%, and are nearly twice as likely to be denied home purchase loans

compared to white borrowers.

26

Data collected through the Home Mortgage Disclosure Act now

includes disaggregated Asian data, and we are including the data that was analyzed by Compliance

Tech in Table 2 and throughout the report for each MSA.

27

Although this data is incomplete for all Asian

borrowers, this gives us a better understanding of the state of home lending for Asian communities

in California and emphasizes the need for more targeted outreach by financial institutions, targeted

language services and supportive home counseling services to specific populations.

Table 2: Home Purchase Loans to Asian Borrowers for All Lenders

Asian Breakout

Number of Loan

Originations

Percent of Loan

Originations

Percent of Total

Loan Originations

Percent of Total

Population

Asian 18,106 19.87% 3.86% -

Asian Indian 19,142 21.01% 4.08% 2.24%

Chinese 22,888 25.12% 4.88% 3.77%

Filipino 9,285 10.19% 1.98% 3.21%

Japanese 1,227 1.35% 0.26% 0.65%

Korean 6,083 6.68% 1.30% 1.17%

Vietnamese 6,086 6.68% 1.30% 1.70%

Asian Other 5,294 5.81% 1.13% 1.72%

28

Multi-Asian 3,003 3.30% 0.64% 0.54%

17Home Lending to Communities of Color in California | MARCH 2023

Top 15 Lenders in Six Metropolitan Areas of California:

For the regional analysis, we studied six metropolitan regions: Sacramento, San Francisco, Oakland,

Fresno, Los Angeles and San Diego. The analysis evaluated the top 15 lenders of each MSA by:

• Home purchase originations by race;

• Home purchase originations by race and gender, focusing on loans to women of color;

• Home purchase originations by borrower income, and;

• Home purchase originations by borrower income and race.

Table 2: Home Purchase Loans by Race and Gender

39,237,836

California Population

Women of Color

comprise

30%

of CA’s population

take out

8%

of home purchase loans

Eight percent of the home purchase loans made by the top 15 lenders are to women of color, who

comprise 30% of the state’s population.

29

This rate is consistent with last year.

18Home Lending to Communities of Color in California | MARCH 2023

Sacramento-Roseville-Folsom

MSA

Total Population: 2,411,428, 6.15% of California’s population

Sacramento MSA Demographics

Overview of Lending in Sacramento-Roseville-Folsom MSA

Lender Type of Lender % of Market

United Wholesale Mortgage Non-Bank 15.25%

Rocket Mortgage Non-Bank 6.24%

American Pacific Mortgage Corporation Non-Bank 4.61%

Guild Mortgage Company Non-Bank 4.14%

Loandepot.com Non-Bank 3.85%

Finance of America Mortgage Non-Bank 3.84%

Home Point Financial Corporation Non-Bank 2.50%

Movement Mortgage Non-Bank 2.48%

Caliber Home Loans Non-Bank 2.26%

Fairway Independent Mortgage Corporation Non-Bank 2.25%

Lennar Mortgage Non-Bank 2.20%

Wells Fargo Bank, National Association Bank 2.13%

Summit Funding Non-Bank 2.03%

U.S. Bank, National Association Bank 1.48%

Flagstar Bank Bank 1.36%

*Nonbank lenders are highlighted.

In the Sacramento region, Black, Latino and Pacific Islander communities receive fewer loans relative

to their share of the population than other racial groups in the region. Latino households receive just

14% of home purchase loans, while making up 23% of the population.

++N

00++N

07++N

01++N

++N

++N

07++N

14.3%

Asian

0.2%

Native

American

6.8%

Black

0.8%

Pacific

Islander

22.7%

Latino

48.4%

White

6.8%

Other

19Home Lending to Communities of Color in California | MARCH 2023

Table 3: Home Purchase Loans by Race for All Lenders

Race

Number of Loan

Originations

Percent of Loan

Originations Percent of Population

White 17,249 42.88% 48.40%

Asian 6,960 17.30% 14.30%

Native American 124 0.31% 0.20%

Black 1,687 4.19% 6.80%

Pacific Islander 190 0.47% 0.80%

Latino 5,472 13.60% 22.70%

Table 4: Home Purchase Loans to Asian Borrowers for All Lenders

Race

Number of Loan

Originations

Percent of Loan

Originations

Percent of Total Loan

Originations

Asian 1,287 18.49% 3.20%

Asian Indian 1,569 22.54% 3.90%

Chinese 1,270 18.25% 3.16%

Filipino 994 14.28% 2.47%

Japanese 93 1.34% 0.23%

Korean 196 2.82% 0.49%

Vietnamese 602 8.65% 1.50%

Asian Other 635 9.12% 1.58%

Multi-Asian 314 4.51% 0.78%

Top 15 Lenders in Sacramento-Roseville-Folsom MSA

The top 15 lenders in the Sacramento region account for 57% of the market. Similar to last year,

nonbank lenders make up 12 of the top 15 lenders. The top lender, United Wholesale Mortgage,

accounts for 15% of all loan originations.

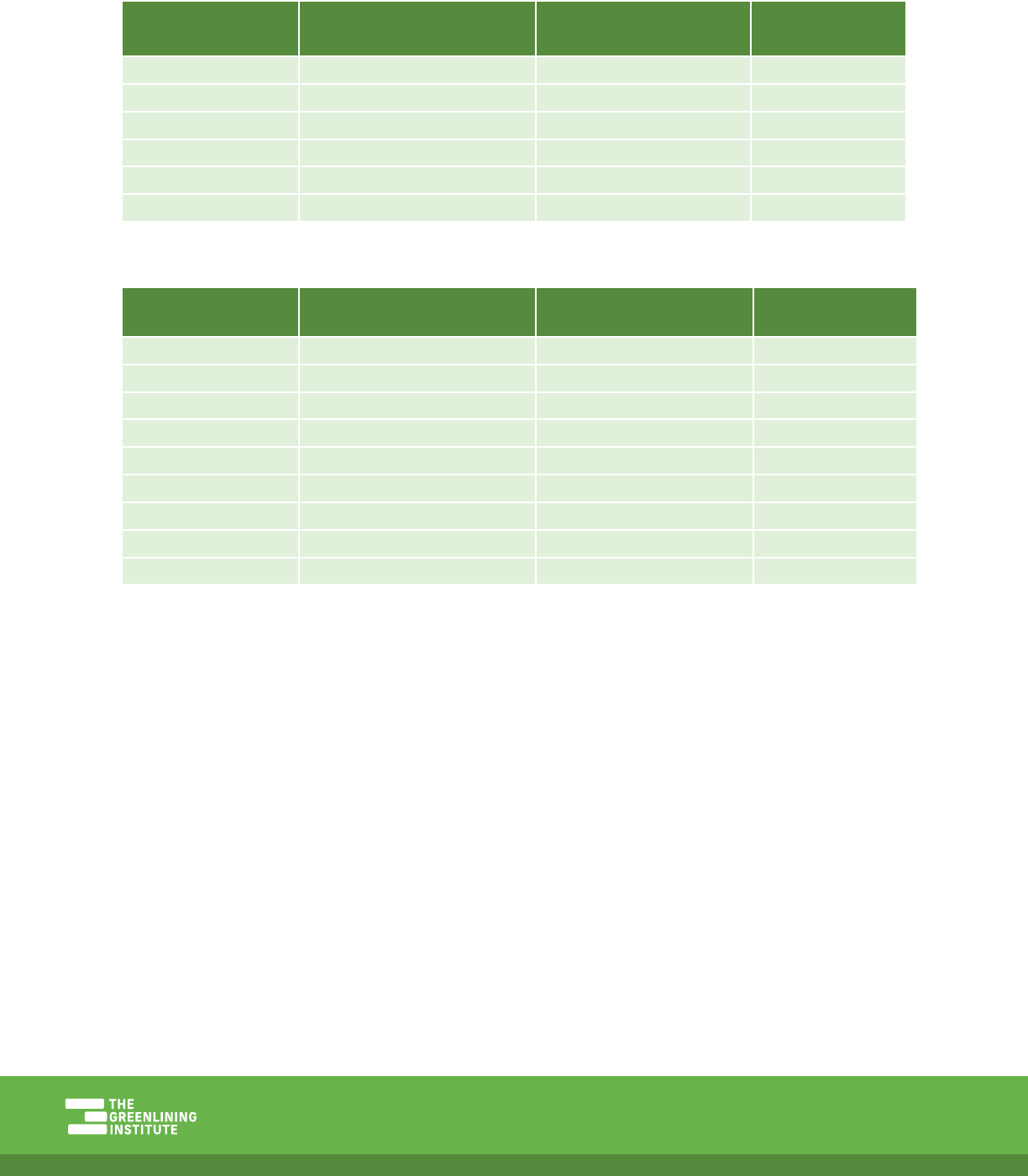

Table 5 below illustrates the number of home purchase loan originations by race for each of the top

15 lenders in the Sacramento MSA in 2021. A majority of loans across both loan product types for each

institution are issued to White borrowers.

20Home Lending to Communities of Color in California | MARCH 2023

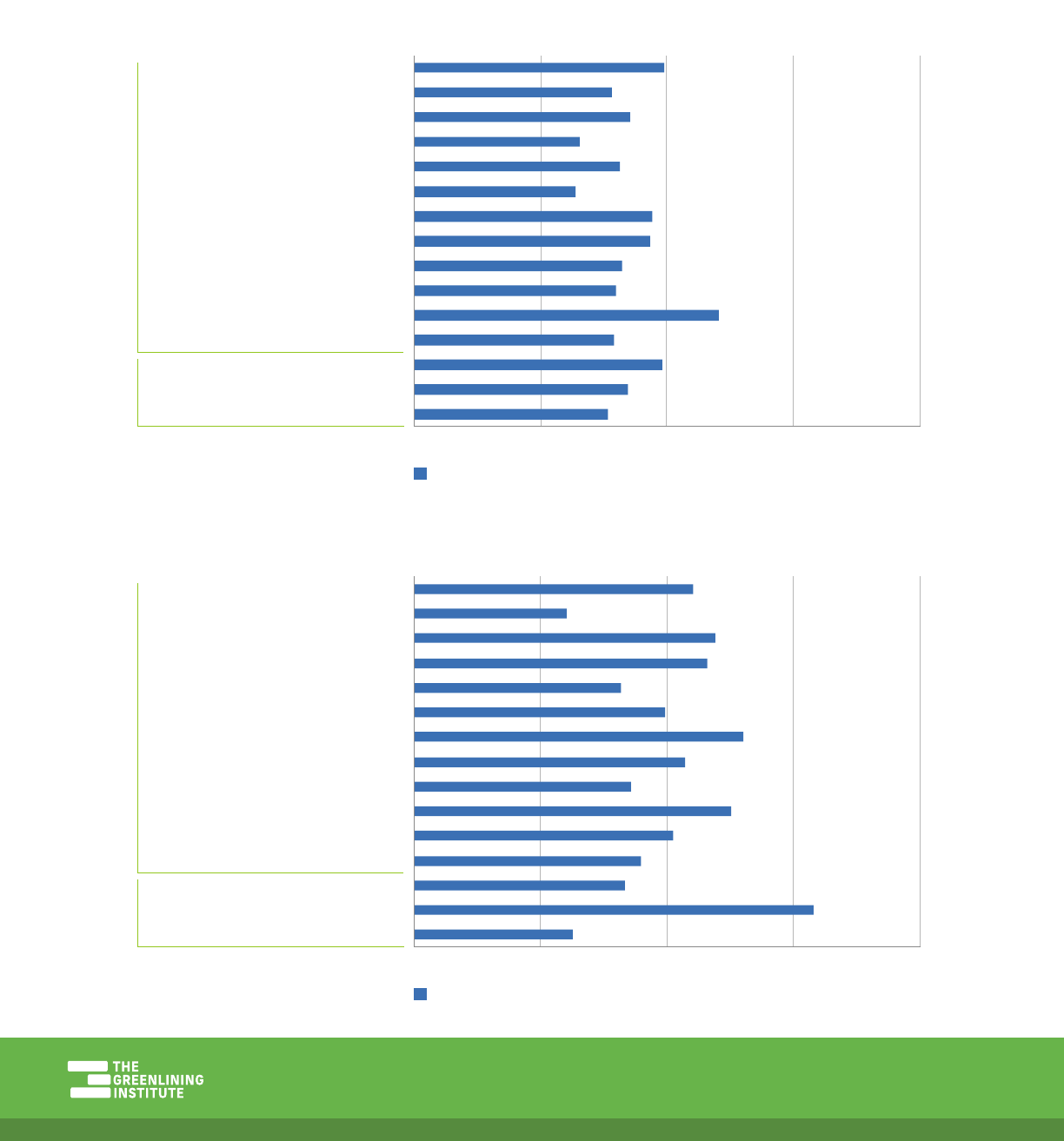

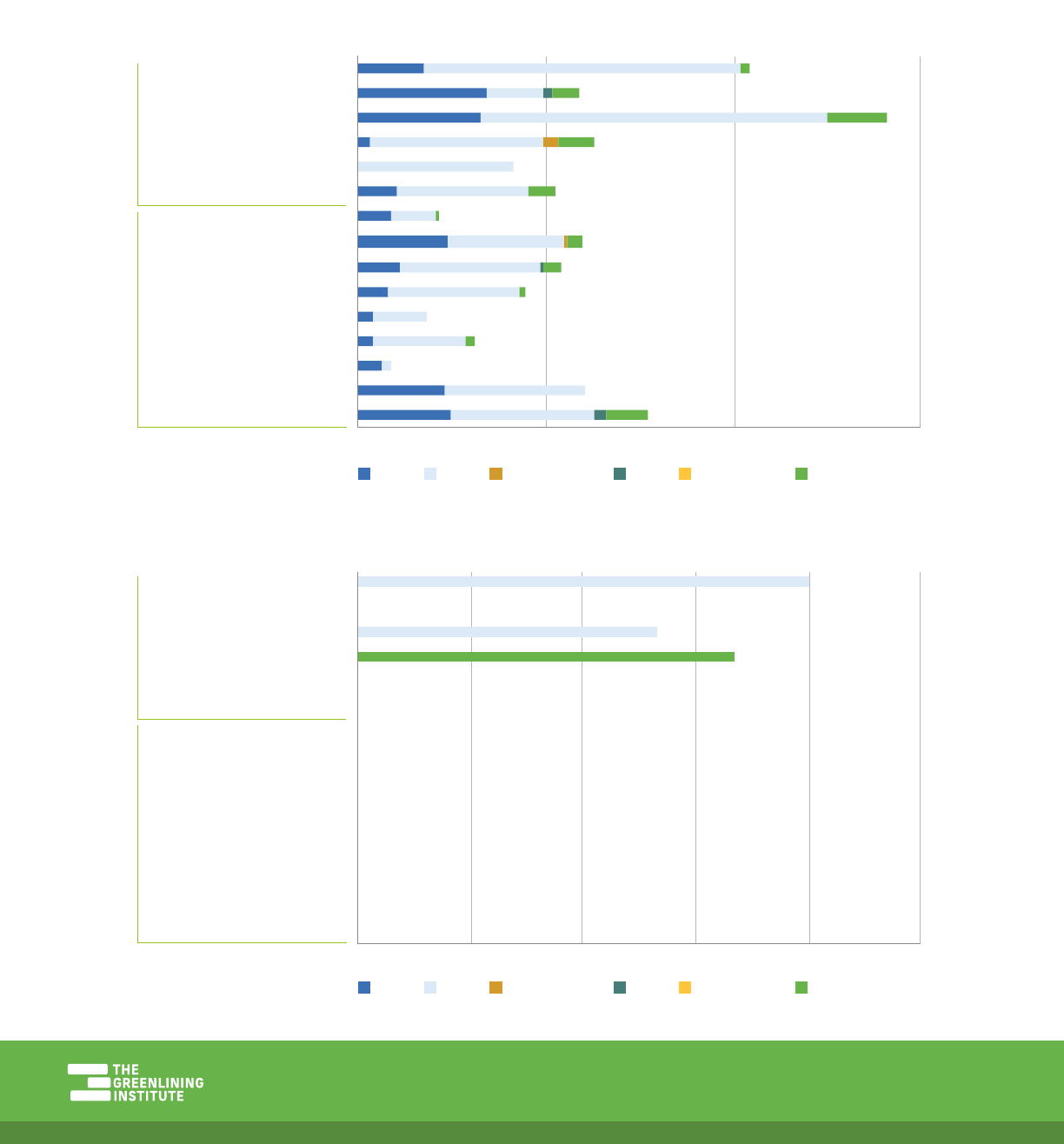

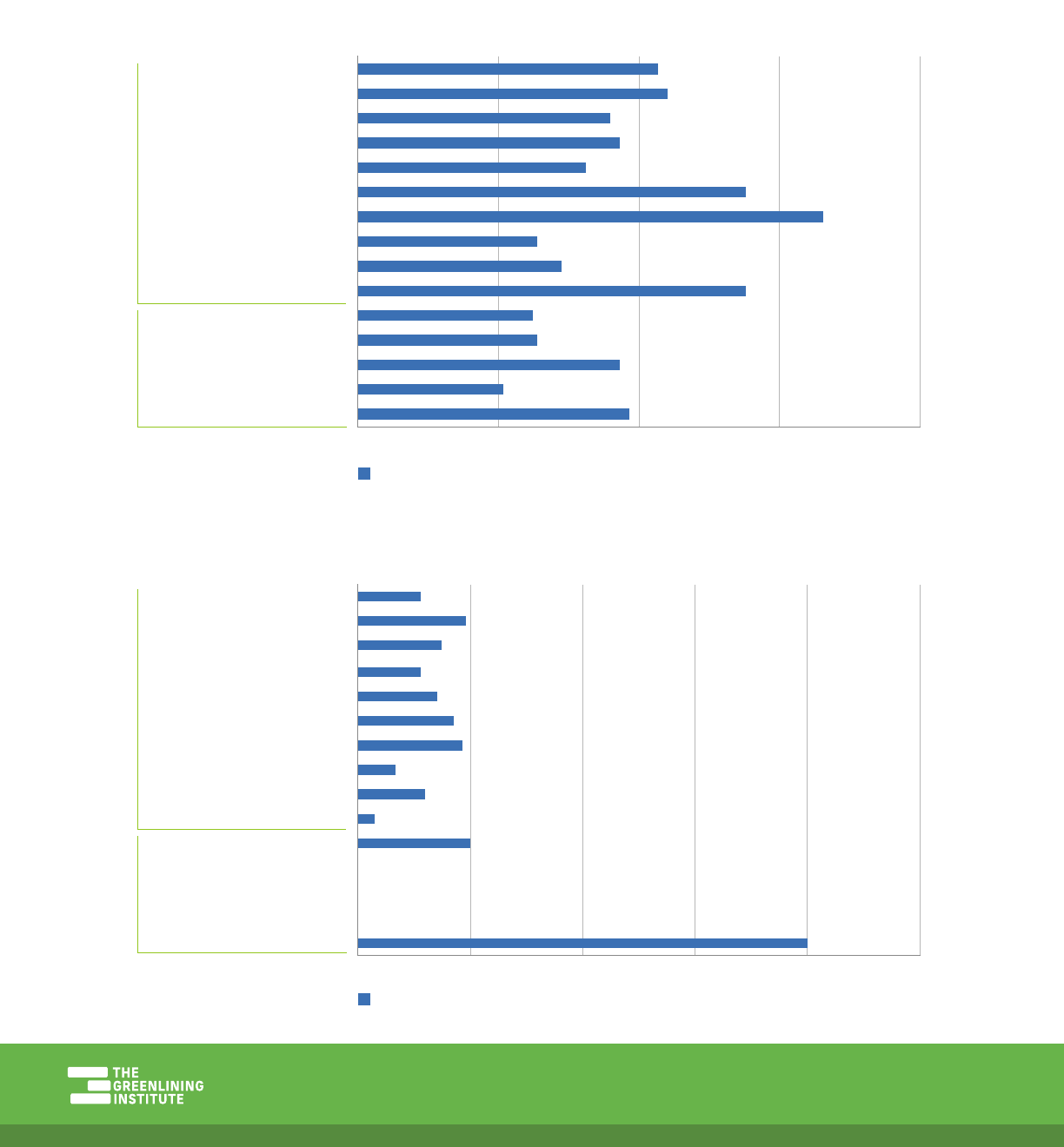

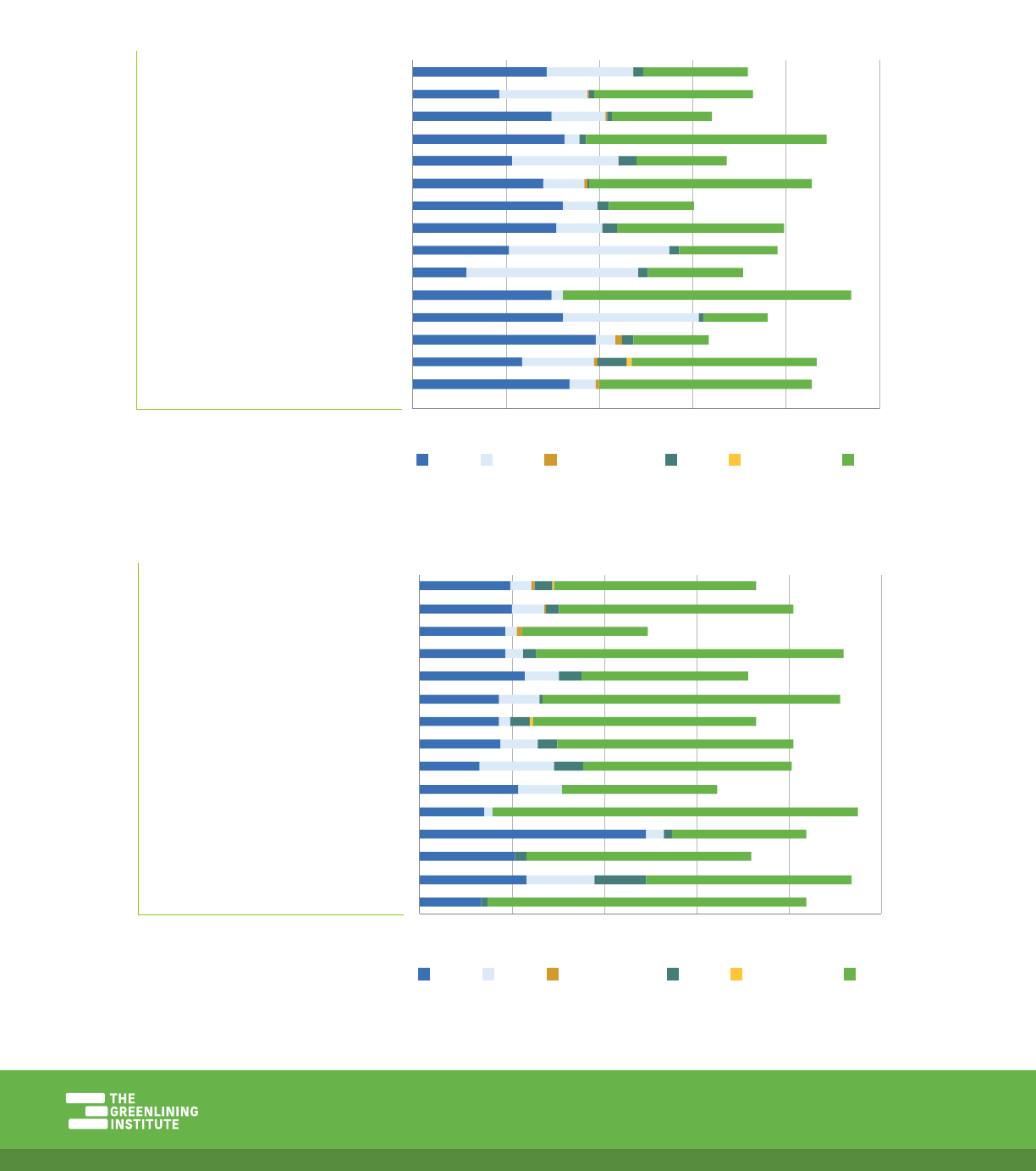

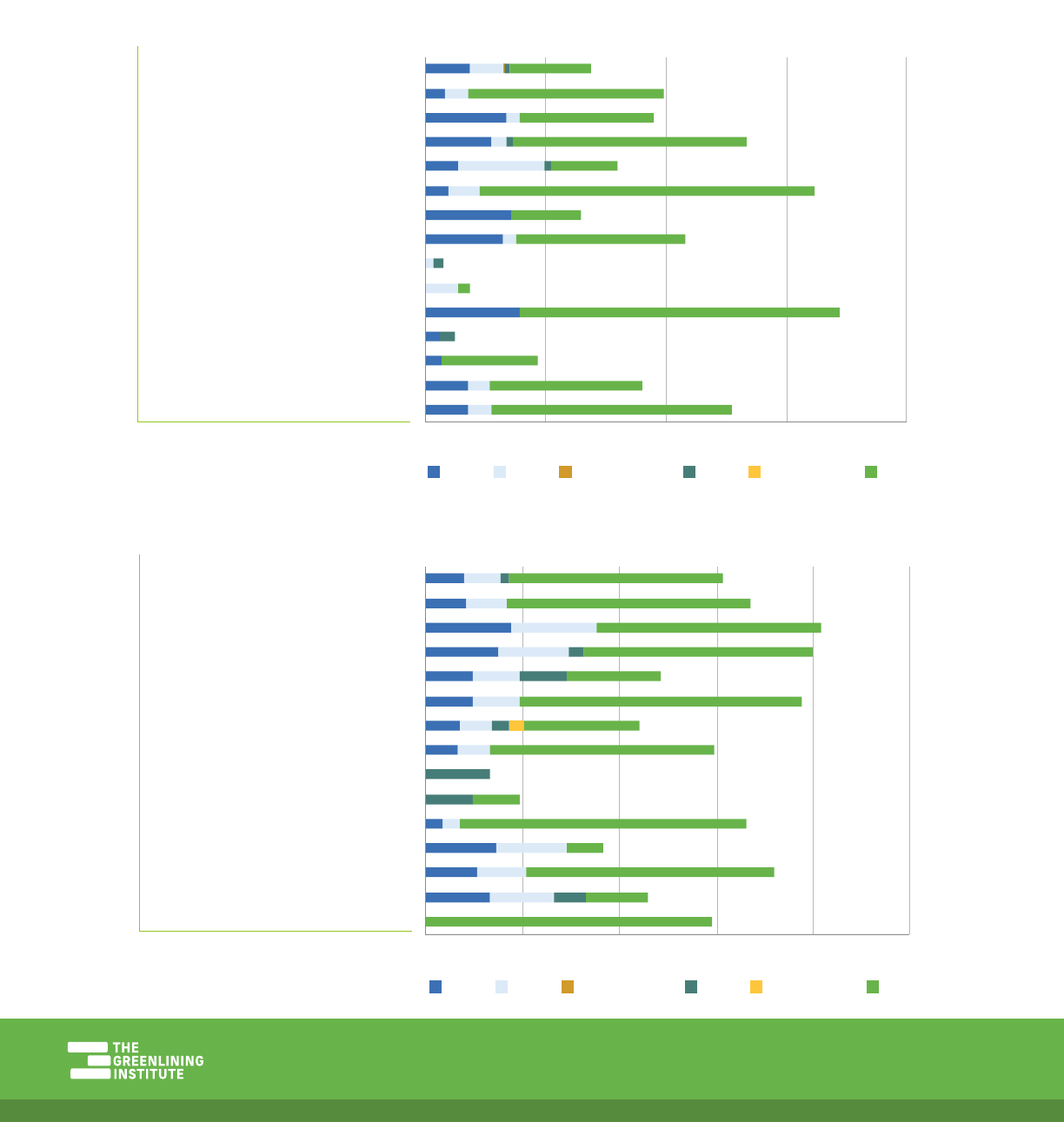

Table 5: Home Purchase Loans by Race

White Asian Native American Black Pacific Islander Latino

UNITED WHOLESALE MORTGAGE

ROCKET MORTGAGE

AMERICAN PACIFIC MORTGAGE

GUILD MORTGAGE COMPANY

LOANDEPOT.COM

FINANCE OF AMERICA MORTGAGE

HOME POINT FINANCIAL

MOVEMENT MORTGAGE

CALIBER HOME LOANS

FAIRWAY INDEPENDENT MORTGAGE

LENNAR MORTGAGE

SUMMIT FUNDING

WELLS FARGO BANK

U.S. BANK

FLAGSTAR BANK

0% 20% 40% 60% 80% 100%

Nonbank

Bank

White Asian Native American Black Pacific Islander Latino

UNITED WHOLESALE MORTGAGE

ROCKET MORTGAGE

AMERICAN PACIFIC MORTGAGE

GUILD MORTGAGE COMPANY

LOANDEPOT.COM

FINANCE OF AMERICA MORTGAGE

HOME POINT FINANCIAL

MOVEMENT MORTGAGE

CALIBER HOME LOANS

FAIRWAY INDEPENDENT MORTGAGE

LENNAR MORTGAGE

SUMMIT FUNDING

WELLS FARGO BANK

U.S. BANK

FLAGSTAR BANK

0% 20% 40% 60% 80% 100%

Nonbank

Bank

21Home Lending to Communities of Color in California | MARCH 2023

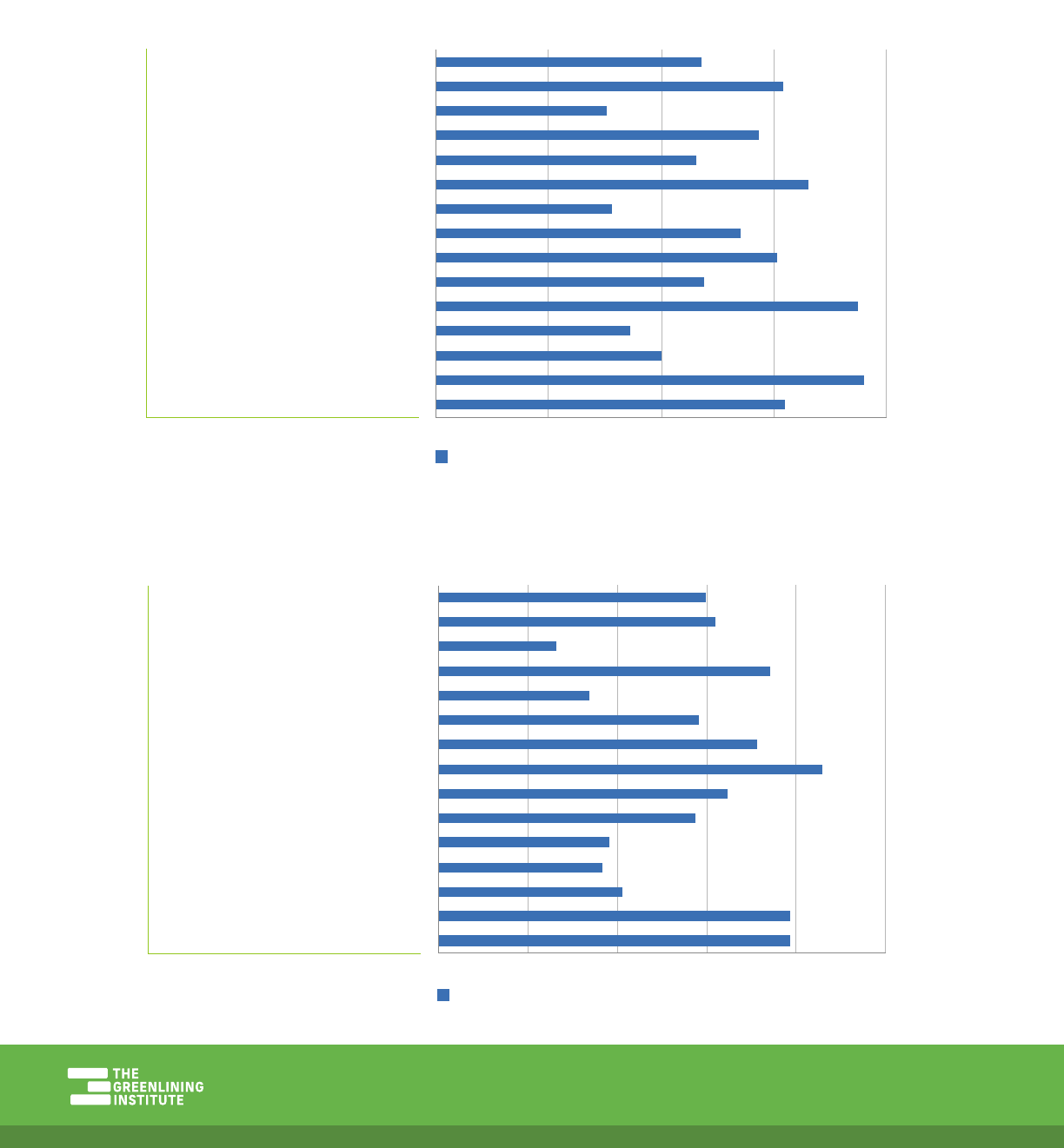

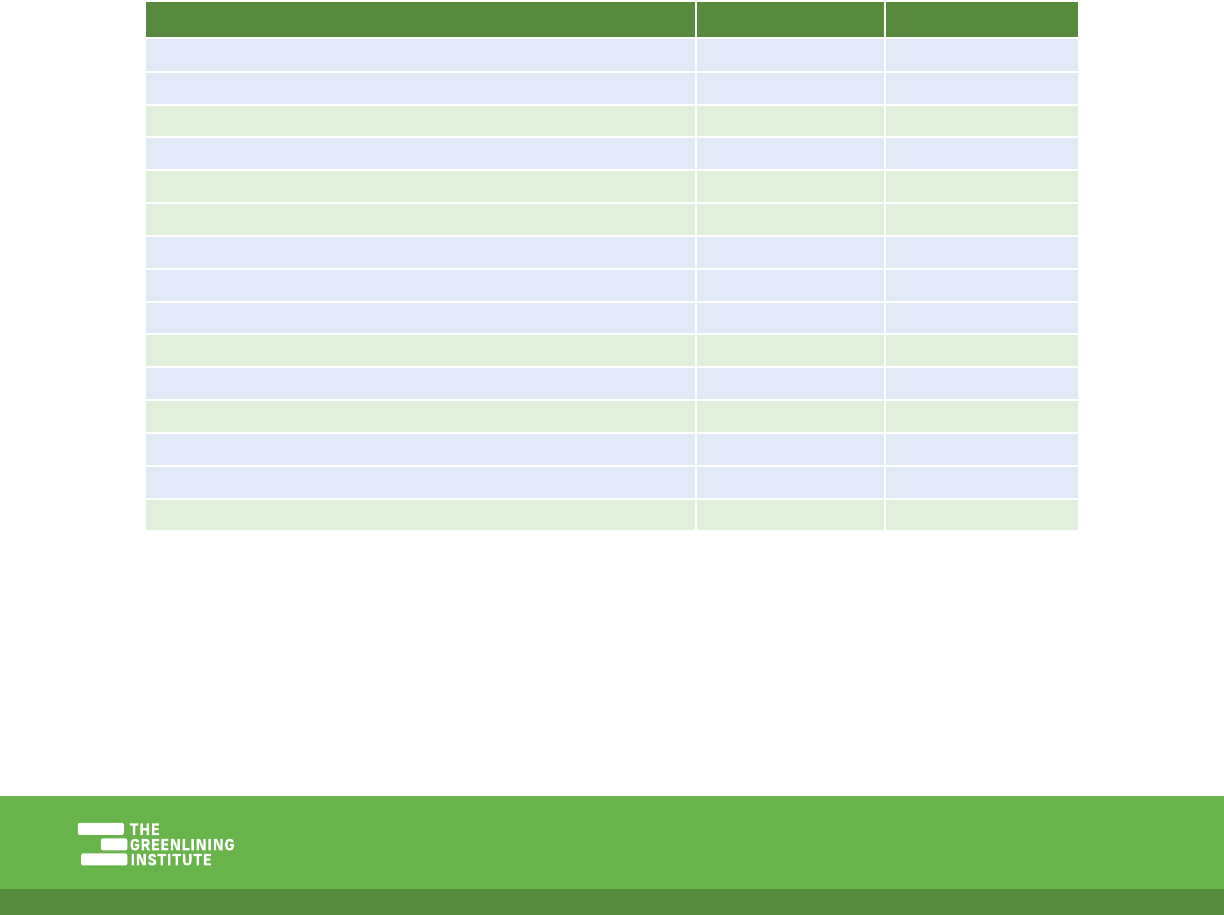

Table 6 illustrates the number of home purchase loan originations for women-identified people of

color (non-White) for each of the top 15 lenders in the Sacramento MSA in 2021.

Table 6: Home Purchase Loans to Women of Color

UNITED WHOLESALE MORTGAGE

ROCKET MORTGAGE

AMERICAN PACIFIC MORTGAGE

GUILD MORTGAGE COMPANY

LOANDEPOT.COM

FINANCE OF AMERICA MORTGAGE

HOME POINT FINANCIAL

MOVEMENT MORTGAGE

CALIBER HOME LOANS

FAIRWAY INDEPENDENT MORTGAGE

LENNAR MORTGAGE

SUMMIT FUNDING

WELLS FARGO BANK

U.S. BANK

FLAGSTAR BANK

0% 5% 10% 15% 20%

Nonbank

Bank

WoC (non-White)

UNITED WHOLESALE MORTGAGE

ROCKET MORTGAGE

AMERICAN PACIFIC MORTGAGE

GUILD MORTGAGE COMPANY

LOANDEPOT.COM

FINANCE OF AMERICA MORTGAGE

HOME POINT FINANCIAL

MOVEMENT MORTGAGE

CALIBER HOME LOANS

FAIRWAY INDEPENDENT MORTGAGE

LENNAR MORTGAGE

SUMMIT FUNDING

WELLS FARGO BANK

U.S. BANK

FLAGSTAR BANK

0% 5% 10% 15% 20%

Nonbank

Bank

WoC (non-White)

22Home Lending to Communities of Color in California | MARCH 2023

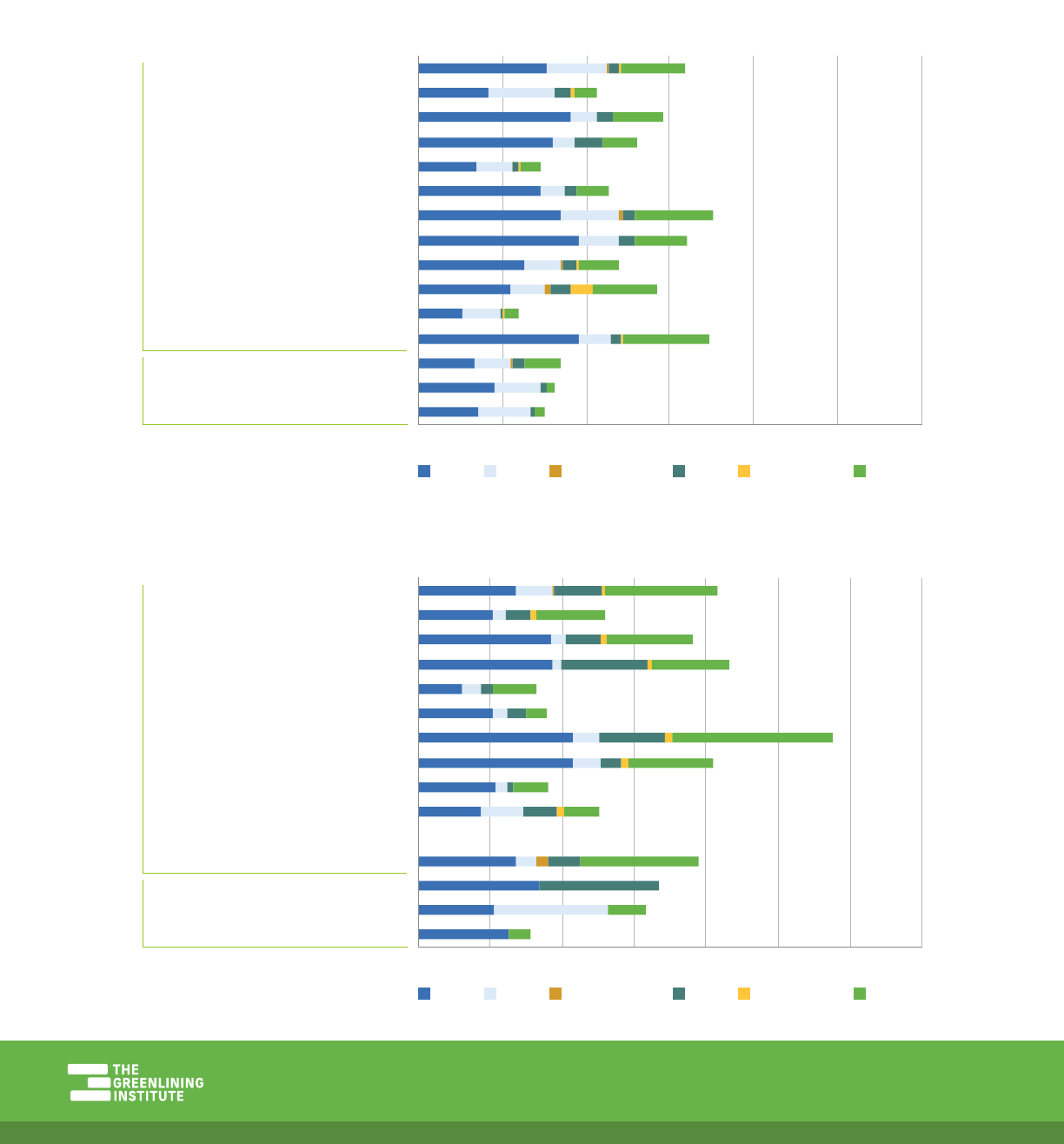

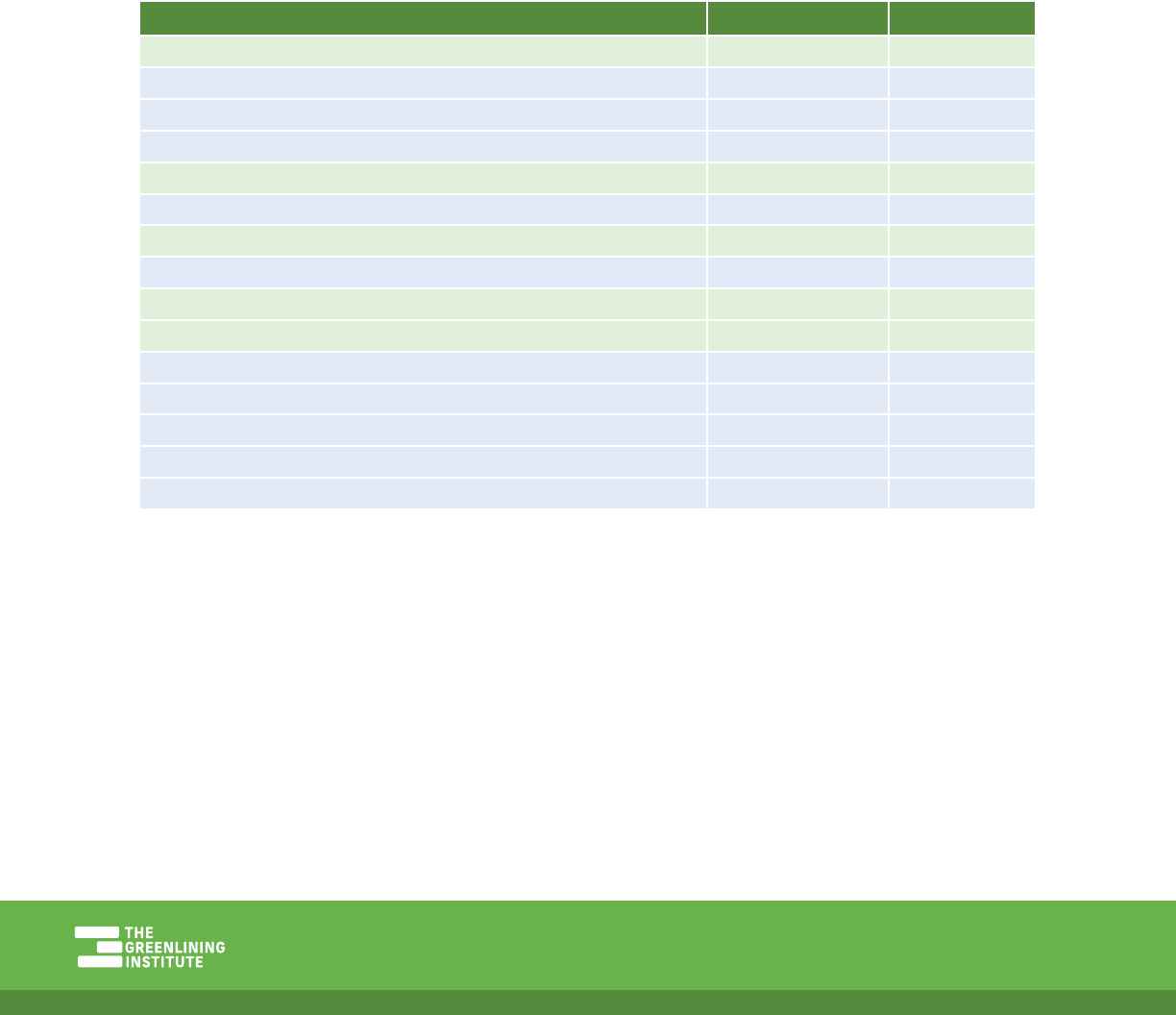

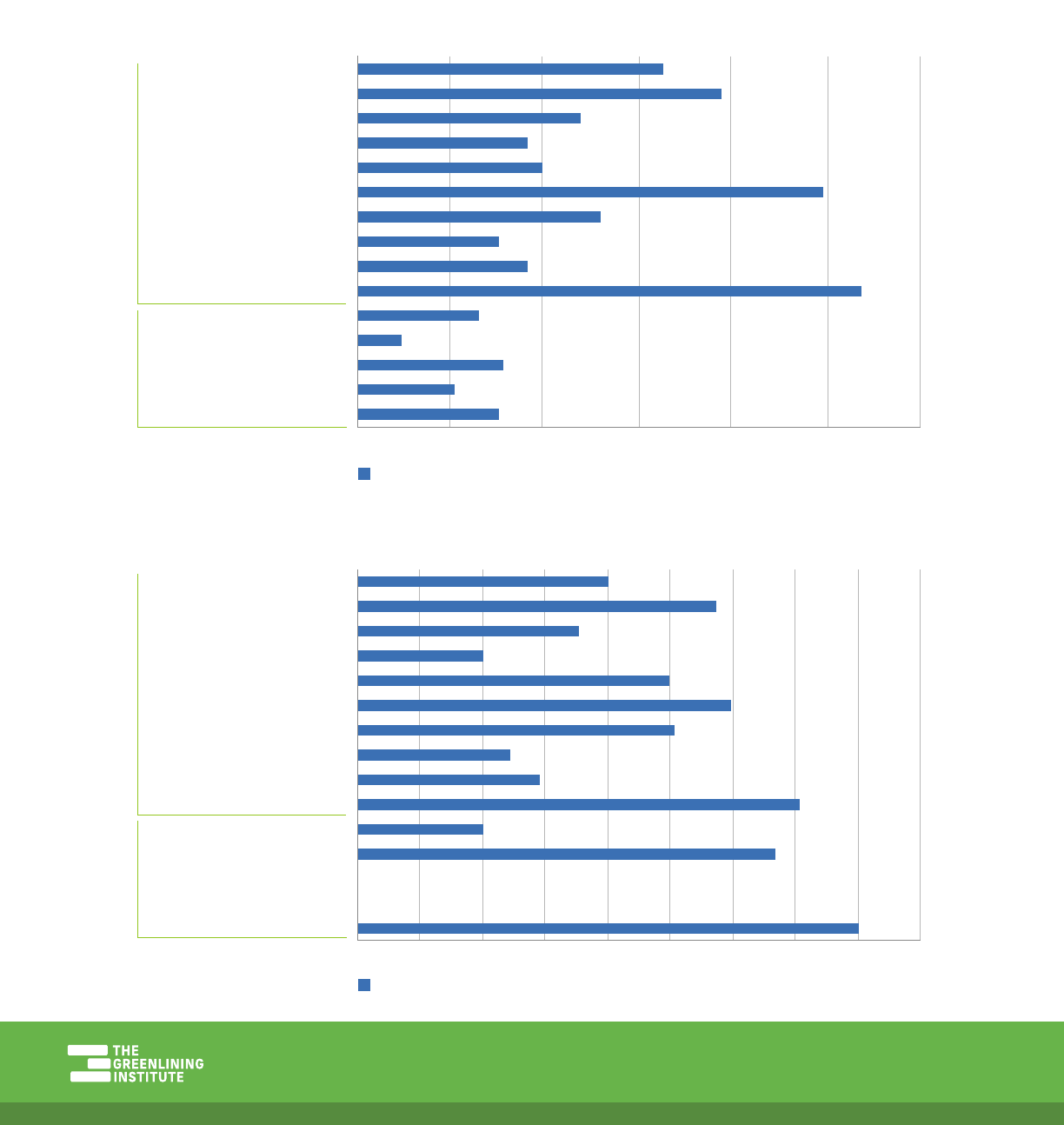

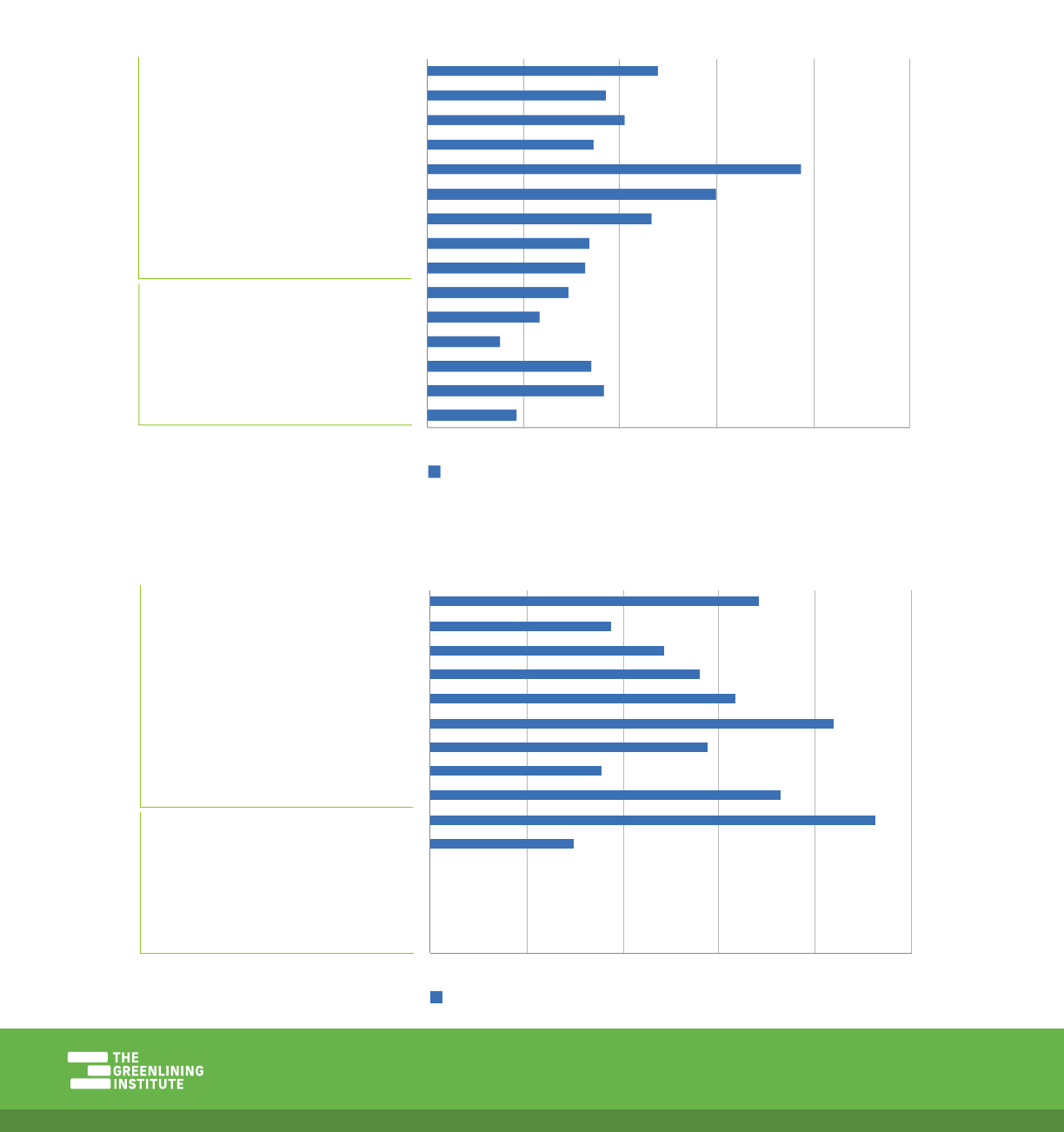

Table 7 below illustrates the number of home purchase loan originations to low-income borrowers,

defined as borrowers who report an income below 80% of the region’s Area Median Income, for each

of the top 15 lenders in the Sacramento MSA in 2021. On average, a higher percentage of low-income

borrowers are served by nonbanks than mainstream banks.

Table 7: Home Purchase Loans to Low-Income Borrowers

UNITED WHOLESALE MORTGAGE

ROCKET MORTGAGE

AMERICAN PACIFIC MORTGAGE

GUILD MORTGAGE COMPANY

LOANDEPOT.COM

FINANCE OF AMERICA MORTGAGE

HOME POINT FINANCIAL

MOVEMENT MORTGAGE

CALIBER HOME LOANS

FAIRWAY INDEPENDENT MORTGAGE

LENNAR MORTGAGE

SUMMIT FUNDING

WELLS FARGO BANK

U.S. BANK

FLAGSTAR BANK

0% 10% 20% 30% 40%

Nonbank

Bank

Borrowers < 80% of AMI

UNITED WHOLESALE MORTGAGE

ROCKET MORTGAGE

AMERICAN PACIFIC MORTGAGE

GUILD MORTGAGE COMPANY

LOANDEPOT.COM

FINANCE OF AMERICA MORTGAGE

HOME POINT FINANCIAL

MOVEMENT MORTGAGE

CALIBER HOME LOANS

FAIRWAY INDEPENDENT MORTGAGE

LENNAR MORTGAGE

SUMMIT FUNDING

WELLS FARGO BANK

U.S. BANK

FLAGSTAR BANK

0% 10% 20% 30% 40%

Nonbank

Bank

Borrowers < 80% of AMI

23Home Lending to Communities of Color in California | MARCH 2023

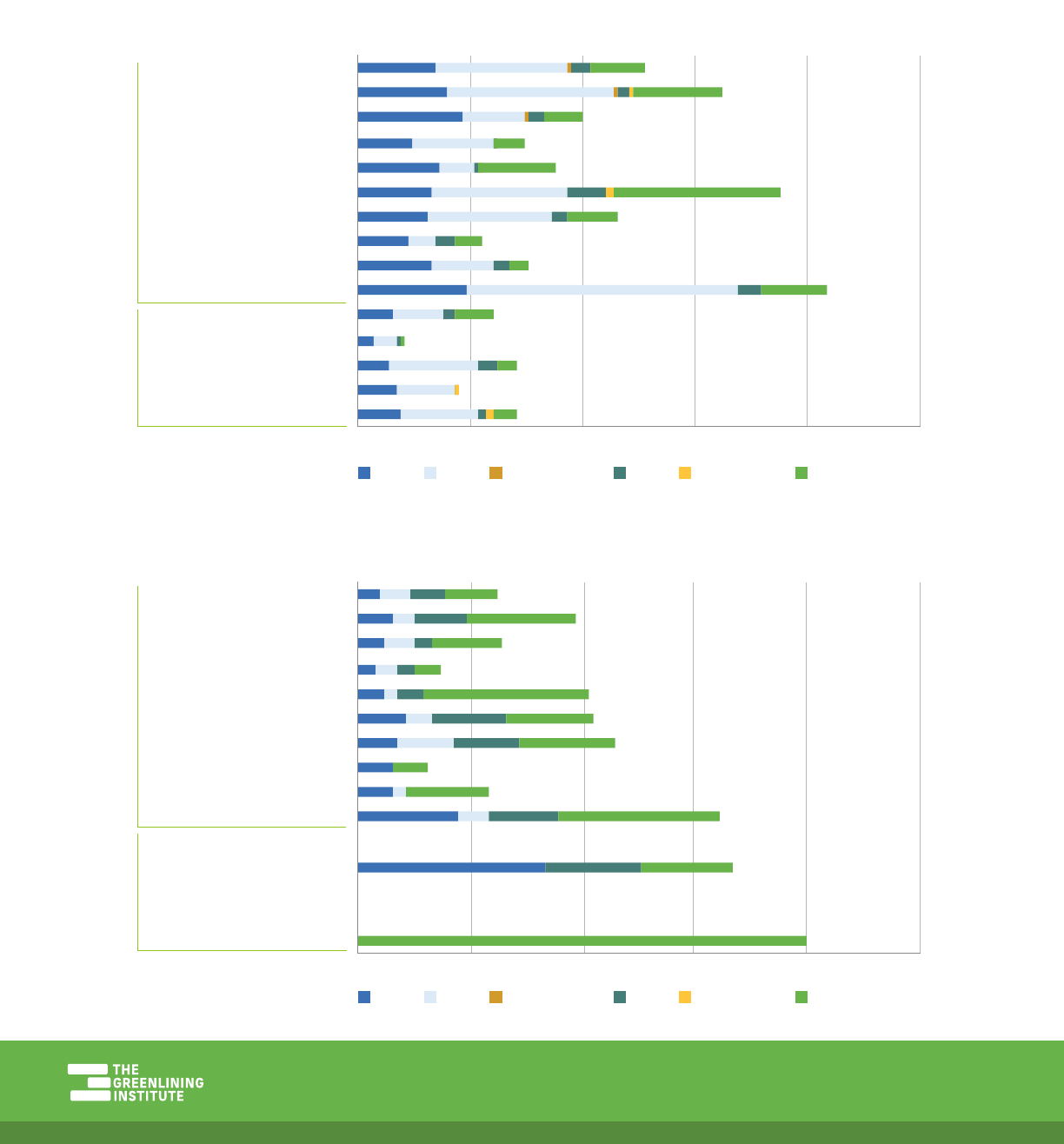

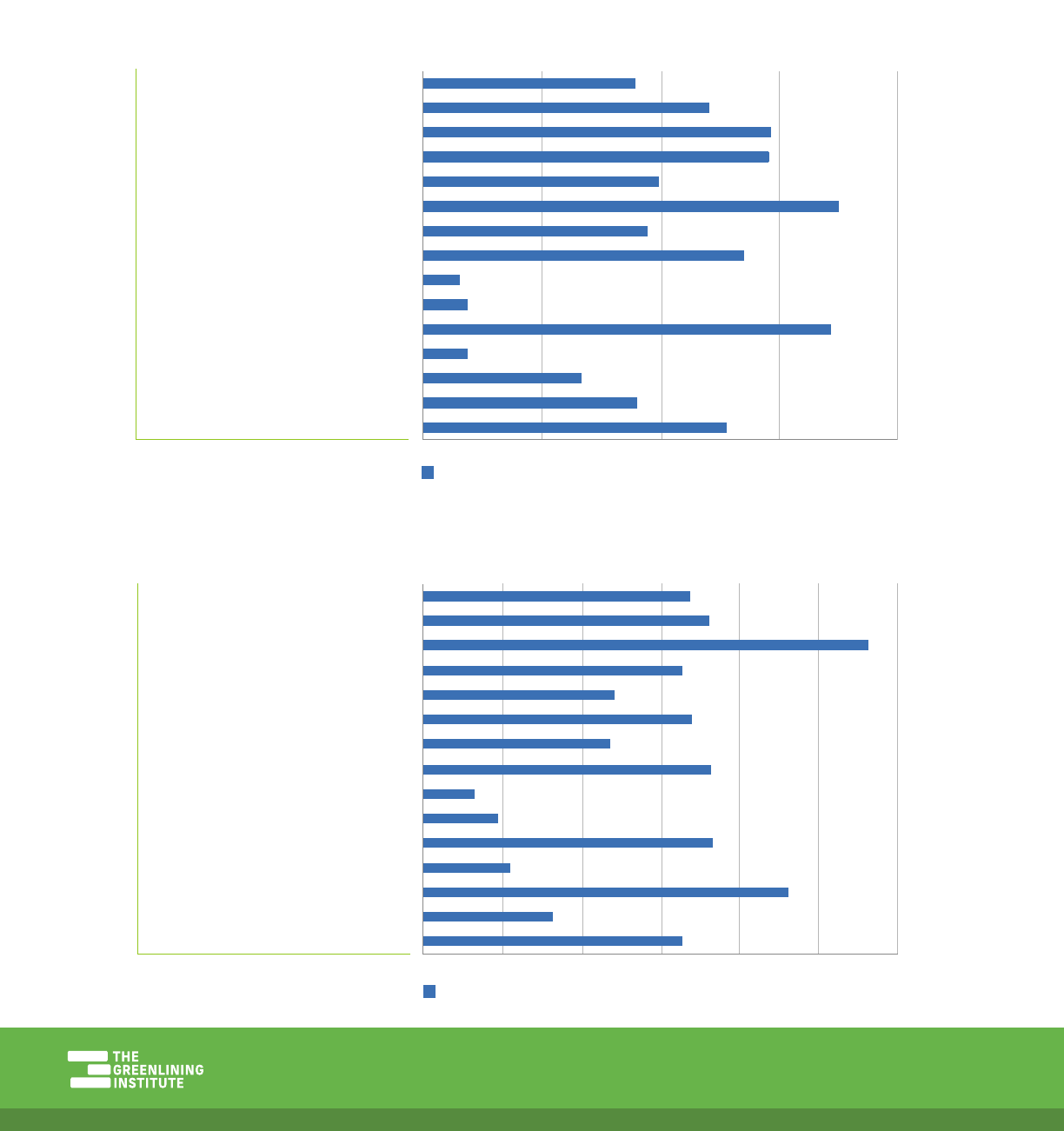

Table 8 below illustrates the number of home purchase loan originations to low-income borrowers by

race for each of the top 15 lenders in the Sacramento MSA in 2021.

Table 8: Home Purchase Loans to Low-Income Borrowers by Race

UNITED WHOLESALE MORTGAGE

ROCKET MORTGAGE

AMERICAN PACIFIC MORTGAGE

GUILD MORTGAGE COMPANY

LOANDEPOT.COM

FINANCE OF AMERICA MORTGAGE

HOME POINT FINANCIAL

MOVEMENT MORTGAGE

CALIBER HOME LOANS

FAIRWAY INDEPENDENT MORTGAGE

LENNAR MORTGAGE

SUMMIT FUNDING

WELLS FARGO BANK

U.S. BANK

FLAGSTAR BANK

0% 10%5% 15%

20%

25% 30%

Nonbank

Bank

White Asian Native American Black Pacific Islander Latino

UNITED WHOLESALE MORTGAGE

ROCKET MORTGAGE

AMERICAN PACIFIC MORTGAGE

GUILD MORTGAGE COMPANY

LOANDEPOT.COM

FINANCE OF AMERICA MORTGAGE

HOME POINT FINANCIAL

MOVEMENT MORTGAGE

CALIBER HOME LOANS

FAIRWAY INDEPENDENT MORTGAGE

LENNAR MORTGAGE

SUMMIT FUNDING

WELLS FARGO BANK

U.S. BANK

FLAGSTAR BANK

Nonbank

Bank

White Asian Native American Black Pacific Islander Latino

0% 10%5% 15%

20%

25% 30%

24Home Lending to Communities of Color in California | MARCH 2023

San Francisco-San Mateo-

Redwood City MSA

Total Population: 1,553,089, 3.96% of California’s population

San Francisco-San Mateo-Redwood City MSA Demographics

Overview of Lending in San Francisco-San Mateo-Redwood

City MSA

Lender Type of Lender % of Market

Wells Fargo Bank Bank 15.65%

First Republic Bank Bank 11.06%

Bank of America Bank 6.40%

JPMorgan Chase Bank Bank 4.90%

Rocket Mortgage Non-Bank 3.49%

Guaranteed Rate Non-Bank 3.47%

United Wholesale Mortgage Non-Bank 3.31%

Citibank Bank 3.25%

U.S. Bank Bank 3.19%

PNC Bank Bank 2.98%

Loandepot.com Non-Bank 2.03%

Flagstar Bank Bank 1.98%

Amwest Funding Non-Bank 1.90%

Guaranteed Rate Ainity Non-Bank 1.90%

MUFG Union Bank Bank 1.89%

*Nonbank lenders are highlighted.

In the San Francisco region, Black and Latino communities receive far fewer loans relative to their

share of the population than other racial groups in the region. Black households receive below 1% of

home purchase loans, while making up 4% of the population. Latino households receive just 5% of

home purchase loans, while making up 20% of the population.

++N

00++N

04++N

01++N

++N

++N

06++N

33.1%

Asian

0.1%

Native

American

3.7%

Black

0.8%

Pacific

Islander

19.6%

Latino

36.4%

White

6.3%

Other

25Home Lending to Communities of Color in California | MARCH 2023

Table 9: Home Purchase Loans by Race for All Lenders

Race Number of Loan Originations

Percent of Loan

Originations

Percent of

Population

White 5,269 34.71% 36.40%

Asian 6,142 40.46% 33.10%

Native American 8 0.05% 0.10%

Black 111 0.73% 3.70%

Pacific Islander 21 0.14% 0.80%

Latino 700 4.61% 19.60%

Table 10: Home Purchase Loans to Asian Borrowers for All Lenders

Race Number of Loan Originations

Percent of Loan

Originations

Percent of Total

Loan Originations

Asian 1,262 20.55% 8.31%

Asian Indian 873 14.21% 5.75%

Chinese 2,857 46.52% 18.82%

Filipino 237 3.86% 1.56%

Japanese 77 1.25% 0.51%

Korean 239 3.89% 1.57%

Vietnamese 151 2.46% 0.99%

Asian Other 259 4.22% 1.71%

Multi-Asian 187 3.04% 1.23%

Top 15 Lenders in San Francisco-San Mateo-

Redwood City MSA

Traditional bank lenders make up nine of the top 15 lenders in the San Francisco region, a departure

from the dominance of nonbank lenders in other California regions. This remains consistent with last

year’s findings.

The top 15 lenders in the San Francisco region account for over 67% of the market. The top lender,

Wells Fargo Bank, accounts for 16% of all home purchase loan originations.

Table 11 below illustrates the number of home purchase loan originations by race for each of the top

15 lenders in the San Francisco MSA in 2021. Asian and white borrowers make up the majority of both

conventional and government-subsidized home purchase loan originations.

In the San Francisco MSA, eight institutions did not issue any government-subsidized loans in 2021,

reflected in the table below.

26Home Lending to Communities of Color in California | MARCH 2023

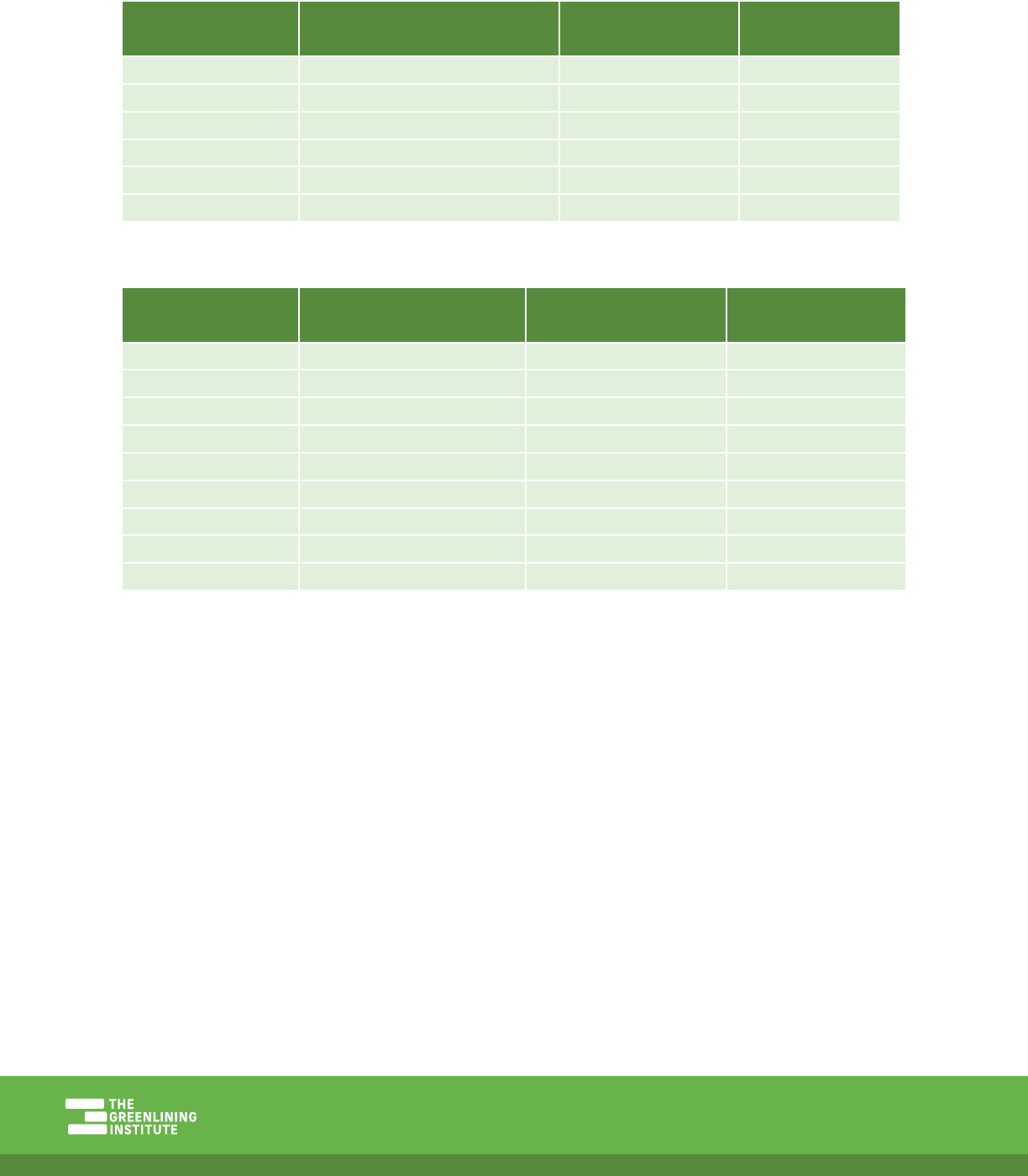

Table 11: Home Purchase Loans by Race

White Asian Native American Black Pacific Islander Latino

0% 40% 100%20% 60% 80%

Nonbank

Bank

ROCKET MORTGAGE

GUARANTEED RATE

UNITED WHOLESALE MORTGAGE

LOANDEPOT.COM

AMWEST FUNDING

GUARANTEED RATE AFFINITY

WELLS FARGO BANK

FIRST REPUBLIC BANK

BANK OF AMERICA

JPMORGAN CHASE BANK

CITIBANK

U.S. BANK

PNC BANK

FLAGSTAR BANK

MUFG UNION BANK

White Asian Native American Black Pacific Islander Latino

0% 40% 100%20% 60% 80%

Nonbank

Bank

ROCKET MORTGAGE

GUARANTEED RATE

UNITED WHOLESALE MORTGAGE

LOANDEPOT.COM

AMWEST FUNDING

GUARANTEED RATE AFFINITY

WELLS FARGO BANK

FIRST REPUBLIC BANK

BANK OF AMERICA

JPMORGAN CHASE BANK

CITIBANK

U.S. BANK

PNC BANK

FLAGSTAR BANK

MUFG UNION BANK

27Home Lending to Communities of Color in California | MARCH 2023

Table 12 illustrates the number of home purchase loan originations for women-identified people of

color (non-White) for each of the top 15 lenders in the San Francisco MSA in 2021.

Of the top 15 institutions in the San Francisco MSA, only two made government-subsidized loans to

women of color.

Table 12: Home Purchase Loans to Women of Color

WoC (non-White)

0% 20% 40%10% 30% 50%

Nonbank

Bank

ROCKET MORTGAGE

GUARANTEED RATE

UNITED WHOLESALE MORTGAGE

LOANDEPOT.COM

AMWEST FUNDING

GUARANTEED RATE AFFINITY

WELLS FARGO BANK

FIRST REPUBLIC BANK

BANK OF AMERICA

JPMORGAN CHASE BANK

CITIBANK

U.S. BANK

PNC BANK

FLAGSTAR BANK

MUFG UNION BANK

Nonbank

Bank

ROCKET MORTGAGE

GUARANTEED RATE

UNITED WHOLESALE MORTGAGE

LOANDEPOT.COM

AMWEST FUNDING

GUARANTEED RATE AFFINITY

WELLS FARGO BANK

FIRST REPUBLIC BANK

BANK OF AMERICA

JPMORGAN CHASE BANK

CITIBANK

U.S. BANK

PNC BANK

FLAGSTAR BANK

MUFG UNION BANK

WoC (non-White)

0% 20% 40%10% 30% 50%

28Home Lending to Communities of Color in California | MARCH 2023

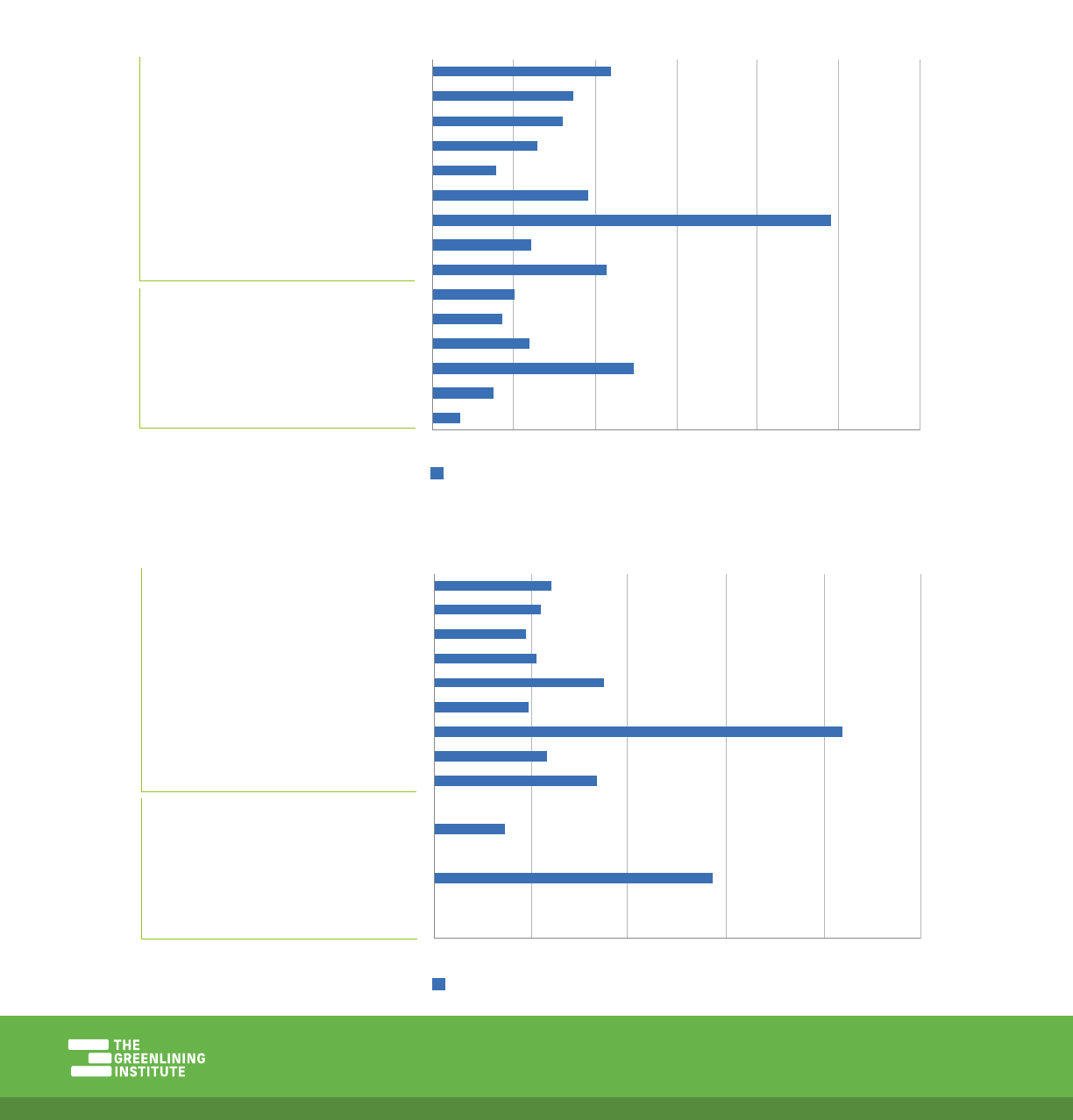

Table 13 below illustrates the number of home purchase loan originations to low-income borrowers,

defined as borrowers who report an income below 80% of the region’s Area Median Income, for each

of the top 15 lenders in the San Francisco MSA in 2021. The data reveals dierences in lending to low-

income households between bank and nonbank lenders, with nonbank lenders lending to low-income

borrowers at a higher rate, if at all.

On average, less than 5% of loans made by banks were to low-income borrowers and 11 institutions

did not make any government-subsidized loans to low-income borrowers.

Table 13: Home Purchase Loans by Borrower Income

Borrowers < 80% of AMI

ROCKET MORTGAGE

GUARANTEED RATE

UNITED WHOLESALE MORTGAGE

LOANDEPOT.COM

AMWEST FUNDING

GUARANTEED RATE AFFINITY

WELLS FARGO BANK

FIRST REPUBLIC BANK

BANK OF AMERICA

JPMORGAN CHASE BANK

CITIBANK

U.S. BANK

PNC BANK

FLAGSTAR BANK

MUFG UNION BANK

0% 10% 20% 30% 40% 50%

Nonbank

Bank

Borrowers < 80% of AMI

ROCKET MORTGAGE

GUARANTEED RATE

UNITED WHOLESALE MORTGAGE

LOANDEPOT.COM

AMWEST FUNDING

GUARANTEED RATE AFFINITY

WELLS FARGO BANK

FIRST REPUBLIC BANK

BANK OF AMERICA

JPMORGAN CHASE BANK

CITIBANK

U.S. BANK

PNC BANK

FLAGSTAR BANK

MUFG UNION BANK

0% 10% 20% 30% 40% 50%

Nonbank

Bank

29Home Lending to Communities of Color in California | MARCH 2023

Table 14 below illustrates the number of home purchase loan originations to low-income borrowers by

race for each of the top 15 lenders in the San Francisco MSA in 2021.

Table 14: Home Purchase Loans by Borrower Income and Race

White Asian Native American Black Pacific Islander Latino

0% 5% 10% 15%

ROCKET MORTGAGE

GUARANTEED RATE

UNITED WHOLESALE MORTGAGE

LOANDEPOT.COM

AMWEST FUNDING

GUARANTEED RATE AFFINITY

WELLS FARGO BANK

FIRST REPUBLIC BANK

BANK OF AMERICA

JPMORGAN CHASE BANK

CITIBANK

U.S. BANK

PNC BANK

FLAGSTAR BANK

MUFG UNION BANK

Nonbank

Bank

0% 5% 10% 15% 20% 25%

ROCKET MORTGAGE

GUARANTEED RATE

UNITED WHOLESALE MORTGAGE

LOANDEPOT.COM

AMWEST FUNDING

GUARANTEED RATE AFFINITY

WELLS FARGO BANK

FIRST REPUBLIC BANK

BANK OF AMERICA

JPMORGAN CHASE BANK

CITIBANK

U.S. BANK

PNC BANK

FLAGSTAR BANK

MUFG UNION BANK

Nonbank

Bank

White Asian Native American Black Pacific Islander Latino

30Home Lending to Communities of Color in California | MARCH 2023

Oakland-Berkeley-Livermore MSA

Total Population: 2,809,969, 7.16% of California’s population

Oakland-Berkeley-Livermore Demographics

Overview of Lending in Oakland-Berkeley-Livermore MSA

Lender Type of Lender % of Market

Wells Fargo Bank Bank 7.47%

Rocket Mortgage Non-Bank 6.98%

United Wholesale Mortgage Non-Bank 6.87%

American Pacific Mortgage Non-Bank 4.90%

U.S. Bank Bank 3.96%

Loandepot.com Non-Bank 3.91%

Bank of America Bank 3.82%

Guaranteed Rate Non-Bank 3.41%

First Republic Bank Bank 2.64%

JPMorgan Chase Bank Bank 2.54%

Caliber Home Loans Non-Bank 2.20%

Commerce Home Mortgage Non-Bank 1.84%

Lendus Non-Bank 1.81%

Crosscountry Mortgage Non-Bank 1.76%

Home Point Financial Non-Bank 1.66%

*Nonbank lenders are highlighted.

In the Oakland region, Black and Latino communities receive far fewer loans relative to their share

of the population than other racial groups in the region. Black households make up 9% of the

population, but receive less than 4% of the home purchase loans; Latino households make up 24%

of the population, but receive only 10% of the loans. Home lending to Asian households significantly

exceeds their share of the region’s population by 12 percentage points.

++N

00++N

09++N

01++N

++N

++N

06++N

26.5%

Asian

0.2%

Native

American

9.1%

Black

0.6%

Pacific

Islander

24.2%

Latino

33.0%

White

6.3%

Other

31Home Lending to Communities of Color in California | MARCH 2023

Table 15: Home Purchase Loans by Race for All Lenders

Race

Number of Loan

Originations

Percent of Loan

Originations

Percent of

Population

White 9,981 26.87% 33.00%

Asian 14,488 39.00% 26.50%

Native American 41 0.11% 0.20%

Black 1,454 3.91% 9.10%

Pacific Islander 103 0.28% 0.60%

Latino 3,863 10.40% 24.20%

Table 16: Home Purchase Loans to Asian Borrowers for All Lenders

Race

Number of Loan

Originations

Percent of Loan

Originations

Percent of Total

Loan Originations

Asian 2,422 16.72% 6.52%

Asian Indian 4,934 34.06% 13.28%

Chinese 3,774 26.05% 10.16%

Filipino 1,160 8.01% 3.12%

Japanese 108 0.75% 0.29%

Korean 412 2.84% 1.11%

Vietnamese 429 2.96% 1.15%

Asian Other 709 4.89% 1.91%

Multi-Asian 540 3.73% 1.45%

Top 15 Lenders in Oakland-Berkeley-Livermore MSA

The top 15 lenders in the Oakland region account for over 56% of the market. The top lender, Wells

Fargo Bank, accounts for 7% of all home purchase loan originations.

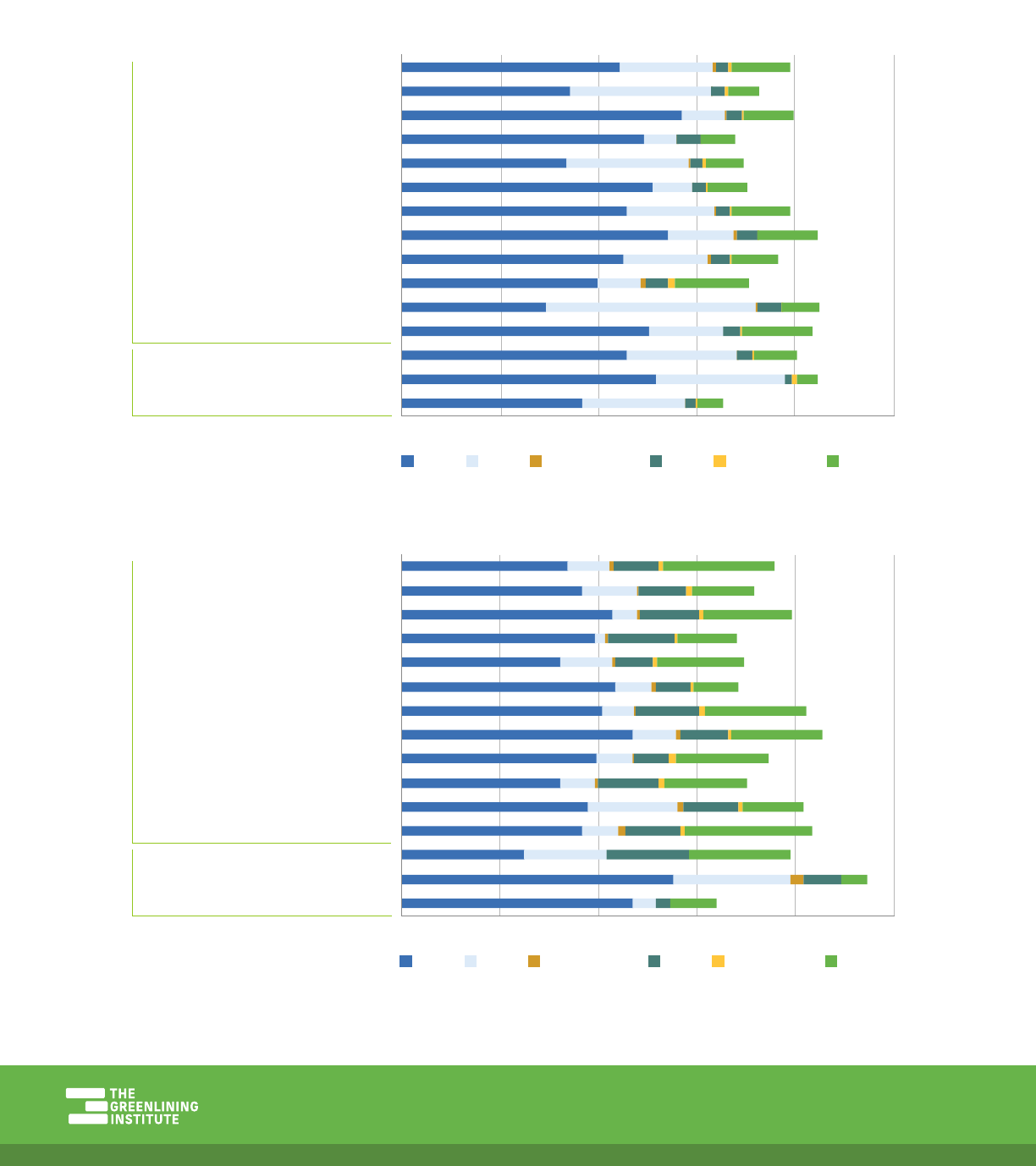

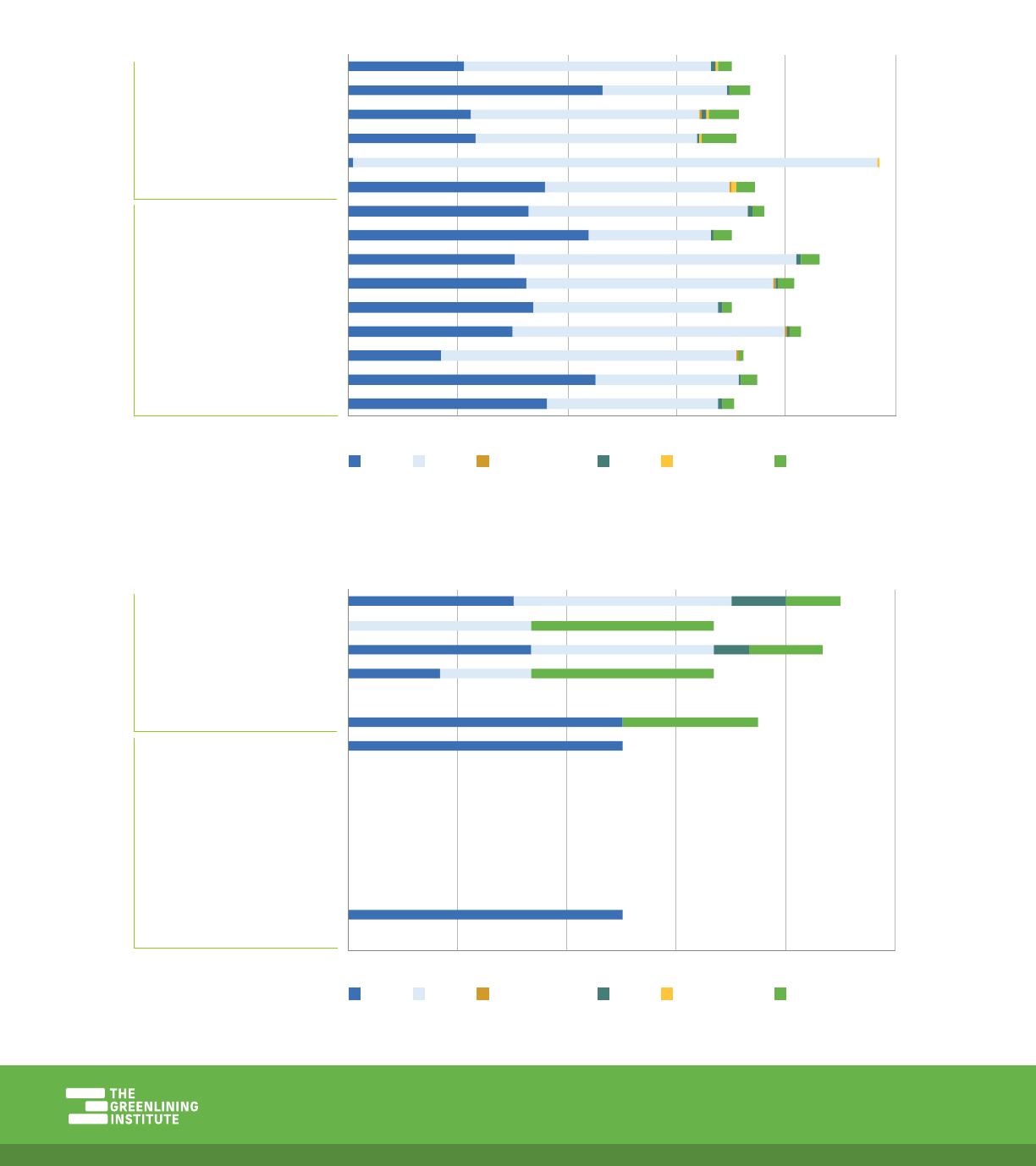

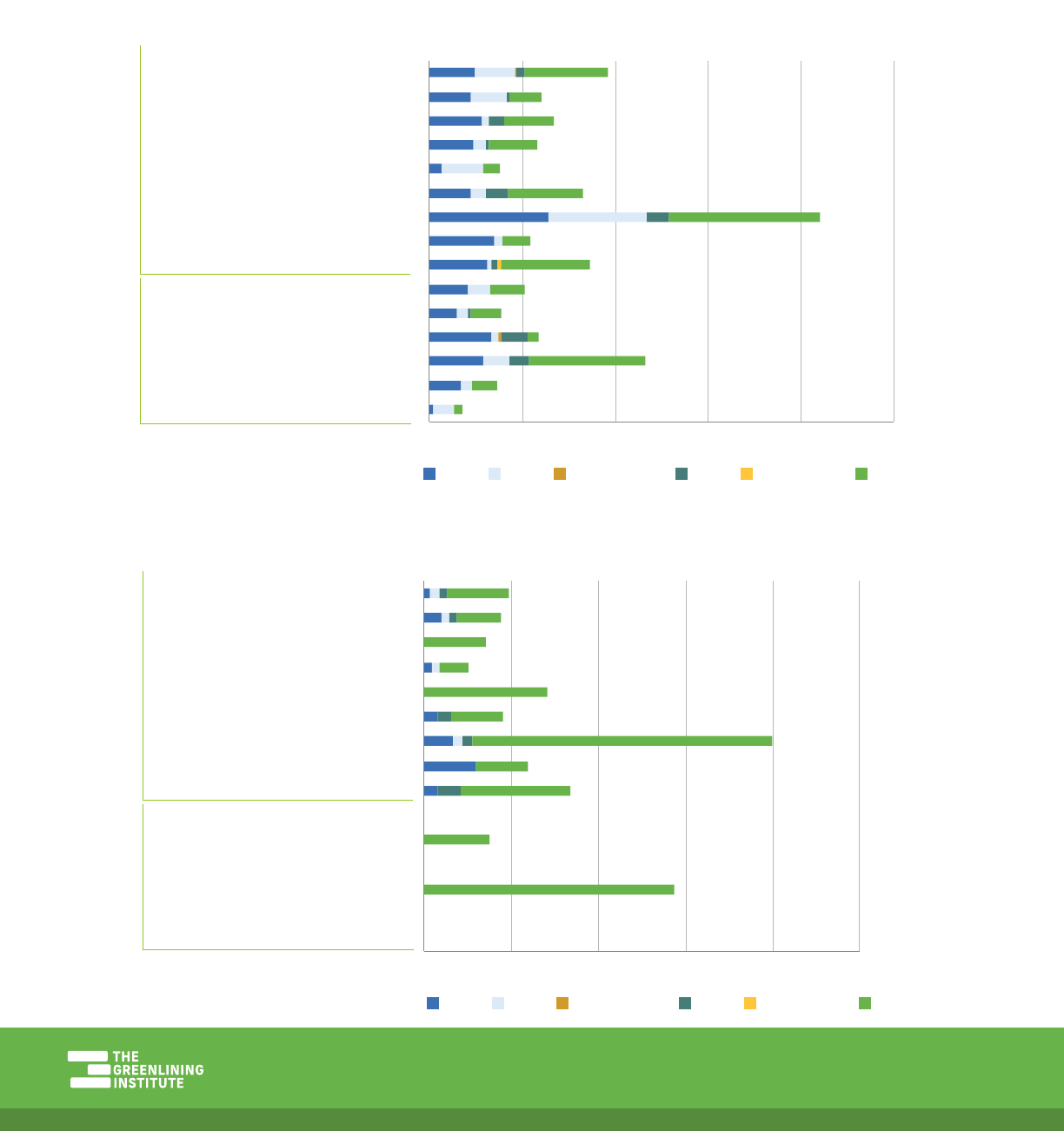

Table 17 below illustrates the number of home purchase loan originations by race for each of the top

15 lenders in the Oakland MSA in 2021. Black and Latino borrowers are significantly underrepresented

across all lenders for conventional loans proportional to their share of the population.

First Republic Bank did not make any government-subsidized home purchase loans in 2021.

32Home Lending to Communities of Color in California | MARCH 2023

Table 17: Home Purchase Loans by Race

White Asian Native American Black Pacific Islander Latino

ROCKET MORTGAGE

UNITED WHOLESALE MORTGAGE

AMERICAN PACIFIC MORTGAGE

LOANDEPOT.COM

GUARANTEED RATE

CALIBER HOME LOANS

COMMERCE HOME MORTGAGE

LENDUS

CROSSCOUNTRY MORTGAGE

HOME POINT FINANCIAL

WELLS FARGO BANK

U.S. BANK

BANK OF AMERICA

FIRST REPUBLIC BANK

JPMORGAN CHASE BANK

0% 20% 40% 60% 80% 100%

Nonbank

Bank

ROCKET MORTGAGE

UNITED WHOLESALE MORTGAGE

AMERICAN PACIFIC MORTGAGE

LOANDEPOT.COM

GUARANTEED RATE

CALIBER HOME LOANS

COMMERCE HOME MORTGAGE

LENDUS

CROSSCOUNTRY MORTGAGE

HOME POINT FINANCIAL

WELLS FARGO BANK

U.S. BANK

BANK OF AMERICA

FIRST REPUBLIC BANK

JPMORGAN CHASE BANK

0% 20% 40% 60% 80% 100%

White Asian Native American Black Pacific Islander Latino

Nonbank

Bank

33Home Lending to Communities of Color in California | MARCH 2023

Table 18 illustrates the number of home purchase loan originations for women-identified people of

color (non-White) for each of the top 15 lenders in the Oakland MSA in 2021.

Table 18: Home Purchase Loans to Women of Color

WoC (non-White)

ROCKET MORTGAGE

UNITED WHOLESALE MORTGAGE

AMERICAN PACIFIC MORTGAGE

LOANDEPOT.COM

GUARANTEED RATE

CALIBER HOME LOANS

COMMERCE HOME MORTGAGE

LENDUS

CROSSCOUNTRY MORTGAGE

HOME POINT FINANCIAL

WELLS FARGO BANK

U.S. BANK

BANK OF AMERICA

FIRST REPUBLIC BANK

JPMORGAN CHASE BANK

0% 5% 10% 15% 20%

Nonbank

Bank

0% 20% 40% 60% 80% 100%

WoC (non-White)

ROCKET MORTGAGE

UNITED WHOLESALE MORTGAGE

AMERICAN PACIFIC MORTGAGE

LOANDEPOT.COM

GUARANTEED RATE

CALIBER HOME LOANS

COMMERCE HOME MORTGAGE

LENDUS

CROSSCOUNTRY MORTGAGE

HOME POINT FINANCIAL

WELLS FARGO BANK

U.S. BANK

BANK OF AMERICA

FIRST REPUBLIC BANK

JPMORGAN CHASE BANK

Nonbank

Bank

34Home Lending to Communities of Color in California | MARCH 2023

Table 19 below illustrates the number of home purchase loan originations to low-income borrowers,

defined as borrowers who report an income below 80% of the region’s Area Median Income (AMI), for

each of the top 15 lenders in the Oakland MSA in 2021.

Table 19: Home Purchase Loans to Low-Income Borrowers

0% 10%5% 15% 20% 25% 30%

Borrowers < 80% of AMI

ROCKET MORTGAGE

UNITED WHOLESALE MORTGAGE

AMERICAN PACIFIC MORTGAGE

LOANDEPOT.COM

GUARANTEED RATE

CALIBER HOME LOANS

COMMERCE HOME MORTGAGE

LENDUS

CROSSCOUNTRY MORTGAGE

HOME POINT FINANCIAL

WELLS FARGO BANK

U.S. BANK

BANK OF AMERICA

FIRST REPUBLIC BANK

JPMORGAN CHASE BANK

Nonbank

Bank

0% 10% 20% 35% 45%5% 15% 25% 30% 40%

Borrowers < 80% of AMI

ROCKET MORTGAGE

UNITED WHOLESALE MORTGAGE

AMERICAN PACIFIC MORTGAGE

LOANDEPOT.COM

GUARANTEED RATE

CALIBER HOME LOANS

COMMERCE HOME MORTGAGE

LENDUS

CROSSCOUNTRY MORTGAGE

HOME POINT FINANCIAL

WELLS FARGO BANK

U.S. BANK

BANK OF AMERICA

FIRST REPUBLIC BANK

JPMORGAN CHASE BANK

Nonbank

Bank

35Home Lending to Communities of Color in California | MARCH 2023

Table 20 below illustrates the number of home purchase loan originations to low-income borrowers by

race for each of the top 15 lenders in the Oakland MSA in 2021.

Table 20 Home Purchase Loans to Low-Income Borrowers by Race

White Asian Native American Black Pacific Islander Latino

0% 10% 20%5% 15% 25%

Nonbank

Bank

ROCKET MORTGAGE

UNITED WHOLESALE MORTGAGE

AMERICAN PACIFIC MORTGAGE

LOANDEPOT.COM

GUARANTEED RATE

CALIBER HOME LOANS

COMMERCE HOME MORTGAGE

LENDUS

CROSSCOUNTRY MORTGAGE

HOME POINT FINANCIAL

WELLS FARGO BANK

U.S. BANK

BANK OF AMERICA

FIRST REPUBLIC BANK

JPMORGAN CHASE BANK

0% 10% 20% 30% 40% 50%

White Asian Native American Black Pacific Islander Latino

Nonbank

Bank

ROCKET MORTGAGE

UNITED WHOLESALE MORTGAGE

AMERICAN PACIFIC MORTGAGE

LOANDEPOT.COM

GUARANTEED RATE

CALIBER HOME LOANS

COMMERCE HOME MORTGAGE

LENDUS

CROSSCOUNTRY MORTGAGE

HOME POINT FINANCIAL

WELLS FARGO BANK

U.S. BANK

BANK OF AMERICA

FIRST REPUBLIC BANK

JPMORGAN CHASE BANK

36Home Lending to Communities of Color in California | MARCH 2023

Fresno MSA

Total Population: 1,013,581, 2.58% of California’s population

Fresno Demographics

Overview of Lending in Fresno MSA

Lender Type of Lender % of Market

United Wholesale Mortgage Non-Bank 13.09%

Alameda Mortgage Non-Bank 8.90%

Home Point Financial Non-Bank 6.11%

Homebridge Financial Services Non-Bank 3.82%

Rocket Mortgage Non-Bank 3.68%

Country Club Mortgage Non-Bank 3.52%

Sierra Pacific Mortgage Company Non-Bank 3.51%

American Pacific Mortgage Non-Bank 2.52%

Lennar Mortgage Non-Bank 2.43%

Inspire Home Loans Non-Bank 2.15%

Kings Mortgage Services Non-Bank 2.00%

Finance of America Mortgage Non-Bank 1.79%

Bay Equity Non-Bank 1.56%

Amerifirst Financial Non-Bank 1.42%

Cardinal Financial Company Non-Bank 1.41%

*Nonbank lenders are highlighted.

In the Fresno region, Asian households are overrepresented in loan originations, while Latino

households are significantly underrepresented. Latino households make up 55% of the region’s

population but only 36% of home purchase loans.

++N

01++N

04++N

00++N

++N

++N

04++N

10.6%

Asian

0.4%

Native

American

4.1%

Black

0.2%

Pacific

Islander

54.7%

Latino

26.3%

White

3.7%

Other

37Home Lending to Communities of Color in California | MARCH 2023

Table 21: Home Purchase Loans by Race for All Lenders

Race

Number of Loan

Originations

Percent of Loan

Originations

Percent of

Population

White 3,458 28.50% 26.30%

Asian 1,744 14.37% 10.60%

Native American 34 0.28% 0.40%

Black 305 2.51% 4.10%

Pacific Islander 14 0.12% 0.20%

Latino 4,397 36.24% 54.70%

Table 22: Home Purchase Loans to Asian Borrowers for All Lenders

Race

Number of Loan

Originations

Percent of Loan

Originations

Percent of Total Loan

Originations

Asian 427 24.48% 3.52%

Asian Indian 587 33.66% 4.84%

Chinese 139 7.97% 1.15%

Filipino 111 6.36% 0.91%

Japanese 20 1.15% 0.16%

Korean 20 1.15% 0.16%

Vietnamese 86 4.93% 0.71%

Asian Other 302 17.32% 2.49%

Multi-Asian 52 2.98% 0.43%

Top 15 Lenders in Fresno MSA

The top 15 lenders in the Fresno region account for 58% of the market. Nonbank lenders entirely

dominate and make up all 15 of the top lenders, an increase from 14 last year. In contrast to the

more urban California regions in this report, Fresno and the surrounding San Joaquin Valley have

experienced a significant decrease in bank branches, a rising trend in rural communities that may

account for the increased dominance of nonbank lenders in rural markets.

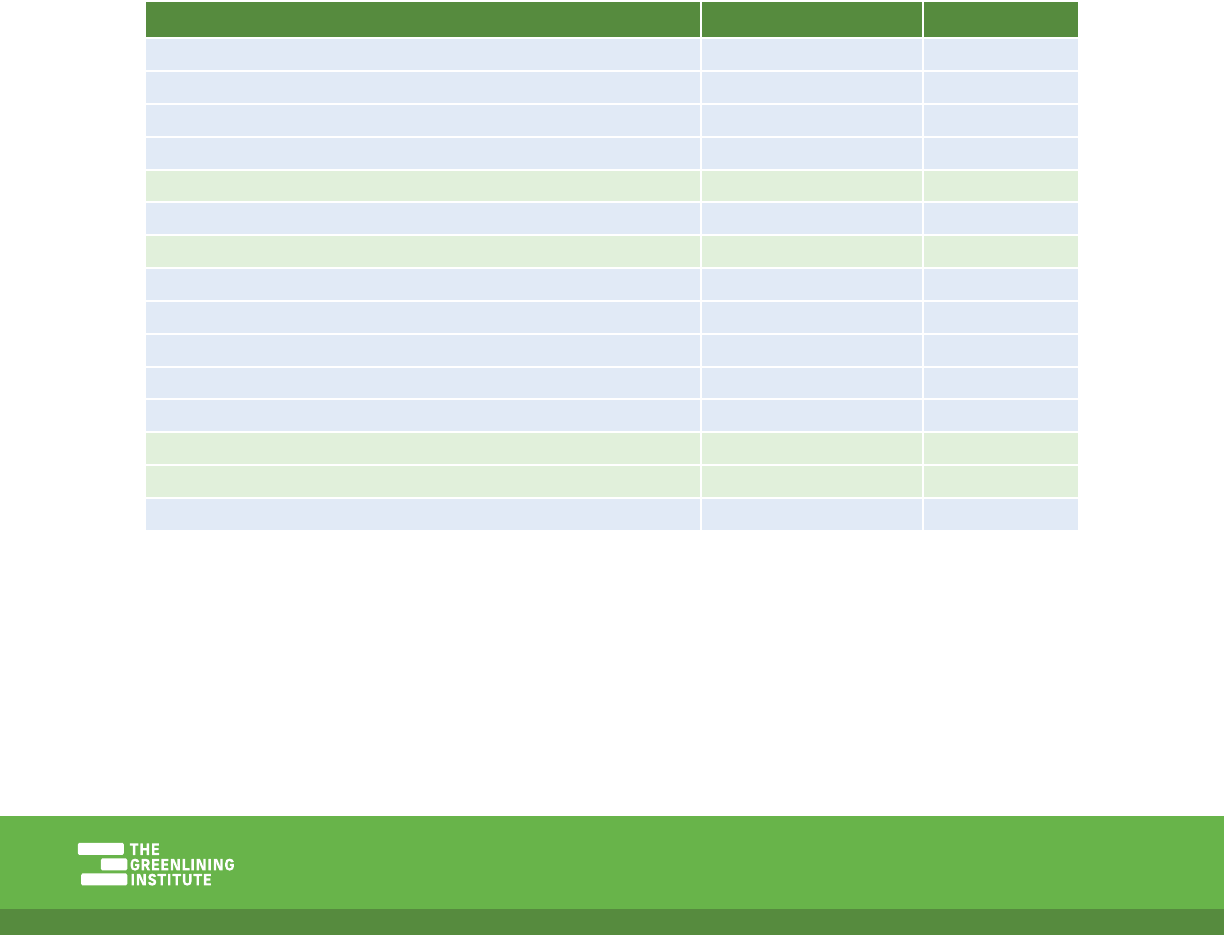

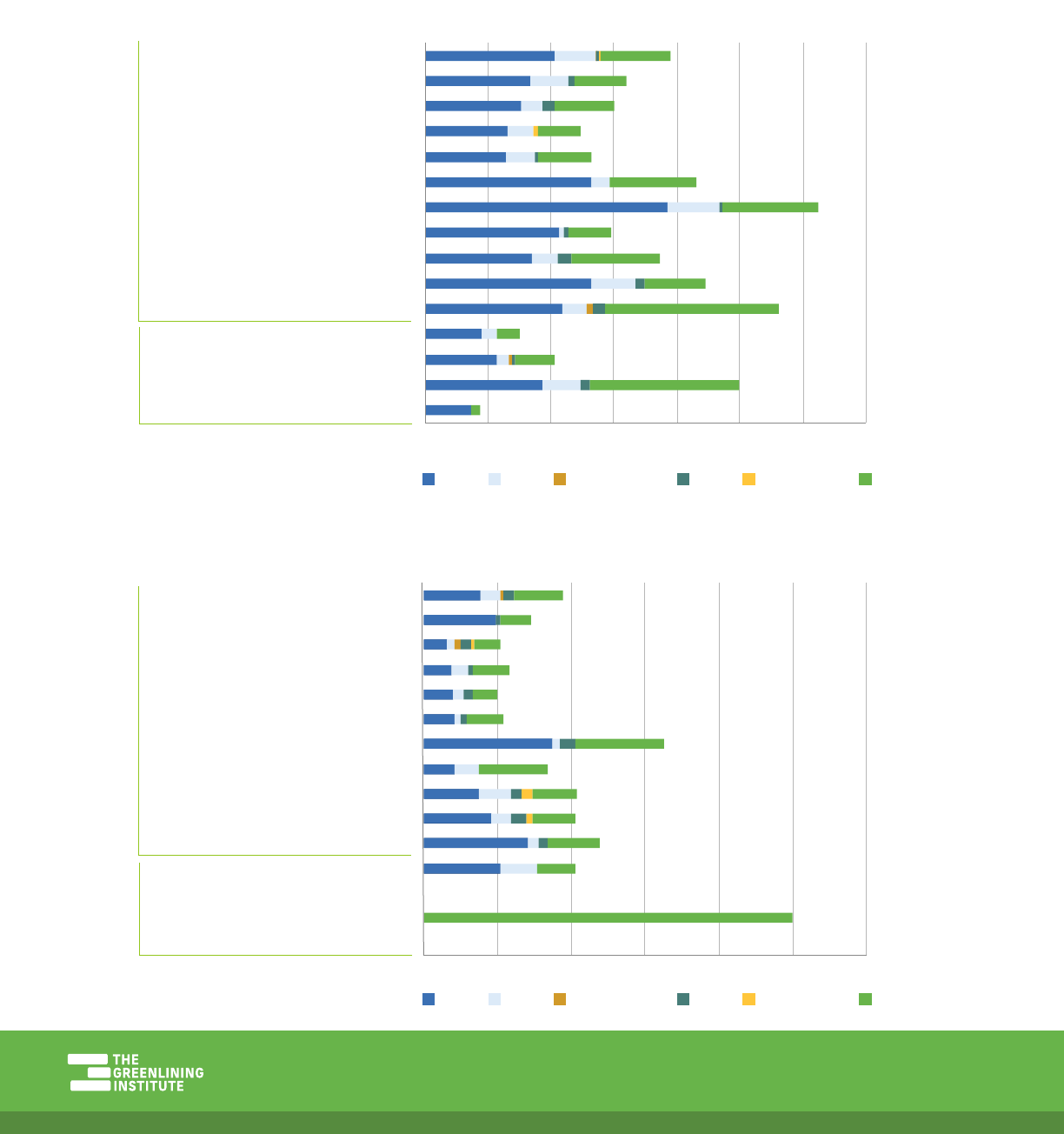

Table 23 below illustrates the number of home purchase loan originations by race for each of the top

15 lenders in the Fresno MSA in 2021. More than half (nine out of 15) of the nonbank lenders in this

sample issued their largest share of government-subsidized loans to Latino borrowers.

38Home Lending to Communities of Color in California | MARCH 2023

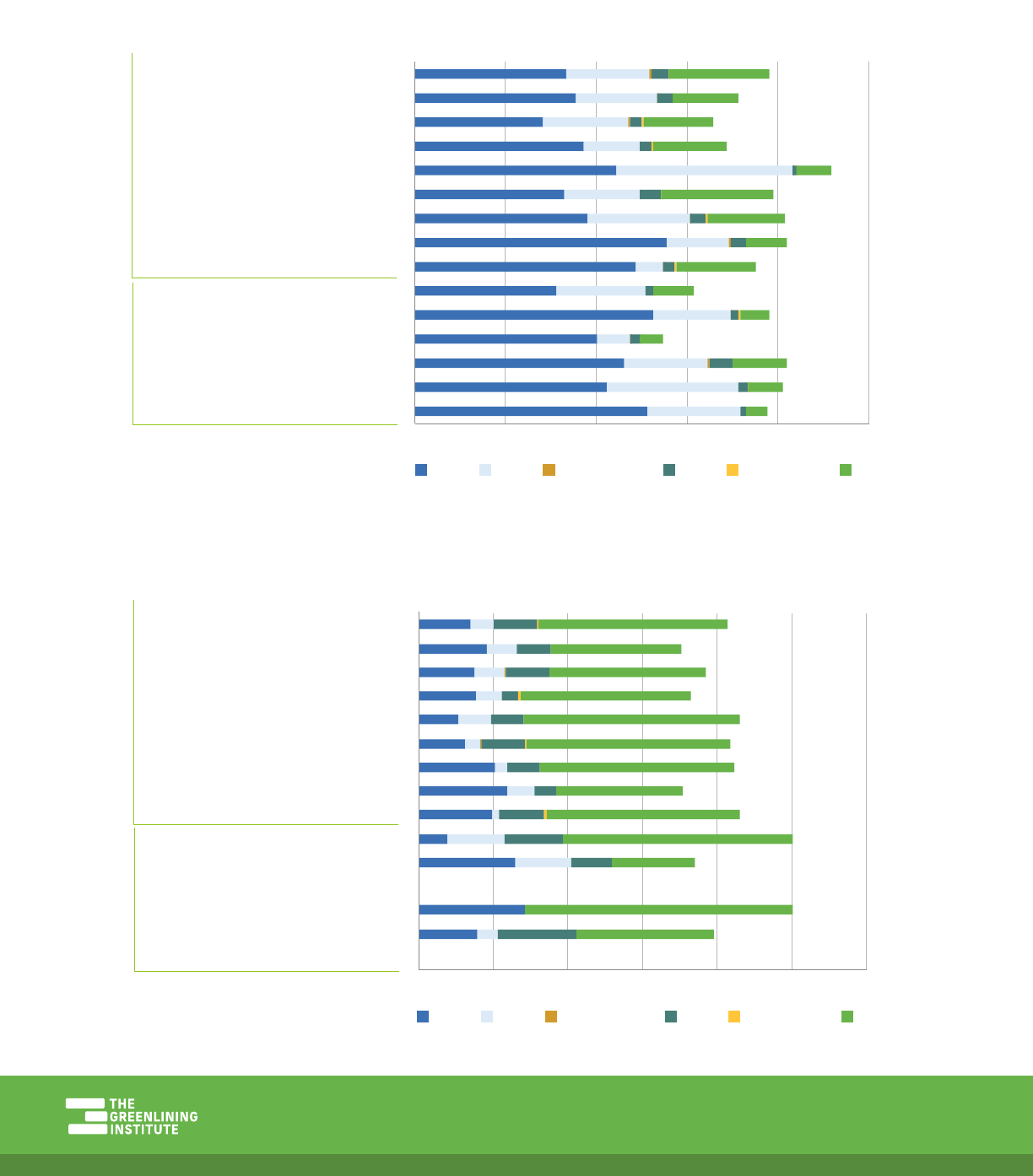

Table 23: Home Purchase Loans by Race

White Asian Native American Black Pacific Islander Latino

UNITED WHOLESALE MORTGAGE

ALAMEDA MORTGAGE

HOME POINT FINANCIAL

HOMEBRIDGE FINANCIAL SERVICES

ROCKET MORTGAGE

COUNTRY CLUB MORTGAGE

SIERRA PACIFIC MORTGAGE COMPANY

AMERICAN PACIFIC MORTGAGE

LENNAR MORTGAGE

INSPIRE HOME LOANS

KINGS MORTGAGE SERVICES

FINANCE OF AMERICA MORTGAGE

BAY EQUITY

AMERIFIRST FINANCIAL

CARDINAL FINANCIAL COMPANY

Nonbank

0% 20% 40% 60% 80% 100%

White Asian Native American Black Pacific Islander Latino

UNITED WHOLESALE MORTGAGE

ALAMEDA MORTGAGE

HOME POINT FINANCIAL

HOMEBRIDGE FINANCIAL SERVICES

ROCKET MORTGAGE

COUNTRY CLUB MORTGAGE

SIERRA PACIFIC MORTGAGE COMPANY

AMERICAN PACIFIC MORTGAGE

LENNAR MORTGAGE

INSPIRE HOME LOANS

KINGS MORTGAGE SERVICES

FINANCE OF AMERICA MORTGAGE

BAY EQUITY

AMERIFIRST FINANCIAL

CARDINAL FINANCIAL COMPANY

Nonbank

0% 20% 40% 60% 80%

100%

39Home Lending to Communities of Color in California | MARCH 2023

Table 24 illustrates the number of home purchase loan originations for women-identified people of

color (non-White) for each of the top 15 lenders in the Fresno MSA in 2021.

Table 24: Home Purchase Loans to Women of Color

Nonbank

UNITED WHOLESALE MORTGAGE

ROCKET MORTGAGE

LOANDEPOT.COM

FINANCE OF AMERICA MORTGAGE

AMWEST FUNDING

BROKER SOLUTIONS

HOME POINT FINANCIAL

GUARANTEED RATE

HOMEBRIDGE FINANCIAL SERVICES

JPMORGAN CHASE BANK

WELLS FARGO BANK

FIRST REPUBLIC BANK

BANK OF AMERICA

U.S. BANK

CITIBANK

0% 5% 10% 15% 20%

WoC (non-White)

Nonbank

UNITED WHOLESALE MORTGAGE

ROCKET MORTGAGE

LOANDEPOT.COM

FINANCE OF AMERICA MORTGAGE

AMWEST FUNDING

BROKER SOLUTIONS

HOME POINT FINANCIAL

GUARANTEED RATE

HOMEBRIDGE FINANCIAL SERVICES

JPMORGAN CHASE BANK

WELLS FARGO BANK

FIRST REPUBLIC BANK

BANK OF AMERICA

U.S. BANK

CITIBANK

0% 5% 10% 15% 20% 25%

WoC (non-White)

40Home Lending to Communities of Color in California | MARCH 2023

Table 25 below illustrates the number of home purchase loan originations to low-income borrowers,

defined as borrowers who report an income below 80% of the region’s Area Median Income, for each

of the top 15 lenders in the Fresno MSA in 2021. Notably, nine out of 15 nonbank lenders in this sample

issued more than 15% of their government-subsidized loans to low-income borrowers.

Table 25: Home Purchase Loans to Low-Income Borrowers

Nonbank

UNITED WHOLESALE MORTGAGE

ALAMEDA MORTGAGE

HOME POINT FINANCIAL

HOMEBRIDGE FINANCIAL SERVICES

ROCKET MORTGAGE

COUNTRY CLUB MORTGAGE

SIERRA PACIFIC MORTGAGE COMPANY

AMERICAN PACIFIC MORTGAGE

LENNAR MORTGAGE

INSPIRE HOME LOANS

KINGS MORTGAGE SERVICES

FINANCE OF AMERICA MORTGAGE

BAY EQUITY

AMERIFIRST FINANCIAL

CARDINAL FINANCIAL COMPANY

0% 5% 10% 15% 20%

Borrowers < 80% of AMI

Nonbank

UNITED WHOLESALE MORTGAGE

ALAMEDA MORTGAGE

HOME POINT FINANCIAL

HOMEBRIDGE FINANCIAL SERVICES

ROCKET MORTGAGE

COUNTRY CLUB MORTGAGE

SIERRA PACIFIC MORTGAGE COMPANY

AMERICAN PACIFIC MORTGAGE

LENNAR MORTGAGE

INSPIRE HOME LOANS

KINGS MORTGAGE SERVICES

FINANCE OF AMERICA MORTGAGE

BAY EQUITY

AMERIFIRST FINANCIAL

CARDINAL FINANCIAL COMPANY

0% 5% 10% 15% 20% 25% 30%

Borrowers < 80% of AMI

41Home Lending to Communities of Color in California | MARCH 2023

Table 26 below illustrates the number of home purchase loan originations to low-income borrowers

by race for each of the top 15 lenders in the Fresno MSA in 2021. Latino borrowers make up the highest

percentage of low-income borrowers across both conventional and government-subsidized loans.

Their share is nearly doubled for government-subsidized loans.

Table 26 Home Purchase Loans to Low-Income Borrowers by Race

White Asian Native American Black Pacific Islander Latino

UNITED WHOLESALE MORTGAGE

ROCKET MORTGAGE

LOANDEPOT.COM

FINANCE OF AMERICA MORTGAGE

AMWEST FUNDING

BROKER SOLUTIONS

HOME POINT FINANCIAL

GUARANTEED RATE

HOMEBRIDGE FINANCIAL SERVICES

JPMORGAN CHASE BANK

WELLS FARGO BANK

FIRST REPUBLIC BANK

BANK OF AMERICA

U.S. BANK

CITIBANK

Nonbank

0% 5% 10% 15% 20%

White Asian Native American Black Pacific Islander Latino

UNITED WHOLESALE MORTGAGE

ROCKET MORTGAGE

LOANDEPOT.COM

FINANCE OF AMERICA MORTGAGE

AMWEST FUNDING

BROKER SOLUTIONS

HOME POINT FINANCIAL

GUARANTEED RATE

HOMEBRIDGE FINANCIAL SERVICES

JPMORGAN CHASE BANK

WELLS FARGO BANK

FIRST REPUBLIC BANK

BANK OF AMERICA

U.S. BANK

CITIBANK

Nonbank

0% 5% 10% 15% 20% 25%

42Home Lending to Communities of Color in California | MARCH 2023

Los Angeles-Long Beach-

Glendale MSA

Total Population: 9,829,544, 25.05% of California’s population

Los Angeles-Long Beach-Glendale Demographics

Overview of Lending in Los Angeles-Long Beach-Glendale

MSA

Lender Type of Lender % of Market

United Wholesale Mortgage Non-Bank 11.17%

Rocket Mortgage Non-Bank 6.28%

JPMorgan Chase Bank Bank 4.01%

Loandepot.com Non-Bank 3.58%

Wells Fargo Bank, Bank 3.39%

First Republic Bank Bank 2.58%

Finance of America Mortgage Non-Bank 2.44%

Amwest Funding Non-Bank 2.35%

Broker Solutions Non-Bank 2.17%

Bank of America Bank 2.05%

Home Point Financial Non-Bank 2.02%

U.S. Bank Bank 1.65%

Guaranteed Rate Non-Bank 1.51%

Homebridge Financial Services Non-Bank 1.48%

Citibank Bank 1.43%

*Nonbank lenders are highlighted.

In the Los Angeles region, Latino households again make up almost half of the population, but only

20% of home purchase loans. Black households are also underrepresented in the region’s home

purchase loans, while white households are significantly overrepresented, by 11 percentage points.

++N

00++N

07++N

00++N

++N

++N

04++N

14.6%

Asian

0.1%

Native

American

7.3%

Black

0.2%

Pacific

Islander

49.1%

Latino

24.6%

White

4.0%

Other

43Home Lending to Communities of Color in California | MARCH 2023

Table 27: Home Purchase Loans by Race for All Lenders

Race Number of Loan Originations

Percent of Loan

Originations

Percent of

Population

White 28,483 35.28% 24.60%

Asian 14,641 18.14% 14.60%

Native American 59 0.07% 0.10%

Black 3,186 3.95% 7.30%

Pacific Islander 103 0.13% 0.20%

Latino 16,056 19.89% 49.10%

Table 28: Home Purchase Loans to Asian Borrowers for All Lenders

Race

Number of Loan

Originations

Percent of Loan

Originations

Percent of Total Loan

Originations

Asian 3,615 24.69% 4.48%

Asian Indian 1,116 7.62% 1.38%

Chinese 4,166 28.45% 5.16%

Filipino 1,425 9.73% 1.77%

Japanese 320 2.19% 0.40%

Korean 2,132 14.56% 2.64%

Vietnamese 597 4.08% 0.74%

Asian Other 780 5.33% 0.97%

Multi-Asian 490 3.35% 0.61%

Top 15 Lenders in Los Angeles-Long Beach-Glendale MSA

The top 15 lenders in the Los Angeles region account for 48% of the market. Of these 15 lenders, Black

and Latino households are more highly represented in government-subsidized loans, though not

all lenders issue these loans. Consistent with years prior, the lender with the greatest percentage of

conventional home purchase loans to both Black and Latino households is the nonbank mortgage

lender Broker Solutions.

Table 29 below illustrates the number of home purchase loan originations by race for each of the top

15 lenders in the Los Angeles MSA in 2021.

44Home Lending to Communities of Color in California | MARCH 2023

Table 29: Home Purchase Loans by Race

UNITED WHOLESALE MORTGAGE

ROCKET MORTGAGE

LOANDEPOT.COM

FINANCE OF AMERICA MORTGAGE

AMWEST FUNDING

BROKER SOLUTIONS

HOME POINT FINANCIAL

GUARANTEED RATE

HOMEBRIDGE FINANCIAL SERVICES

JPMORGAN CHASE BANK

WELLS FARGO BANK

FIRST REPUBLIC BANK

BANK OF AMERICA

U.S. BANK

CITIBANK

Nonbank

Bank

0% 2% 4% 6% 8% 10%

White Asian Native American Black Pacific Islander Latino

UNITED WHOLESALE MORTGAGE

ROCKET MORTGAGE

LOANDEPOT.COM

FINANCE OF AMERICA MORTGAGE

AMWEST FUNDING

BROKER SOLUTIONS

HOME POINT FINANCIAL

GUARANTEED RATE

HOMEBRIDGE FINANCIAL SERVICES

JPMORGAN CHASE BANK

WELLS FARGO BANK

FIRST REPUBLIC BANK

BANK OF AMERICA

U.S. BANK

CITIBANK

Nonbank

Bank

0% 2% 4% 6% 8% 10% 12%

White Asian Native American Black Pacific Islander Latino

45Home Lending to Communities of Color in California | MARCH 2023

Table 30 illustrates the number of home purchase loan originations for women-identified people of

color (non-White) for each of the top 15 lenders in the Los Angeles MSA in 2021.

Table 30: Home Purchase Loans to Women of Color

0% 5% 10% 15% 20% 25%

Nonbank

Bank

UNITED WHOLESALE MORTGAGE

ROCKET MORTGAGE

LOANDEPOT.COM

FINANCE OF AMERICA MORTGAGE

AMWEST FUNDING

BROKER SOLUTIONS

HOME POINT FINANCIAL

GUARANTEED RATE

HOMEBRIDGE FINANCIAL SERVICES

JPMORGAN CHASE BANK

WELLS FARGO BANK

FIRST REPUBLIC BANK

BANK OF AMERICA

U.S. BANK

CITIBANK

WoC (non-White)

0% 5% 10% 15% 20% 25%

Nonbank

Bank

UNITED WHOLESALE MORTGAGE

ROCKET MORTGAGE

LOANDEPOT.COM

FINANCE OF AMERICA MORTGAGE

AMWEST FUNDING

BROKER SOLUTIONS

HOME POINT FINANCIAL

GUARANTEED RATE

HOMEBRIDGE FINANCIAL SERVICES

JPMORGAN CHASE BANK

WELLS FARGO BANK

FIRST REPUBLIC BANK

BANK OF AMERICA

U.S. BANK

CITIBANK

WoC (non-White)

46Home Lending to Communities of Color in California | MARCH 2023

Table 31 below illustrates the number of home purchase loan originations to low-income borrowers,

defined as borrowers who report an income below 80% of the region’s Area Median Income, for each of

the top 15 lenders in the Los Angeles MSA in 2021.

Table 31: Home Purchase Loans to Low-Income Borrowers

0% 2% 4% 6% 8% 10% 12%

Nonbank

Bank

UNITED WHOLESALE MORTGAGE

ROCKET MORTGAGE

LOANDEPOT.COM

FINANCE OF AMERICA MORTGAGE

AMWEST FUNDING

BROKER SOLUTIONS

HOME POINT FINANCIAL

GUARANTEED RATE

HOMEBRIDGE FINANCIAL SERVICES

JPMORGAN CHASE BANK

WELLS FARGO BANK

FIRST REPUBLIC BANK

BANK OF AMERICA

U.S. BANK

CITIBANK

Borrowers < 80% of AMI

Nonbank

Bank

UNITED WHOLESALE MORTGAGE

ROCKET MORTGAGE

LOANDEPOT.COM

FINANCE OF AMERICA MORTGAGE

AMWEST FUNDING

BROKER SOLUTIONS

HOME POINT FINANCIAL

GUARANTEED RATE

HOMEBRIDGE FINANCIAL SERVICES

JPMORGAN CHASE BANK

WELLS FARGO BANK

FIRST REPUBLIC BANK

BANK OF AMERICA

U.S. BANK

CITIBANK

0%

5%

10% 15% 20% 25%

Borrowers < 80% of AMI

47Home Lending to Communities of Color in California | MARCH 2023

Table 32 below illustrates the number of home purchase loan originations to low-income borrowers by

race for each of the top 15 lenders in the Los Angeles MSA in 2021. Similar to Fresno, Latino households

make up the highest percentage of low-income borrowers across both conventional and government-

subsidized loans.

Table 32 Home Purchase Loans to Low-Income Borrowers by Race

White Asian Native American Black Pacific Islander Latino

0% 2% 4% 6% 8% 10%

UNITED WHOLESALE MORTGAGE

ROCKET MORTGAGE

LOANDEPOT.COM

FINANCE OF AMERICA MORTGAGE

AMWEST FUNDING

BROKER SOLUTIONS

HOME POINT FINANCIAL

GUARANTEED RATE

HOMEBRIDGE FINANCIAL SERVICES

JPMORGAN CHASE BANK

WELLS FARGO BANK

FIRST REPUBLIC BANK

BANK OF AMERICA

U.S. BANK

CITIBANK

Nonbank

Bank

White Asian Native American Black Pacific Islander Latino

UNITED WHOLESALE MORTGAGE

ROCKET MORTGAGE

LOANDEPOT.COM

FINANCE OF AMERICA MORTGAGE

AMWEST FUNDING

BROKER SOLUTIONS

HOME POINT FINANCIAL

GUARANTEED RATE

HOMEBRIDGE FINANCIAL SERVICES

JPMORGAN CHASE BANK

WELLS FARGO BANK

FIRST REPUBLIC BANK

BANK OF AMERICA

U.S. BANK

CITIBANK

Nonbank

Bank

0% 5% 10% 15% 20% 25%

48Home Lending to Communities of Color in California | MARCH 2023

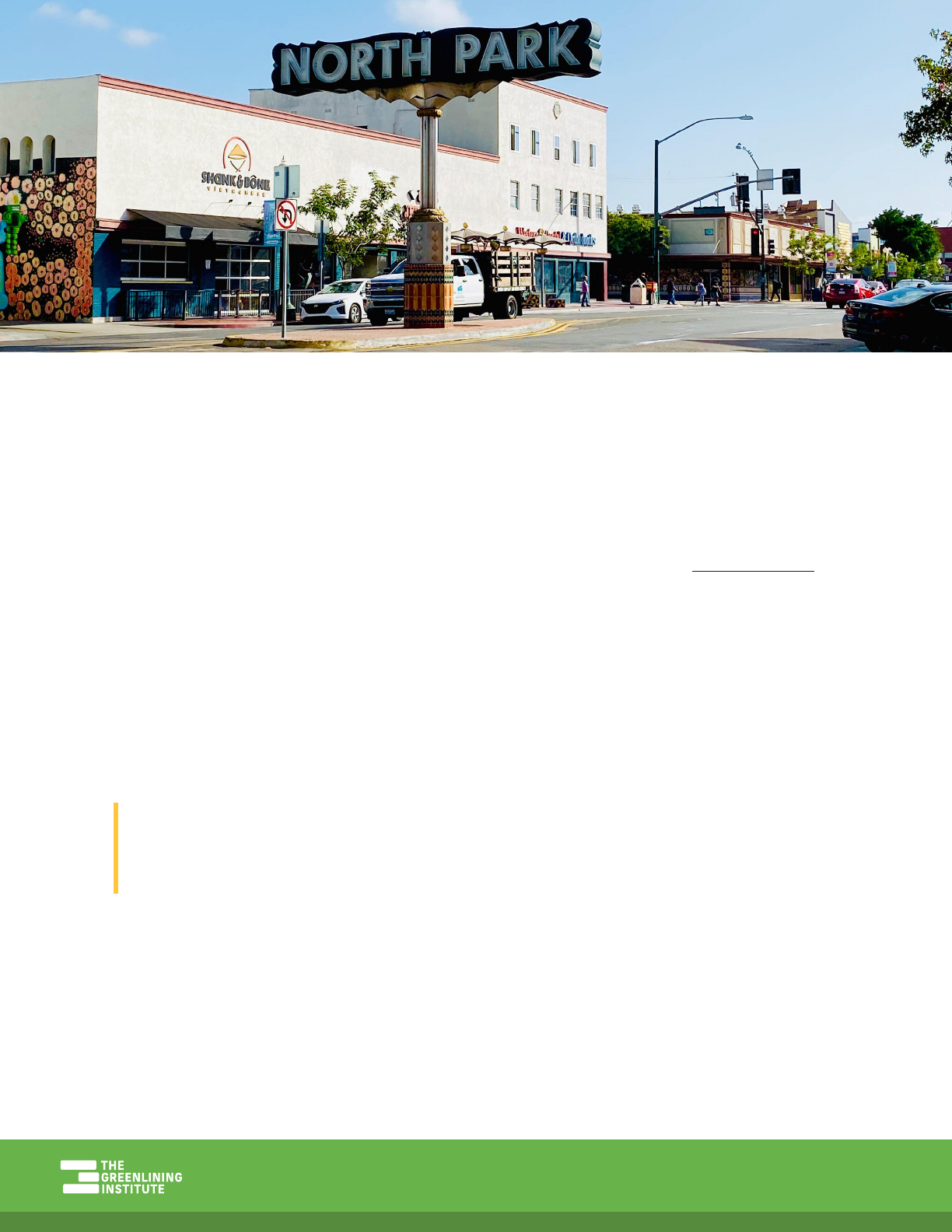

San Diego-Chula Vista-

Carlsbad MSA

Total Population: 3,286,069, 8.37% of California’s population

San Diego-Chula Vista-Carlsbad Demographics

Overview of Lending in San Diego-Chula Vista-Carlsbad

MSA

Lender Type of Lender % of Market

United Wholesale Mortgage Non-Bank 15.05%

Rocket Mortgage Non-Bank 5.98%

Crosscountry Mortgage Non-Bank 3.78%

Loandepot.com Non-Bank 3.15%

Wells Fargo Bank Bank 3.12%

Fairway Independent Mortgage Non-Bank 2.64%

JPMorgan Chase Bank Bank 2.59%

Caliber Home Loans Non-Bank 2.54%

Home Point Financial Non-Bank 2.41%

Guaranteed Rate Non-Bank 2.14%

Finance of America Mortgage Non-Bank 2.08%

American Pacific Mortgage Non-Bank 2.01%

Bank of America Bank 1.79%

U.S. Bank Bank 1.72%

Movement Mortgage Non-Bank 1.64%

*Nonbank lenders are highlighted.

In the San Diego region, Latino households receive far fewer loans relative to their share of the

population than other racial groups in the region. The Latino community in San Diego is the second

largest ethnic group and makes up 35% of the population, but only 16% of home purchase loans,

consistent with last year’s figures.

++N

00++N

04++N

01++N

++N

++N

06++N

11.8%

Asian

0.2%

Native

American

4.4%

Black

0.4%

Pacific

Islander

34.8%

Latino

42.6%

White

5.7%

Other

49Home Lending to Communities of Color in California | MARCH 2023

Table 33: Home Purchase Loans by Race for All Lenders

Race Number of Loan Originations

Percent of Loan

Originations

Percent of

Population

White 18,061 44.38% 42.60%

Asian 5,378 13.22% 11.80%

Native American 87 0.21% 0.20%

Black 1,049 2.58% 4.40%

Pacific Islander 103 0.25% 0.40%

Latino 6,492 15.95% 34.80%

Table 34: Home Purchase Loans to Asian Borrowers for All Lenders

Race Number of Loan Originations

Percent of Loan

Originations

Percent of Total

Loan Originations

Asian 1,120 20.83% 2.75%

Asian Indian 941 17.50% 2.31%

Chinese 947 17.61% 2.33%

Filipino 963 17.91% 2.37%

Japanese 98 1.82% 0.24%

Korean 329 6.12% 0.81%

Vietnamese 463 8.61% 1.14%

Asian Other 337 6.27% 0.83%

Multi-Asian 180 3.35% 0.44%

Top 15 Lenders in San Diego-Chula Vista-Carlsbad MSA

The top 15 lenders in the San Diego region account for 53% of the market. The top lender, United

Wholesale Mortgage, accounts for over 15% of all loan originations.

Table 35 below illustrates the number of home purchase loan originations by race for each of the top

15 lenders in the San Diego MSA in 2021.

50Home Lending to Communities of Color in California | MARCH 2023

Table 35: Home Purchase Loans by Race

White Asian Native American Black Pacific Islander Latino

UNITED WHOLESALE MORTGAGE

ROCKET MORTGAGE

CROSSCOUNTRY MORTGAGE

LOANDEPOT.COM

FAIRWAY INDEPENDENT MORTGAGE

CALIBER HOME LOANS

HOME POINT FINANCIAL

GUARANTEED RATE

FINANCE OF AMERICA MORTGAGE

AMERICAN PACIFIC MORTGAGE

MOVEMENT MORTGAGE

WELLS FARGO BANK

JPMORGAN CHASE BANK

BANK OF AMERICA

U.S. BANK

Nonbank

Bank

0% 20% 40% 60% 80% 100%

White Asian Native American Black Pacific Islander Latino

UNITED WHOLESALE MORTGAGE

ROCKET MORTGAGE